Question: As you are a security analyst preparing a report for firm's expectation regarding two stocks for the year to come. Your reportisto include the expected

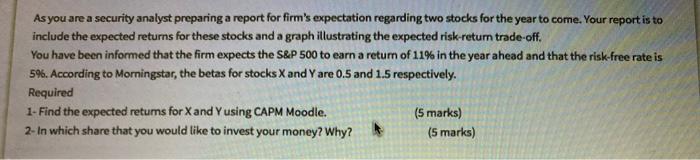

As you are a security analyst preparing a report for firm's expectation regarding two stocks for the year to come. Your reportisto include the expected returns for these stocks and a graph illustrating the expected risk-return trade-off. You have been informed that the firm expects the S&P 500 to earn a return of 11% in the year ahead and that the risk-free rate is 54. According to Morningstar, the betas for stocks X and Yare 0.5 and 1.5 respectively. Required 1- Find the expected retums for X and Y using CAPM Moodle. (5 marks) 2-In which share that you would like to invest your money? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts