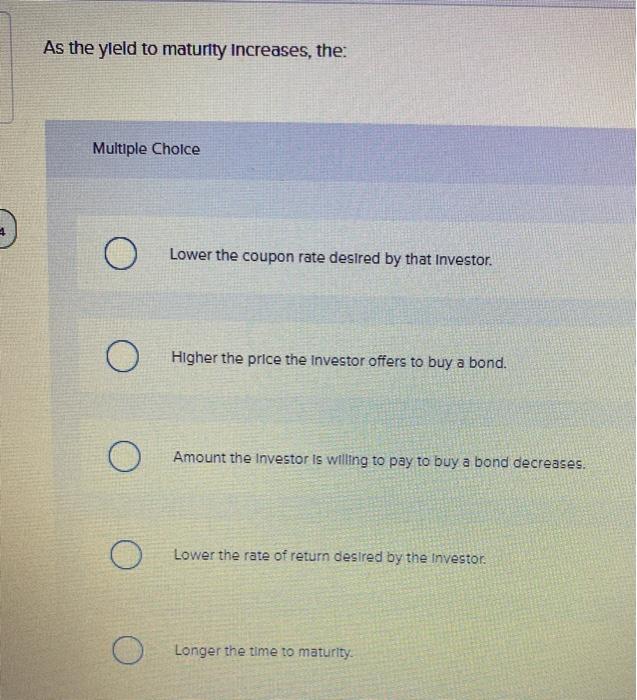

Question: As the yield to maturity Increases, the: Multiple Choice O Lower the coupon rate desired by that investor. O O Higher the price the investor

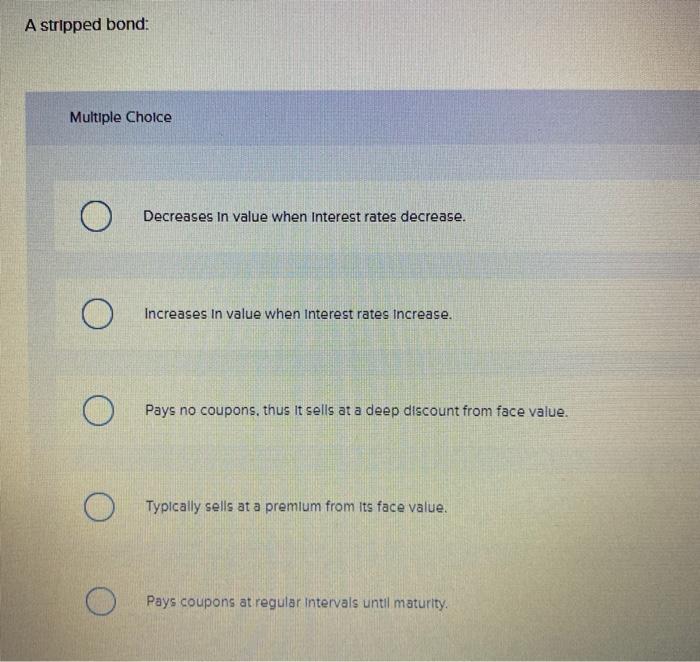

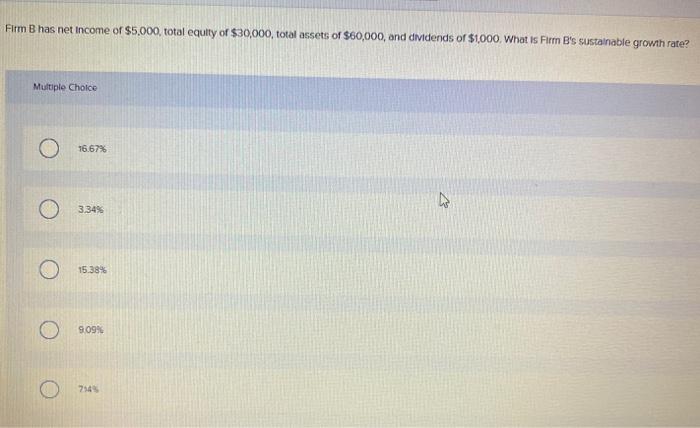

As the yield to maturity Increases, the: Multiple Choice O Lower the coupon rate desired by that investor. O O Higher the price the investor offers to buy a bond. Amount the investor is willing to pay to buy a bond decreases. Lower the rate of return desired by the Investor Longer the time to maturity. A stripped bond: Multiple Choice O Decreases in value when Interest rates decrease. Increases in value when Interest rates increase. Pays no coupons, thus it sells at a deep discount from face value. Typically sells at a premium from its face value. Pays coupons at regular intervals until maturity. Firm B has net income of $5,000, total equity of $30,000, total assets of $60,000, and dividends of $1,000. What is Firm B's sustainable growth rate? Multiple Choice 16.67% 3,34% 15.38% 909% 24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts