Question: ASAP ANSWER You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a very common practice with expensive, hightech

ASAP ANSWER

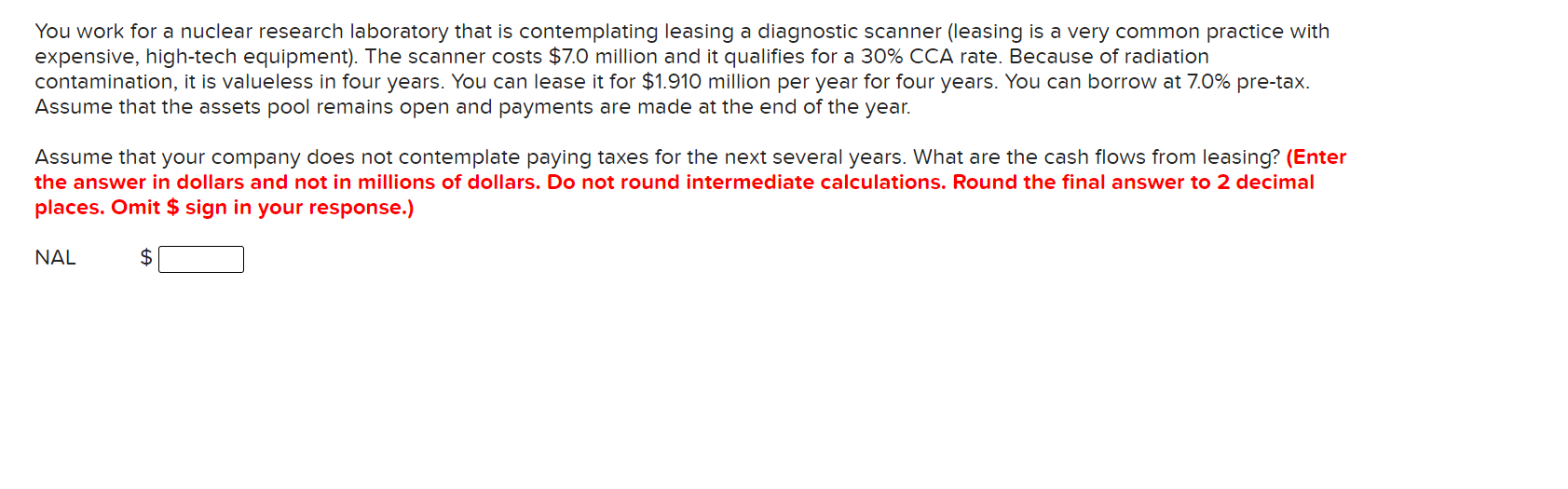

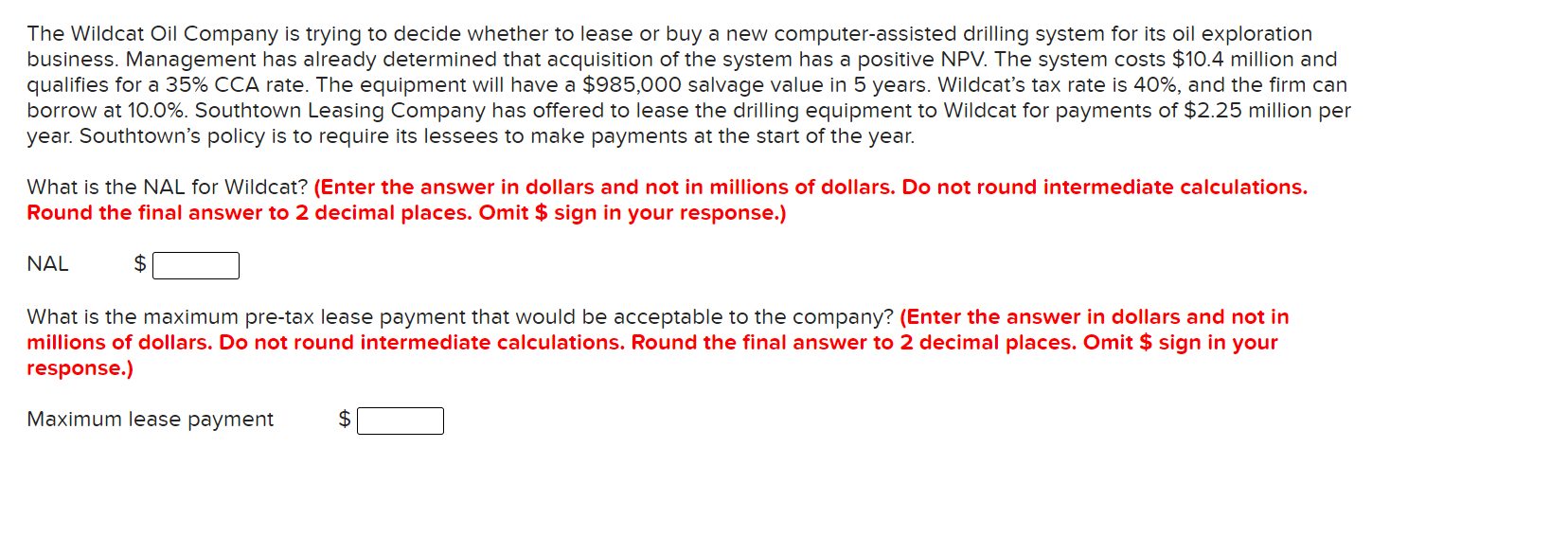

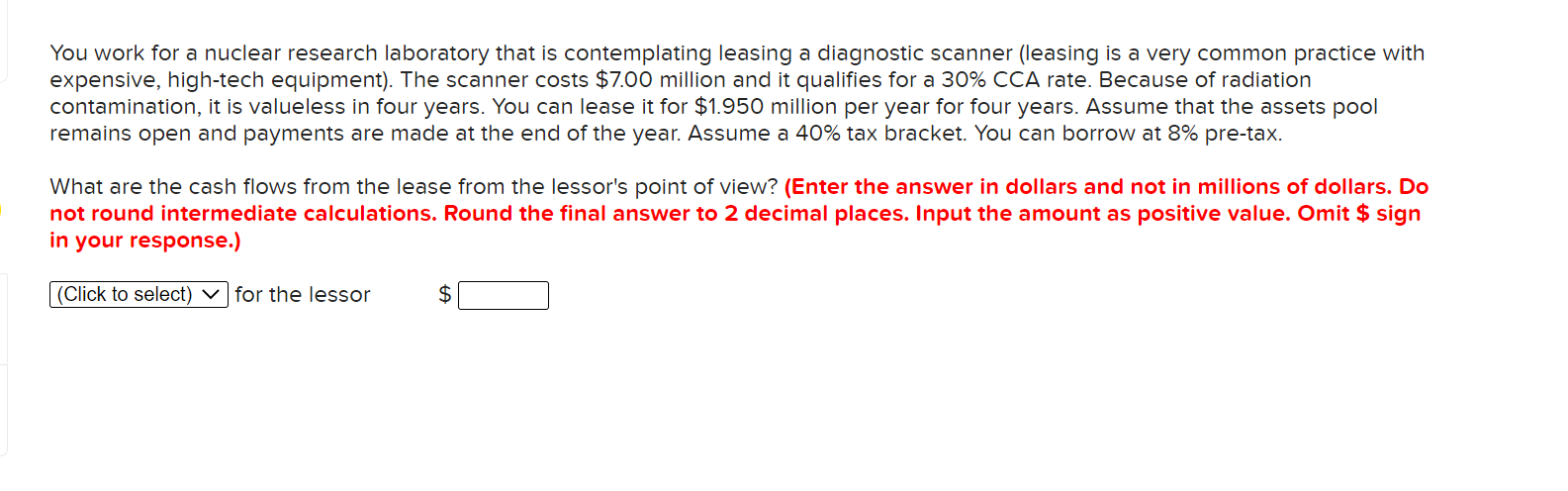

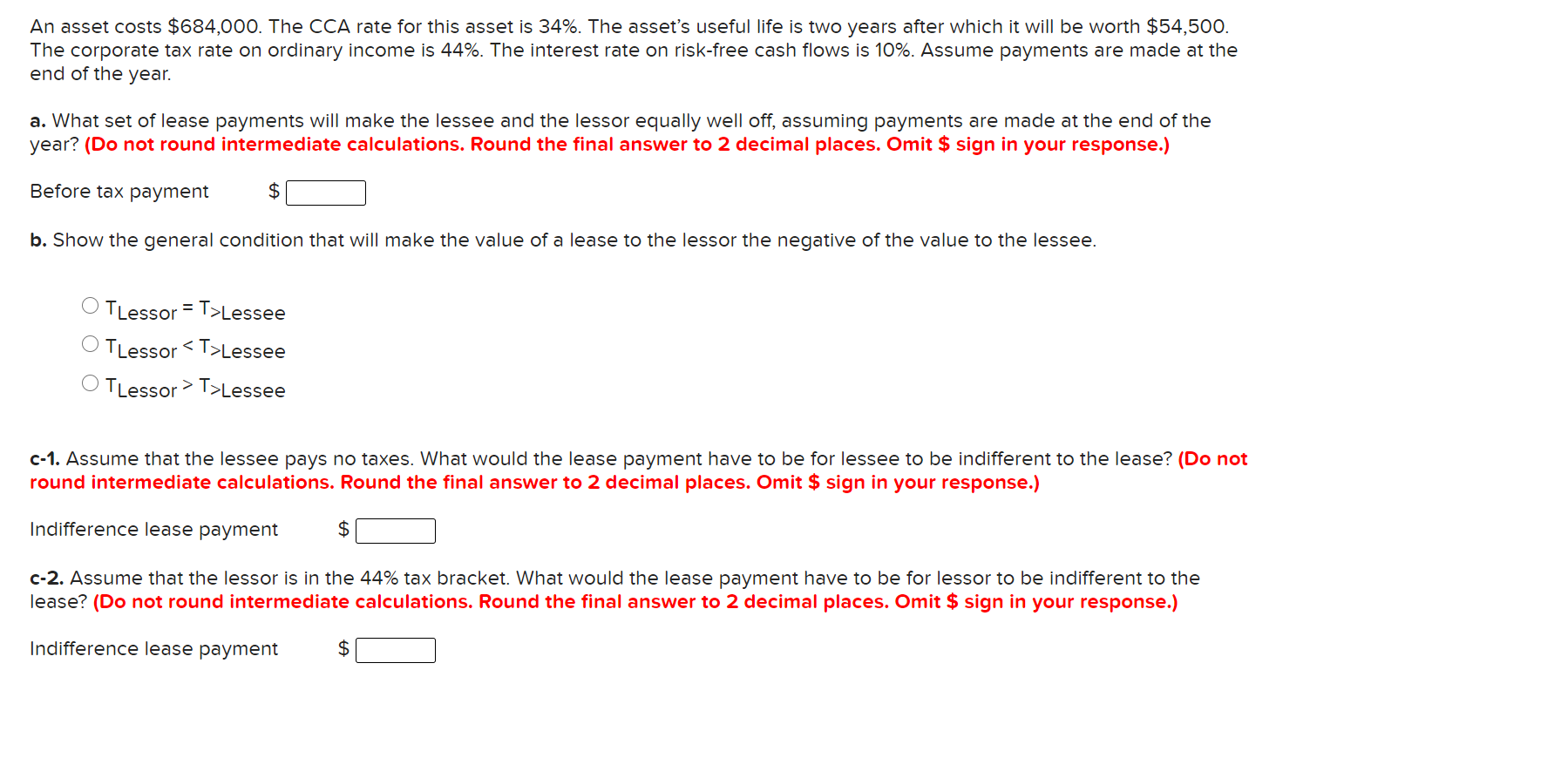

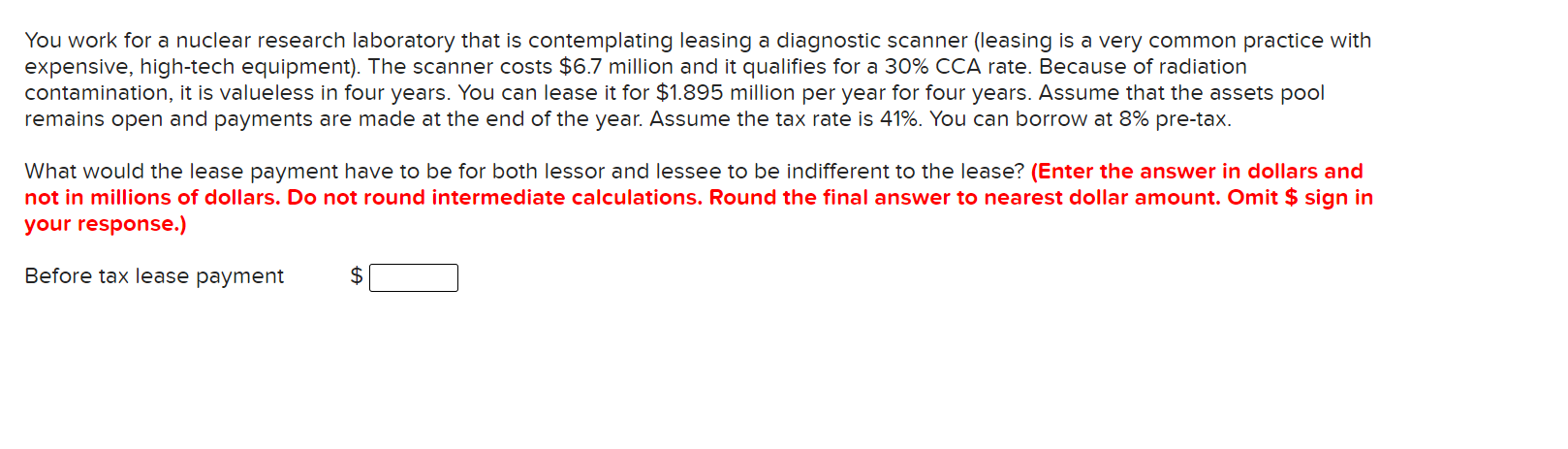

You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a very common practice with expensive, hightech equipment). The scanner costs $7.0 million and it qualifies for a 30% CCA rate. Because of radiation contamination, it is valueless in four years. You can lease it for $1.910 million per year for four years. You can borrow at 7.0% pretax. Assume that the assets pool remains open and payments are made at the end of the year. Assume that your company does not contemplate paying taxes for the next several years. What are the cash flows from leasing? {Enter the answer in dollars and not in millions of dollars. Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) NAL as: The Wildcat Oil Company is trying to decide whether to lease or buy a new computerassisted drilling system for its oil exploration business. Management has already determined that acquisition of the system has a positive NPV. The system costs $10.4 million and qualifies for a 35% CCA rate. The equipment will have a $985,000 salvage value in 5 years. Wildcat's tax rate is 40%, and the firm can borrow at 10.0%. Southtown Leasing Company has offered to lease the drilling equipment to Wildcat for payments of $2.25 million per year. Southtown's policy is to require its lessees to make payments at the start of the year. What is the NAL for Wildcat? (Enter the answer in dollars and not in millions of dollars. Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) NAL 35:] What is the maximum pretax lease payment that would be acceptable to the company? (Enter the answer in dollars and not in millions of dollars. Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) Maximum lease payment 35 l: You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a very common practice with expensive, high-tech equipment). The scanner costs $7.00 million and it qualifies for a 30% CCA rate. Because of radiation contamination, it is valueless in four years. You can lease it for $1.950 million per year for four years. Assume that the assets pool remains open and payments are made at the end of the year. Assume a 40% tax bracket. You can borrow at 8% pretax. What are the cash flows from the lease from the lessor's point of view? (Enter the answer in dollars and not in millions of dollars. Do not round intermediate calculations. Round the final answer to 2 decimal places. Input the amount as positive value. Omit $ sign in your response.) (Click lo select) v for the lessor $ [:] An asset costs $684,000. The CCA rate for this asset is 34%. The asset's useful life is two years after which it will be worth $54,500. The corporate tax rate on ordinary income is 44%. The interest rate on risk-free cash flows is 10%. Assume payments are made at the end of the year. a. What set of lease payments will make the lessee and the lessor equally well off, assuming payments are made at the end of the year? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) Before tax payment :5 E b. Show the general condition that will make the value of a lease to the lessor the negative of the value to the lessee. O TLessor = T>Lessee O TLessor Lessee O TLessor > T>Lessee c-1. Assume that the lessee pays no taxes. What would the lease payment have to be for lessee to be indifferent to the lease? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) Indifference lease payment $ :] c2. Assume that the lessor is in the 44% tax bracket. What would the lease payment have to be for lessor to be indifferent to the lease? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) Indifference lease payment $ :] You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a very common practice with expensive, high-tech equipment). The scanner costs $6.7 million and it qualifies for a 30% CCA rate. Because of radiation contamination, it is valueless in four years. You can lease it for $1.895 million per year for four years. Assume that the assets pool remains open and payments are made at the end of the year. Assume the tax rate is 41%. You can borrow at 8% pre-tax. What would the lease payment have to be for both lessor and lessee to be indifferent to the lease? (Enter the answer in dollars and not in millions of dollars. Do not round intermediate calculations. Round the final answer to nearest dollar amount. Omit $ sign in your response.) Before tax lease payment $ :i

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts