Question: As risk manager, you are concerned about the additional liability exposure the firm will face if it accepts a risky project. You obtain an estimate

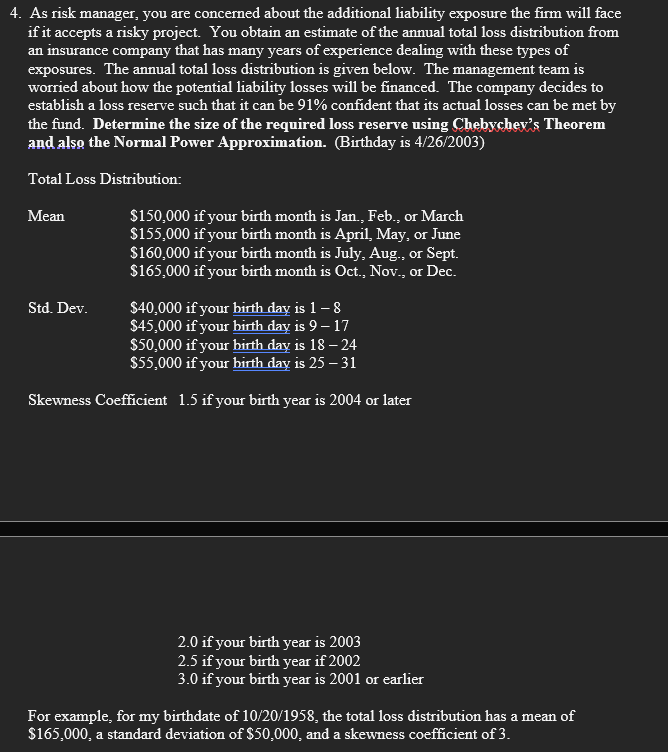

As risk manager, you are concerned about the additional liability exposure the firm will face

if it accepts a risky project. You obtain an estimate of the annual total loss distribution from

an insurance company that has many years of experience dealing with these types of

exposures. The annual total loss distribution is given below. The management team is

worried about how the potential liability losses will be financed. The company decides to

establish a loss reserve such that it can be confident that its actual losses can be met by

the fund. Determine the size of the required loss reserve using Chebychey's Theorem

and also the Normal Power Approximation. Birthday is

Total Loss Distribution:

Mean $ if your birth month is Jan., Feb., or March

$ if your birth month is April, May, or June

$ if your birth month is July, Aug., or Sept.

$ if your birth month is Oct., Nov., or Dec.

Std Dev. $ if your hirth day is

$ if your birth day is

$ if your birth day is

$ if your hirth day is

Skewness Coefficient if your birth year is or later

if your birth year is

if your birth year if

if your birth year is or earlier

For example, for my birthdate of the total loss distribution has a mean of

$ a standard deviation of $ and a skewness coefficient of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock