Question: As there is no category for financial math, I put in the category of finance. Please show the steps thoroughly, thank you! 15 marks The

As there is no category for financial math, I put in the category of finance. Please show the steps thoroughly, thank you!

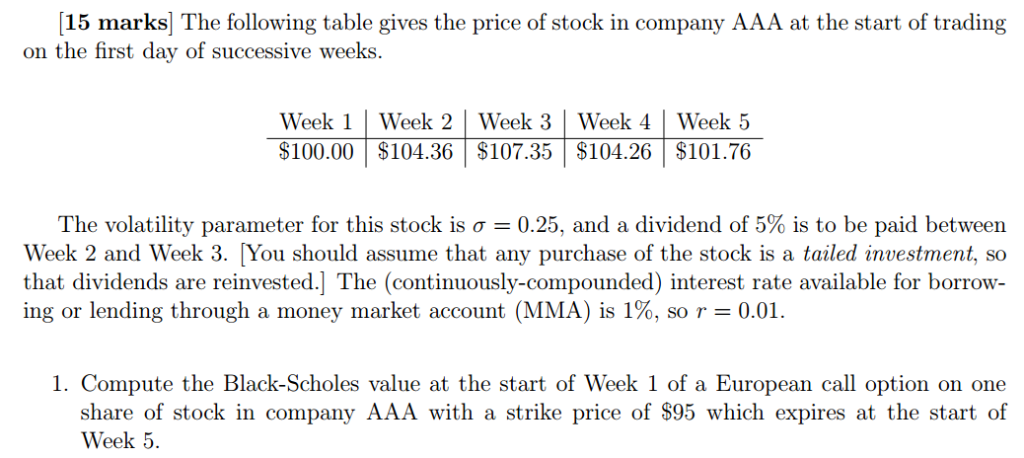

15 marks The following table gives the price of stock in company AAA at the start of trading on the first day of successive weeks Week 1 Week 2 Week 3 Week 4 Week5 $100.00 $104.36 $107.35 $104.26 $101.76 The volatility parameter for this stock is -0.25, and a dividend of 5% is to be paid between Week 2 and Week 3. [You should assume that any purchase of the stock is a tailed investment, so that dividends are reinvested.] The (continuously-compounded) interest rate available for borrow- ing or lending through a money market account (MMA) is 1%, so r 0.01. 1. Compute the Black-Scholes value at the start of Week 1 of a European call option on one share of stock in company AAA with a strike price of $95 which expires at the start of Week 5. 15 marks The following table gives the price of stock in company AAA at the start of trading on the first day of successive weeks Week 1 Week 2 Week 3 Week 4 Week5 $100.00 $104.36 $107.35 $104.26 $101.76 The volatility parameter for this stock is -0.25, and a dividend of 5% is to be paid between Week 2 and Week 3. [You should assume that any purchase of the stock is a tailed investment, so that dividends are reinvested.] The (continuously-compounded) interest rate available for borrow- ing or lending through a money market account (MMA) is 1%, so r 0.01. 1. Compute the Black-Scholes value at the start of Week 1 of a European call option on one share of stock in company AAA with a strike price of $95 which expires at the start of Week 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts