Question: As soon as possible please, thumps up for fast and correct answer :) . Multiple Choice (3 Marks each) DA common approach of estimating the

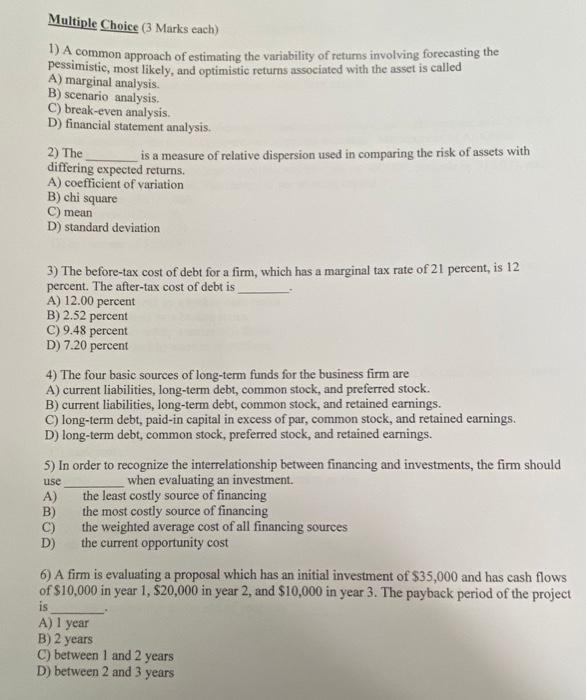

Multiple Choice (3 Marks each) DA common approach of estimating the variability of returns involving forecasting the pessimistic, most likely, and optimistic returns associated with the asset is called A) marginal analysis B) scenario analysis C) break-even analysis D) financial statement analysis. 2) The is a measure of relative dispersion used in comparing the risk of assets with differing expected returns. A) coefficient of variation B) chi square C) mean D) standard deviation 3) The before-tax cost of debt for a firm, which has a marginal tax rate of 21 percent, is 12 percent. The after-tax cost of debt is A) 12.00 percent B) 2.52 percent C) 9.48 percent D) 7.20 percent 4) The four basic sources of long-term funds for the business firm are A) current liabilities, long-term debt, common stock, and preferred stock. B) current liabilities, long-term debt, common stock, and retained earnings. C) long-term debt, paid-in capital in excess of par, common stock, and retained earnings. D) long-term debt, common stock, preferred stock, and retained earnings. 5) In order to recognize the interrelationship between financing and investments, the firm should when evaluating an investment. A) the least costly source of financing B) the most costly source of financing C) the weighted average cost of all financing sources D) the current opportunity cost 6) A firm is evaluating a proposal which has an initial investment of $35,000 and has cash flows of $10,000 in year 1, $20,000 in year 2, and $10,000 in year 3. The payback period of the project is A) 1 year B) 2 years C) between 1 and 2 years D) between 2 and 3 years use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts