Question: as u learn Question 6 Delia is currently 30 years old and she wants to retire at the age of 65. At retirement Delia wants

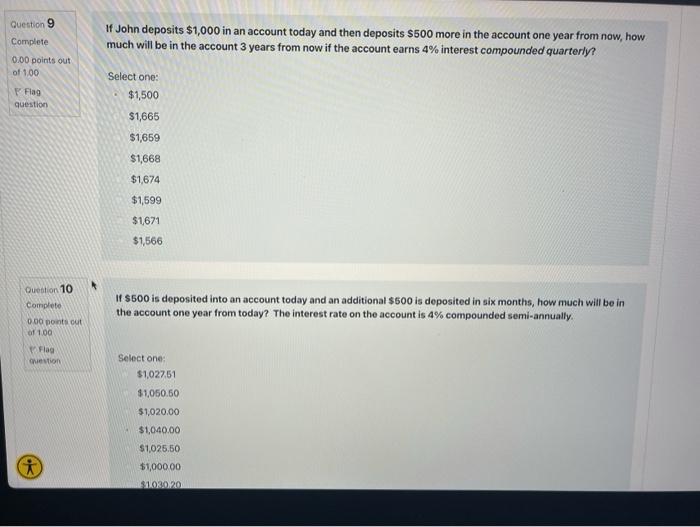

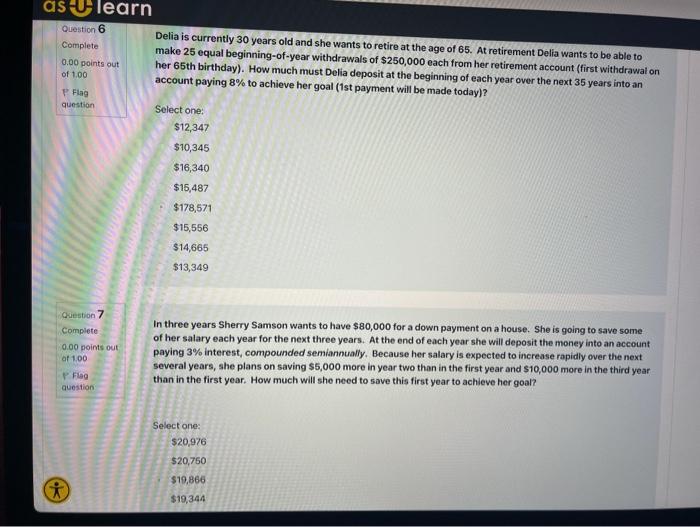

as u learn Question 6 Delia is currently 30 years old and she wants to retire at the age of 65. At retirement Delia wants to be able to Complete make 25 equal beginning-of-year withdrawals of $250,000 each from her retirement account (first withdrawal on 0.00 points out her 65th birthday). How much must Delia deposit at the beginning of each year over the next 35 years into an of 1.00 account paying 8% to achieve her goal (1st payment will be made today)? P Flag question Select one: $12,347 $10,345 $16,340 $16,487 $178,571 $15,556 $14,665 $13,349 Question 7 Complete 0.00 points out af 1.00 in three years Sherry Samson wants to have $80,000 for a down payment on a house. She is going to save some of her salary each year for the next three years. At the end of each year she will deposit the money into an account paying 3% interest, compounded semiannually. Because her salary is expected to increase rapidly over the next several years, she plans on saving $5,000 more in year two than in the first year and $10,000 more in the third year than in the first year. How much will she need to save this first year to achieve her goal? P Flag question Select one: $20,976 $20,750 $19,866 $19,344 as u learn Question 6 Delia is currently 30 years old and she wants to retire at the age of 65. At retirement Delia wants to be able to Complete make 25 equal beginning-of-year withdrawals of $250,000 each from her retirement account (first withdrawal on 0.00 points out her 65th birthday). How much must Delia deposit at the beginning of each year over the next 35 years into an of 1.00 account paying 8% to achieve her goal (1st payment will be made today)? P Flag question Select one: $12,347 $10,345 $16,340 $16,487 $178,571 $15,556 $14,665 $13,349 Question 7 Complete 0.00 points out af 1.00 in three years Sherry Samson wants to have $80,000 for a down payment on a house. She is going to save some of her salary each year for the next three years. At the end of each year she will deposit the money into an account paying 3% interest, compounded semiannually. Because her salary is expected to increase rapidly over the next several years, she plans on saving $5,000 more in year two than in the first year and $10,000 more in the third year than in the first year. How much will she need to save this first year to achieve her goal? P Flag question Select one: $20,976 $20,750 $19,866 $19,344

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts