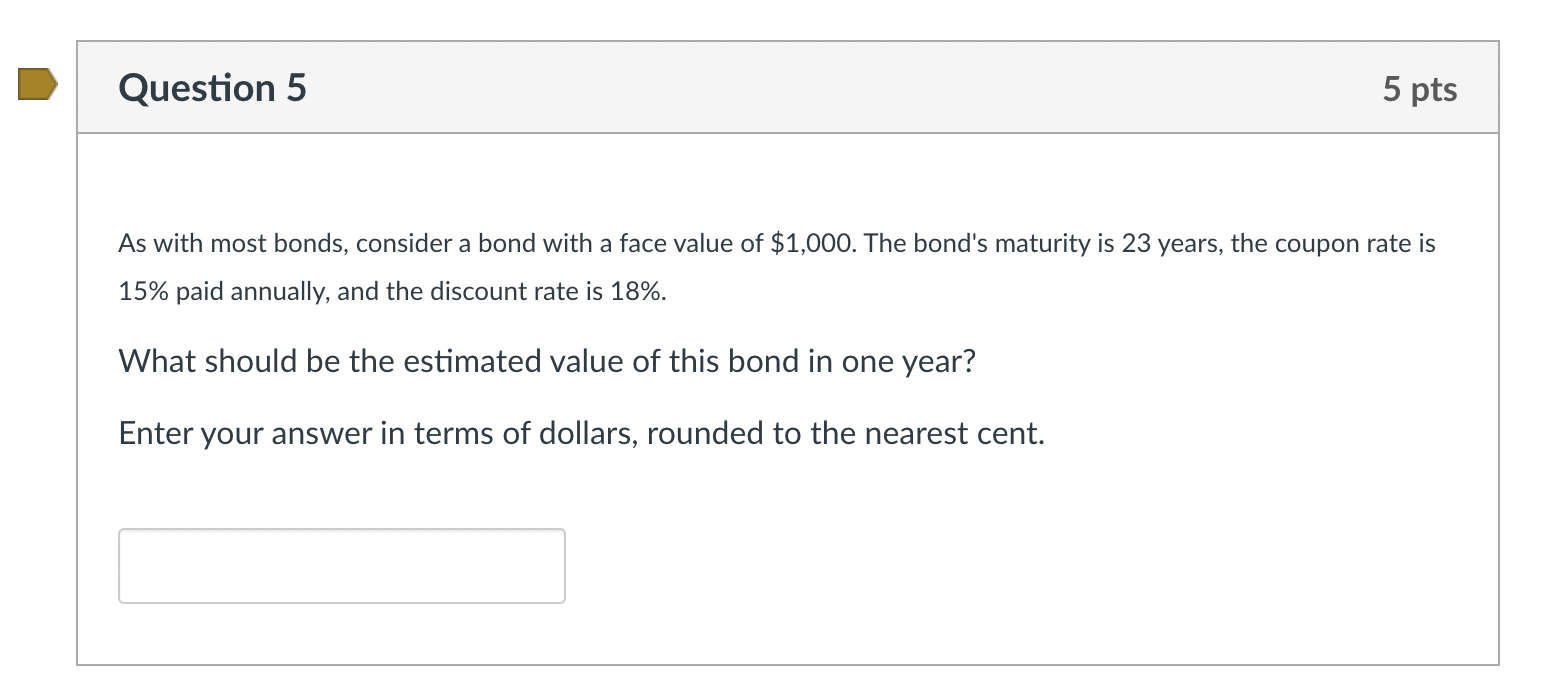

Question: As with most bonds, consider a bond with a face value of $1,000. The bond's maturity is 23 years, the coupon rate is 15% paid

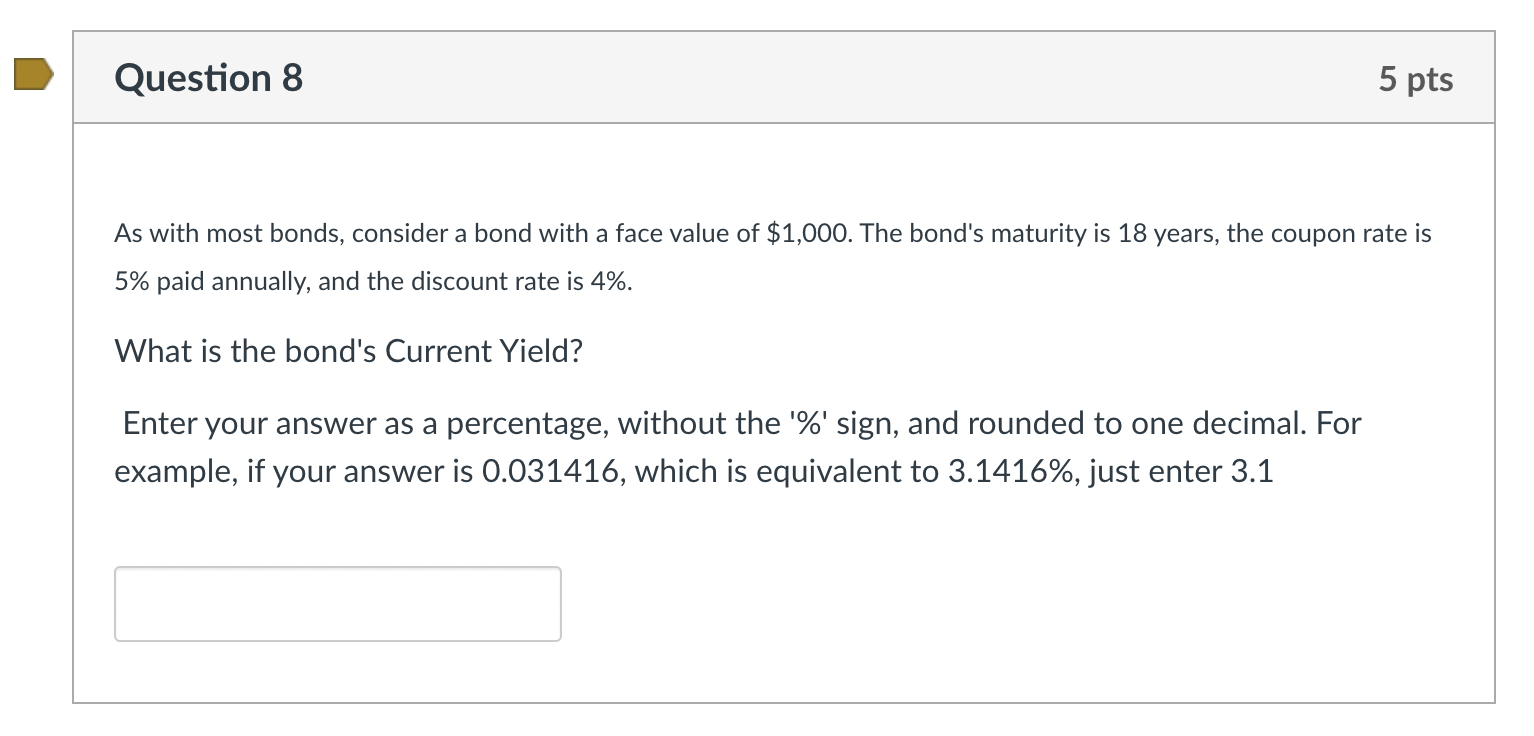

As with most bonds, consider a bond with a face value of $1,000. The bond's maturity is 23 years, the coupon rate is 15% paid annually, and the discount rate is 18%. What should be the estimated value of this bond in one year? Enter your answer in terms of dollars, rounded to the nearest cent. As with most bonds, consider a bond with a face value of $1,000. The bond's maturity is 18 years, the coupon rate is 5% paid annually, and the discount rate is 4%. What is the bond's Current Yield? Enter your answer as a percentage, without the '\%' sign, and rounded to one decimal. For example, if your answer is 0.031416 , which is equivalent to 3.1416%, just enter 3.1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts