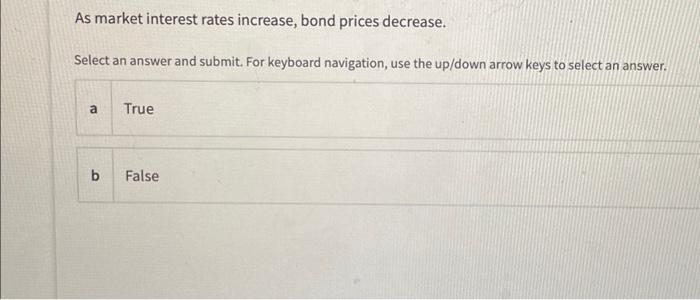

Question: As market interest rates increase, bond prices decrease. Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer.

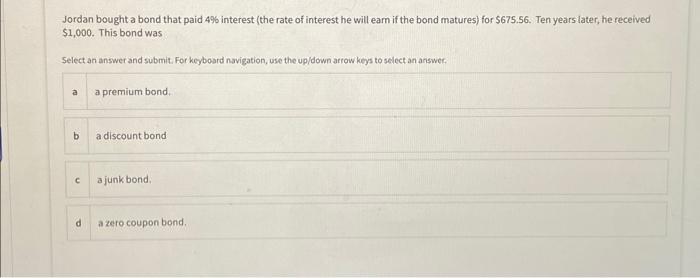

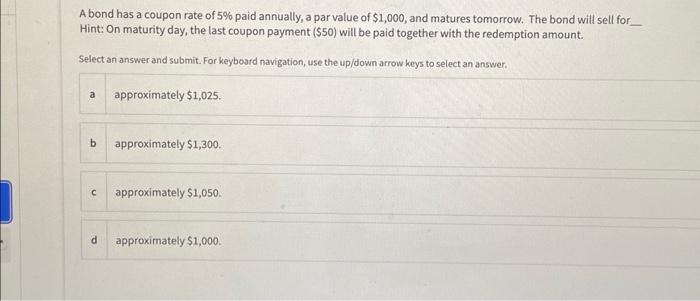

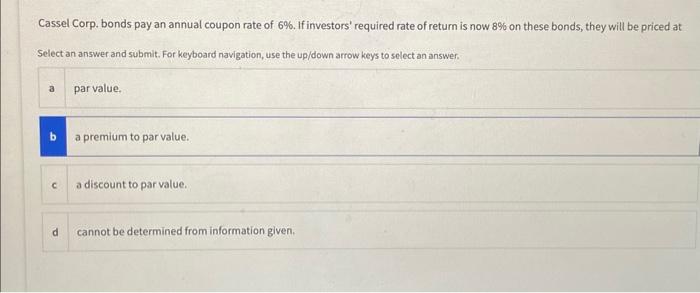

As market interest rates increase, bond prices decrease. Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a True b False Jordan bought a bond that paid 4% interest (the rate of interest he will eam if the bond matures) for $675.56. Ten years later, he received $1,000. This bond was Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a premium bond. a discount bond a junk bond. d azerocoupon bond. A bond has a coupon rate of 5% paid annually, a par value of $1,000, and matures tomorrow. The bond will sell for Hint: On maturity day, the last coupon payment ($50) will be paid together with the redemption amount. Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a approximately $1,025. b approximately $1,300. c approximately $1,050. d approximately $1,000. Cassel Corp. bonds pay an annual coupon rate of 6%. If investors' required rate of return is now 8% on these bonds, they will be priced at Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a parvalue, b a premium to par value. c a discount to parvalue. d cannot be determined from information given. A bond is most likely to be called when the market rate is lower than the coupon rate. Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a True b False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts