Question: As per chegg guidelines this is all one question, i only need help with parts B through F. Thanks so much in advance will rate

As per chegg guidelines this is all one question, i only need help with parts B through F. Thanks so much in advance will rate well.

![below.] The following transactions pertain to Smith Training Company for Year 1](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f70f8fe4d64_40766f70f8f62fa7.jpg)

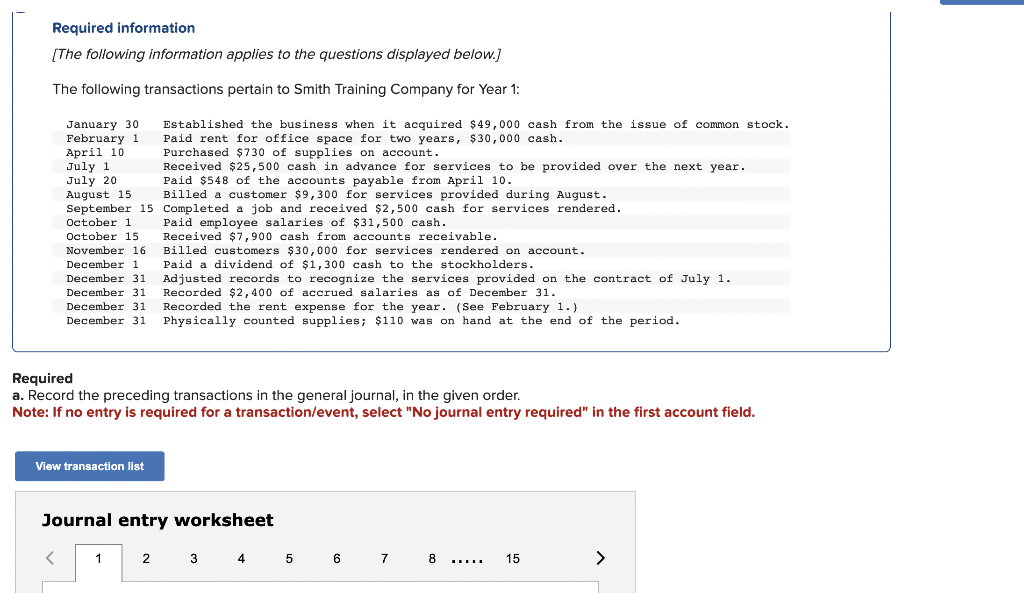

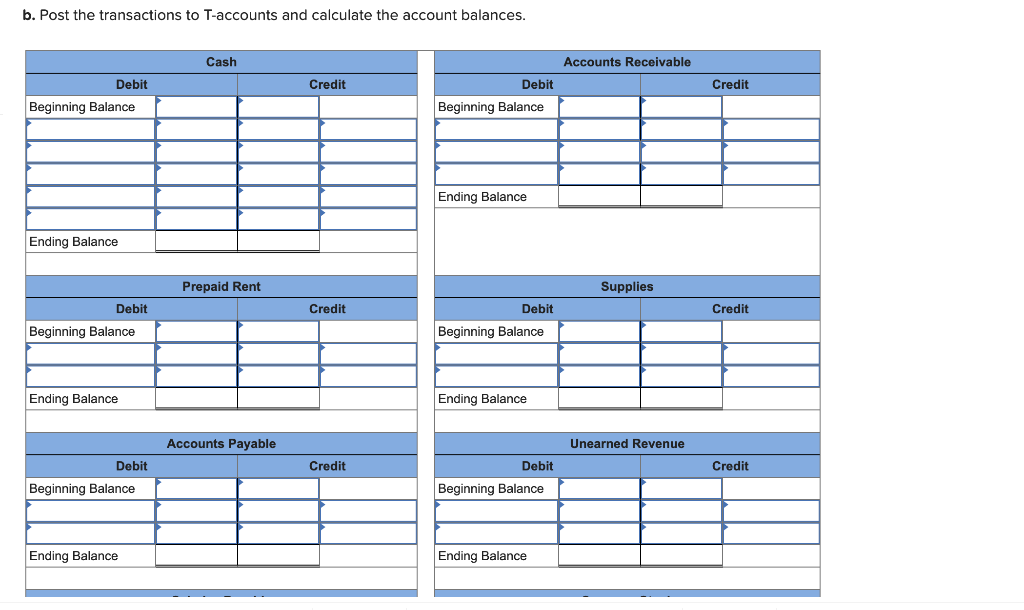

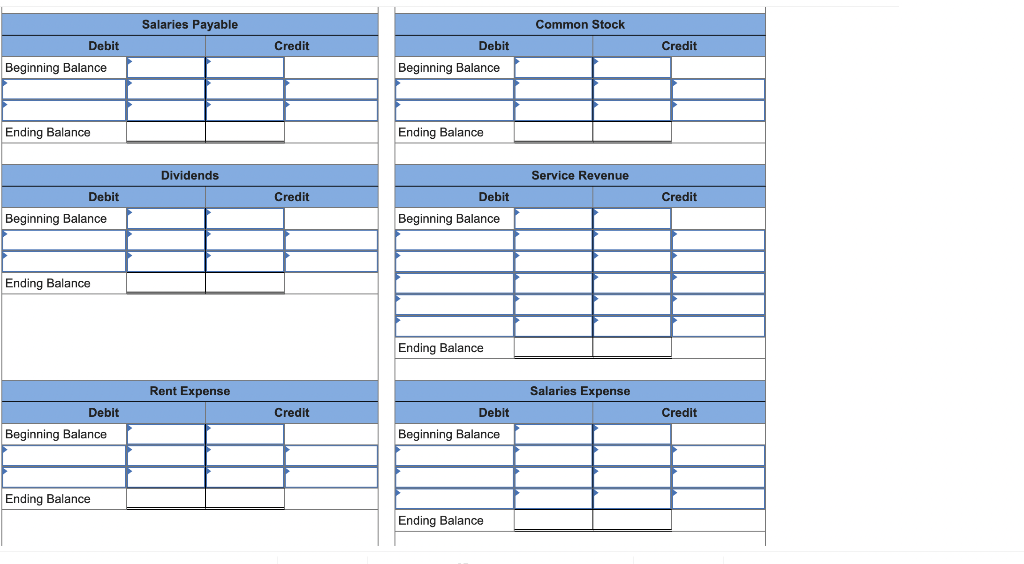

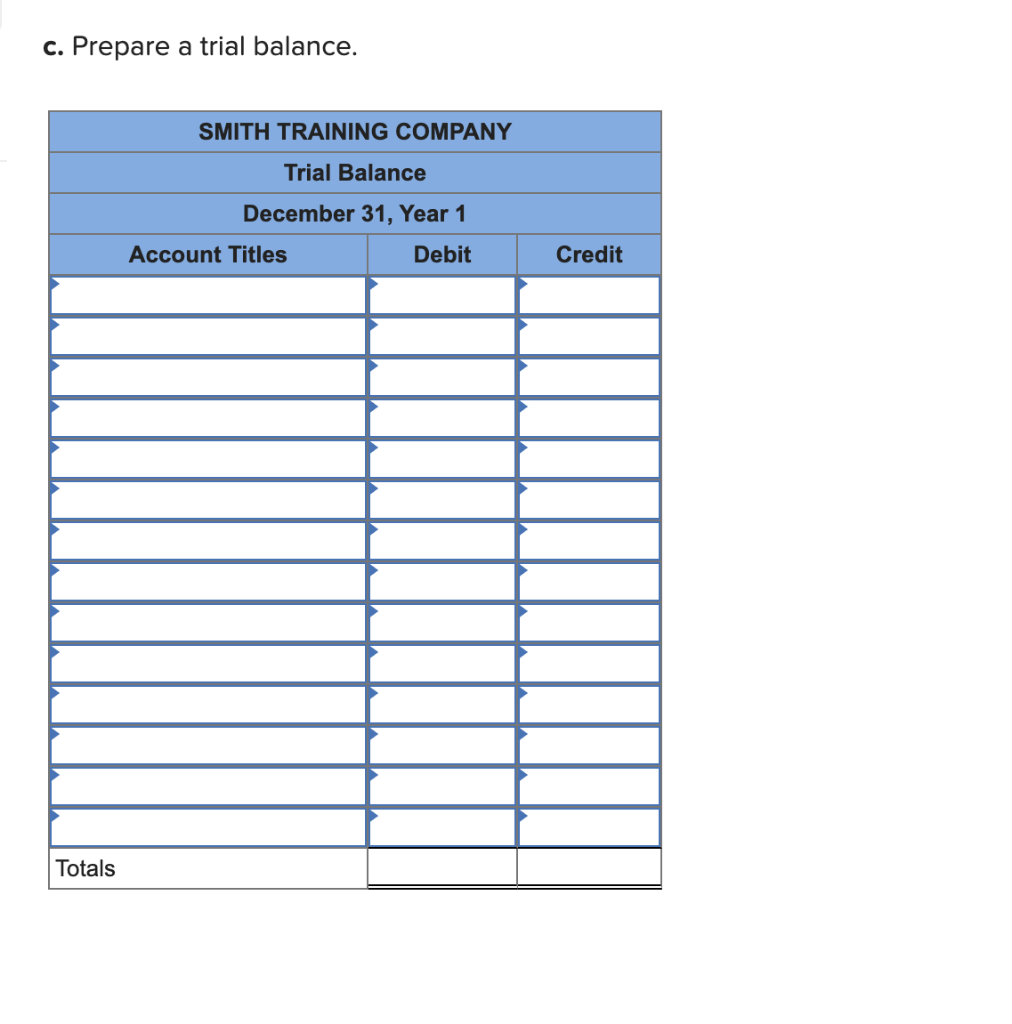

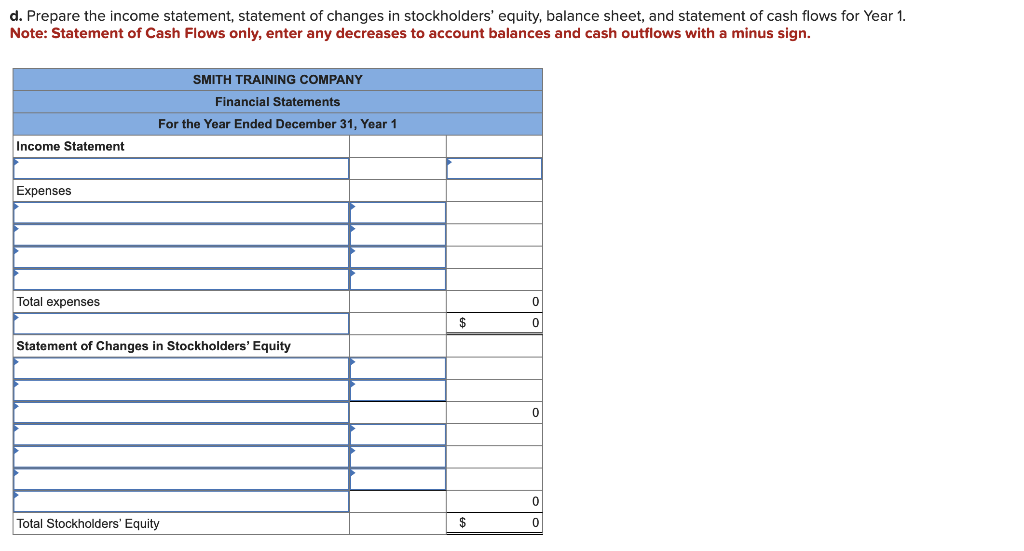

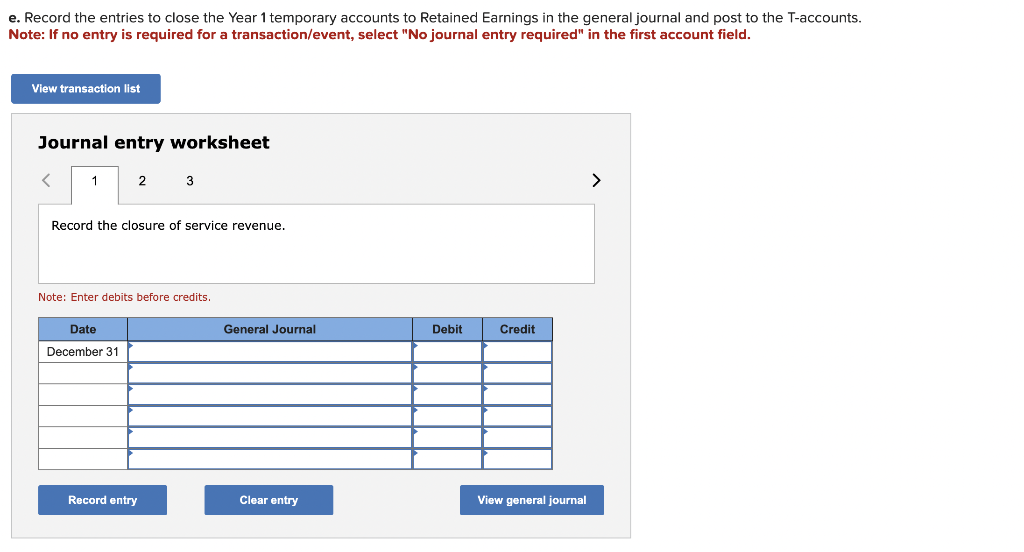

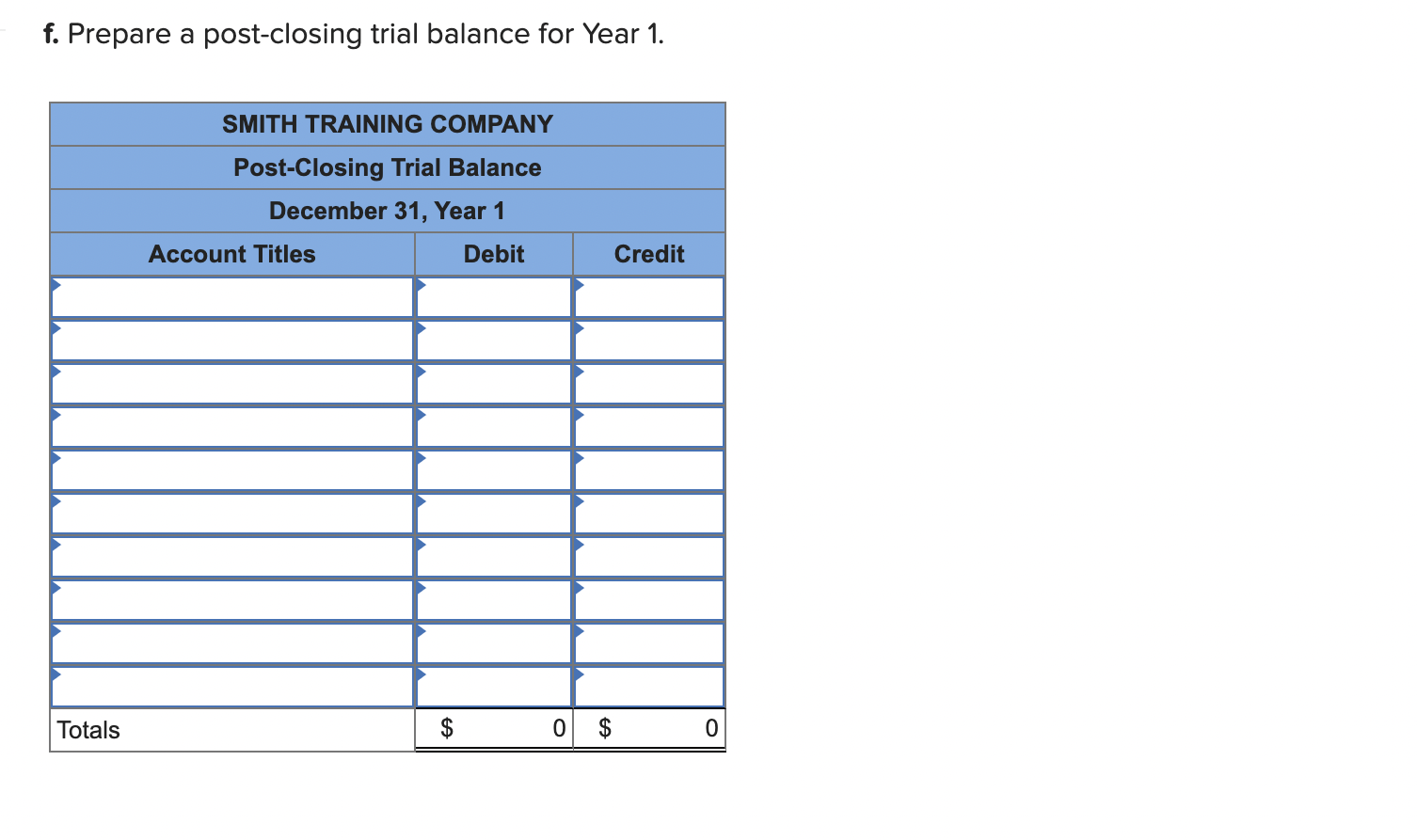

Required information [The following information applies to the questions displayed below.] The following transactions pertain to Smith Training Company for Year 1 : January 30 Established the business when it acquired \$49,000 cash from the issue of common stock. February 1 Paid rent for office space for two years, $30,000 cash. April 10 Purchased $730 of supplies on account. July 1 Received $25,500 cash in advance for services to be provided over the next year. July 20 Paid $548 of the accounts payable from April 10. August 15 Billed a customer \$9,300 for services provided during August. September 15 Completed a job and received $2,500 cash for services rendered. October 1 Paid employee salaries of $31,500 cash. October 15 Received $7,900 cash from accounts receivable. November 16 Billed customers $30,000 for services rendered on account. December 1 Paid a dividend of $1,300 cash to the stockholders. December 31 Adjusted records to recognize the services provided on the contract of July 1 . December 31 Recorded $2,400 of accrued salaries as of December 31 . December 31 Recorded the rent expense for the year. (See February 1.) December 31 Physically counted supplies; \$110 was on hand at the end of the period. Required a. Record the preceding transactions in the general journal, in the given order. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. b. Post the transactions to T-accounts and calculate the account balances. \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Salaries Payable } \\ \hline \multicolumn{1}{|c|}{ Debit } & \multicolumn{2}{c|}{ Credit } \\ \hline Beginning Balance & & & \\ \hline & & & \\ \hline & & & \\ \hline Ending Balance & & & \\ \hline \end{tabular} c. Prepare a trial balance. d. Prepare the income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Year 1 . Note: Statement of Cash Flows only, enter any decreases to account balances and cash outflows with a minus sign. Record the entries to close the Year 1 temporary accounts to Retained Earnings in the general journal and post to the T-accounts. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. f. Prepare a post-closing trial balance for Year 1. Required information [The following information applies to the questions displayed below.] The following transactions pertain to Smith Training Company for Year 1 : January 30 Established the business when it acquired \$49,000 cash from the issue of common stock. February 1 Paid rent for office space for two years, $30,000 cash. April 10 Purchased $730 of supplies on account. July 1 Received $25,500 cash in advance for services to be provided over the next year. July 20 Paid $548 of the accounts payable from April 10. August 15 Billed a customer \$9,300 for services provided during August. September 15 Completed a job and received $2,500 cash for services rendered. October 1 Paid employee salaries of $31,500 cash. October 15 Received $7,900 cash from accounts receivable. November 16 Billed customers $30,000 for services rendered on account. December 1 Paid a dividend of $1,300 cash to the stockholders. December 31 Adjusted records to recognize the services provided on the contract of July 1 . December 31 Recorded $2,400 of accrued salaries as of December 31 . December 31 Recorded the rent expense for the year. (See February 1.) December 31 Physically counted supplies; \$110 was on hand at the end of the period. Required a. Record the preceding transactions in the general journal, in the given order. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. b. Post the transactions to T-accounts and calculate the account balances. \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Salaries Payable } \\ \hline \multicolumn{1}{|c|}{ Debit } & \multicolumn{2}{c|}{ Credit } \\ \hline Beginning Balance & & & \\ \hline & & & \\ \hline & & & \\ \hline Ending Balance & & & \\ \hline \end{tabular} c. Prepare a trial balance. d. Prepare the income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Year 1 . Note: Statement of Cash Flows only, enter any decreases to account balances and cash outflows with a minus sign. Record the entries to close the Year 1 temporary accounts to Retained Earnings in the general journal and post to the T-accounts. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. f. Prepare a post-closing trial balance for Year 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts