Question: As the problem and the website (https://www.chegg.com/homework-help/investments-10th-edition-chapter-18-problem-5cp-solution-9780077861674?trackid=29e63c248c0a&strackid=a3cd293b9995) ,which include the reference answer to the problem above : Please look at the Step 3,the calculation of

As the problem and the website (https://www.chegg.com/homework-help/investments-10th-edition-chapter-18-problem-5cp-solution-9780077861674?trackid=29e63c248c0a&strackid=a3cd293b9995) ,which include the reference answer to the problem above :

Please look at the Step 3,the calculation of b ,which is as follows:

B=(208-0.8*100)/208=0.6154

But why we use the Net income 208,which is published at the end of 2010??????

And my answer is as follows :

b=(200-0.8*100)/200=0.6(the Net income 200 is from the year 2009)

In my view, the growth rate in 2010 is from the reinvestment of the earning inthe year 2009

Here is my detailed answer:

In the year 2010:

b=(200-0.8*100)/200=0.6 ROE=208/1380=0.1507

The substainable growth rate=0.6*0.1507=9.04%

In the year 2013:

b=(252-0.8*100)/252=0.6825 ROE=275/1836=0.1498

The substainable growth rate=0.6825*0.1498=10.22%

Which ansewer is correct ?Please give me a hand

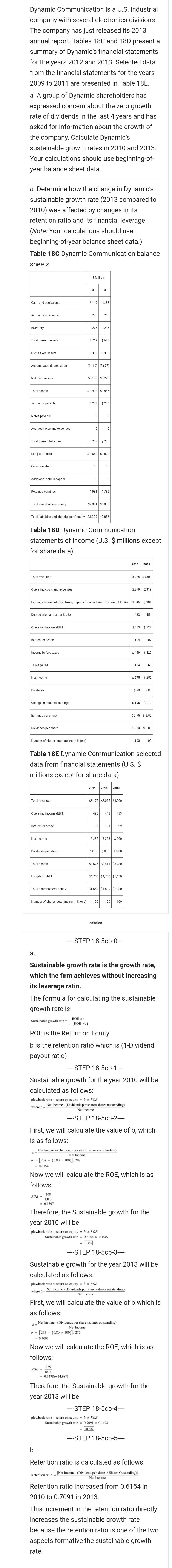

Dynamic Communication is a U.S. industrial company with several electronics divisions. The company has just released its 2013 annual report. Tables 18C and 18D present a summary of Dynamic's financial statements for the years 2012 and 2013. Selected data from the financial statements for the years 2009 to 2011 are presented in Table 18E. a. A group of Dynamic shareholders has expressed concern about the zero growth rate of dividends in the last 4 years and has asked for information about the growth of the company. Calculate Dynamic's sustainable growth rates in 2010 and 2013. Your calculations should use beginning-of- year balance sheet data. b. Determine how the change in Dynamic's sustainable growth rate (2013 compared to 2010) was affected by changes in its retention ratio and its financial leverage. (Note: Your calculations should use beginning-of-year balance sheet data.) Table 18C Dynamic Communication balance sheets $ Million 2013 2012 Cash and equivalents $ 149 $ 83 Accounts receivable 295 265 Inventory 275 285 Total current assets S 719 $ 633 Gross fixed assets 9,350 8,900 Accumulated depreciation (6,160) (5,677) Net fixed assets 53,190 $3,223 Total assets $ 3,909 $3,856 Accounts payable S 228 $ 220 Notes payable 0 0 Accrued taxes and expenses 0 0 Total current liabilities S 228 $ 220 Long-term debt $ 1,650 $1,800 Common stock 50 50 Additional paid-in capital 0 0 Retained earnings 1,981 1,786 Total shareholders' equity $2,031 $1,836 Total liabilities and shareholders' equity S3.9C9 $3.856 Table 18D Dynamic Communication statements of income (U.S. $ millions except for share data) 2013 2012 Total revenues $3.425 $3,300 Operating costs and expenses 2,379 2,319 Earnings before interest, taxes, depreciation and amortization (EBITDA) 51,046 $ 981 Depreciation and amortization 483 454 Operating income (EBIT) $ 563 $527 Interest expense 104 107 Income before taxes $ 459 $ 420 Taxes (40%) 184 168 Net income $ 275 $ 252 Dividends $ 80 S 80 Change in retained earnings $ 195 $ 172 Earnings per share $ 2.75 $ 2.52 Dividends per share $ 0.80 $ 0.80 Number of shares outstanding (millions) 100 100 Table 18E Dynamic Communication selected data from financial statements (U.S. $ millions except for share data) 2011 2010 2009 Total revenues $3,175 $3,075 $3,000 Operating income (EBIT) 495 448 433 Interest expense 104 101 99 Net income $ 235 S 208 $200 Dividends per share $ 0.80 $0.80 $ 0.80 Total assets $3,625 $3,414 $3,230 Long-term debt $1,750 $1,700 $1,650 Total shareholders' equity $1.664 $1.509 $1,380 Number of shares outstanding millions) 100 100 100 solution ----STEP 18-5cp-0---- a. Sustainable growth rate is the growth rate, which the firm achieves without increasing its leverage ratio. The formula for calculating the sustainable growth rate is ROE xb Sustainable growth rate = 1-(ROE xb) ROE is the Return on Equity b is the retention ratio which is (1-Dividend payout ratio) ----STEP 18-5cp-1--- Sustainable growth for the year 2010 will be calculated as follows: plowback ratio x return on equity = 5 x ROE Net Income - (Dividends per share x shares outstanding) where b = Net Income ----STEP 18-5cp-2---- First, we will calculate the value of b, which is as follows: Net Income - (Dividends per share x shares outstanding) b= Net Income b = [208 (0.80 x 100)]/ 208 = 0.6154 Now we will calculate the ROE, which is as follows: 208 ROE = 1380 = 0.1507 Therefore, the Sustainable growth for the year 2010 will be plowback ratio x return on equity = b ROE Sustainable growth rate = 0.6154 x 0.1507 = 9.3% ----STEP 18-5cp-3---- Sustainable growth for the year 2013 will be calculated as follows: plowback ratio x return on equity = 5 x ROE Net Income - (Dividends per share x shares outstanding) where b = Net Income First, we will calculate the value of b which is as follows: Net Income - (Dividends per share x shares outstanding) b= Net Income b= [275 - (0.80 x 100)]/275 = 0.7091 Now we will calculate the ROE, which is as follows: 275 ROE = 1836 = 0.1498 or 14.98% Therefore, the Sustainable growth for the year 2013 will be ----STEP 18-5cp-4---- plowback ratio x return on equity = 5 x ROE Sustainable growth rate = 0.7091 * 0.1498 10.6% ----STEP 18-5cp-5---- b. Retention ratio is calculated as follows: [Net Income - (Dividend per share > Shares Oustanding)] Retention ratio = Net Income Retention ratio increased from 0.6154 in 2010 to 0.7091 in 2013. This increment in the retention ratio directly increases the sustainable growth rate because the retention ratio is one of the two aspects formative the sustainable growth rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts