Question: As the c orrelation c oefficient between two stocks increases, the benefits of diversification received by combining them into a portfolio also increase. t or

As the correlation coefficient between two stocks increases, the benefits of diversification received by combining them into a portfolio also increase. t or f

Any portfolio is mean-variance efficient it has the lowest risk for a given level of return among the attainable set of portfolios.

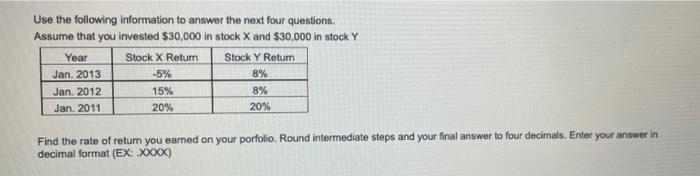

Use the following information to answer the next four questions. Assume that you invested $30,000 in stock X and $30,000 in stock Y Year Stock X Return Stock Y Return Jan. 2013 -5% 8% Jan. 2012 15% 8% Jan. 2011 20% 20% Find the rate of return you earned on your porfolio. Round intermediate steps and your final answer to four decimals. Enter your answer in decimal format (EX: XXXX)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts