Question: As requested by our teacher, we opened a coffee shop in Thailand, this is our Depreciation and Income Statement. Depreciation Income Statement a) From the

As requested by our teacher, we opened a coffee shop in Thailand, this is our Depreciation and Income Statement.

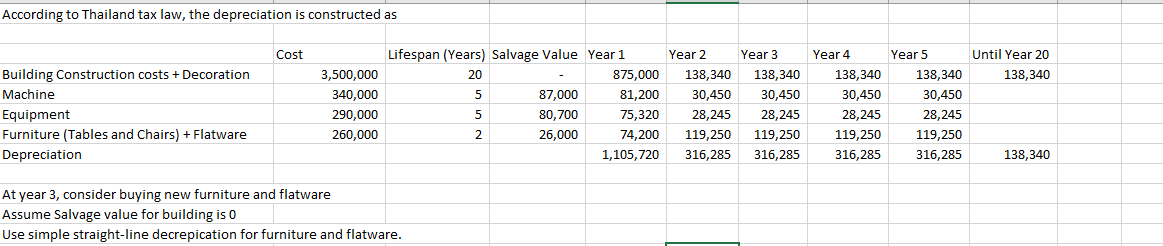

Depreciation

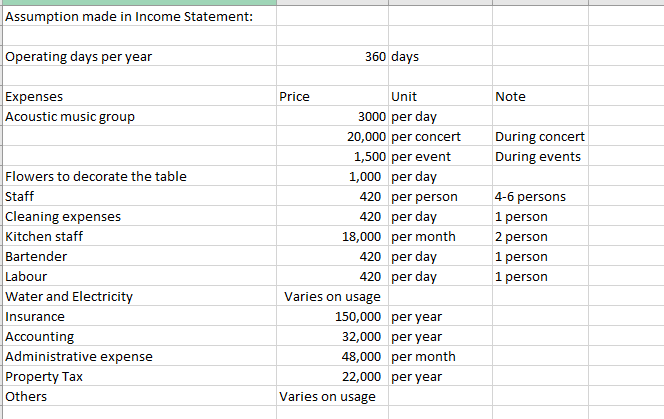

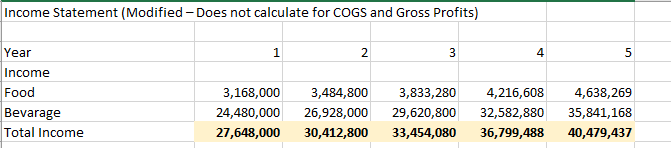

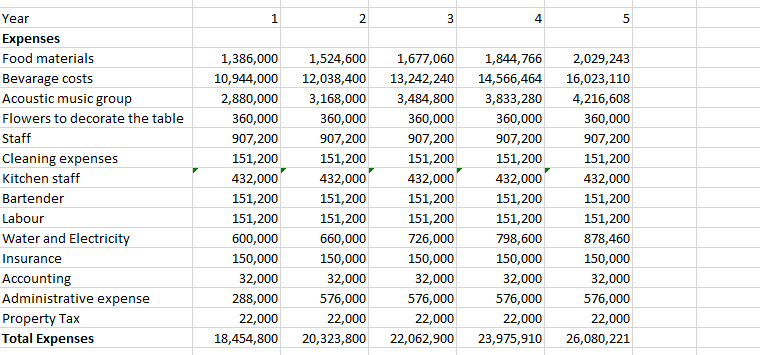

Income Statement

a) From the above figures, please help me calculate EBITDA, Operating Income, Income Before Tax, Interest Paid, Income Tax, Net Income. b) From the above figures, please help me calculate Cash Flow from Operations, Working Capital, Free Cash Flow. Cash = ((1/12)*The year revenues)+((1/12)*The following year expenses)

And show it in Excel for me, with the formula to calculate it, thanks a lot

\begin{tabular}{|l|r|r|r|r|r|r|} \hline Income Statement (Modified - Does not calculate for COGS and Gross Profits) & \\ \hline Year & & & & & \\ \hline Income & 1 & 2 & 3 & 4 & 5 \\ \hline Food & 3,168,000 & 3,484,800 & 3,833,280 & 4,216,608 & 4,638,269 \\ \hline Bevarage & 24,480,000 & 26,928,000 & 29,620,800 & 32,582,880 & 35,841,168 \\ \hline Total Income & 27,648,000 & 30,412,800 & 33,454,080 & 36,799,488 & 40,479,437 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|r|r|r|} \hline Income Statement (Modified - Does not calculate for COGS and Gross Profits) & \\ \hline Year & & & & & \\ \hline Income & 1 & 2 & 3 & 4 & 5 \\ \hline Food & 3,168,000 & 3,484,800 & 3,833,280 & 4,216,608 & 4,638,269 \\ \hline Bevarage & 24,480,000 & 26,928,000 & 29,620,800 & 32,582,880 & 35,841,168 \\ \hline Total Income & 27,648,000 & 30,412,800 & 33,454,080 & 36,799,488 & 40,479,437 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts