Question: ASAP An investor is looking at a possible triangular arbitrage trade using U.S., Brazilian and Swiss currencies, to be executed based on a dealer's bid/offer

ASAP

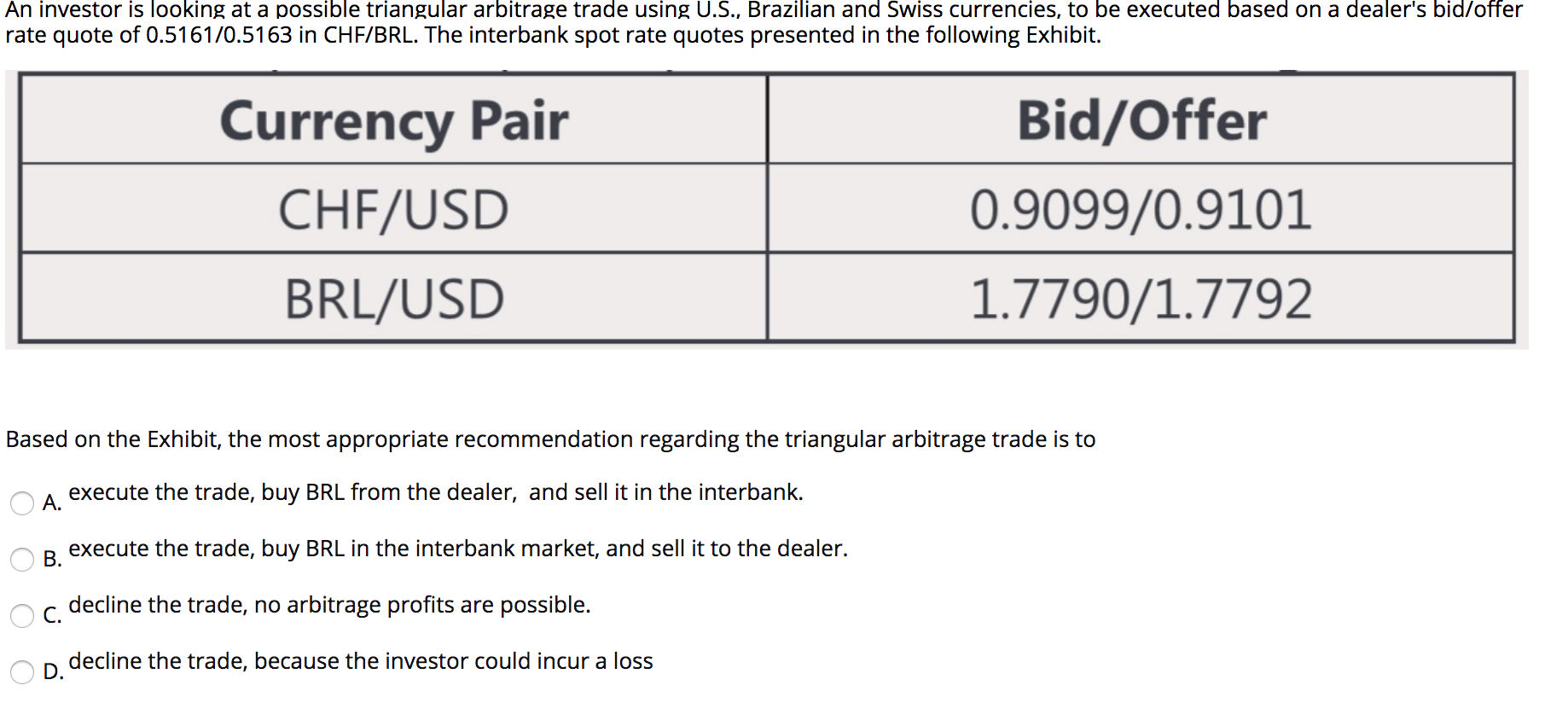

An investor is looking at a possible triangular arbitrage trade using U.S., Brazilian and Swiss currencies, to be executed based on a dealer's bid/offer rate quote of 0.5161/0.5163 in CHF/BRL. The interbank spot rate quotes presented in the following Exhibit. Currency Pair CHF/USD BRL/USD Bid/Offer 0.9099/0.9101 1.7790/1.7792 Based on the Exhibit, the most appropriate recommendation regarding the triangular arbitrage trade is to A execute the trade, buy BRL from the dealer, and sell it in the interbank. execute the trade, buy BRL in the interbank market, and sell it to the dealer. oc decline the trade, no arbitrage profits are possible. Op decline the trade, because the investor could incur a loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts