Q

genaral information:

your intereste in investing in a building costing 10000000

your can either finance the purchase of the building using either:

> Mortgage A and a 40% loan-to-value Ratio; or

> Mortgage B and a 59% loan-to-value Ratio.

further details regarding the Mortgages are provided in Table 1.

you require 8% return on an unlevered equity investment.

you anticipate receiving 1000000 in rental income at the end of every year for five years

you poan to sell the building after fuve years for 11000000.

Table 1: Mortgage details

Mortg A Mortg B

interest rate per annum 5% 5%

compounded. Annually Annu

payment frequncy. Annu in arrears Ann arre

Type interest oly constant.

payment

Loan to value Ratio 40%. 50%

terms(years). 5. 5

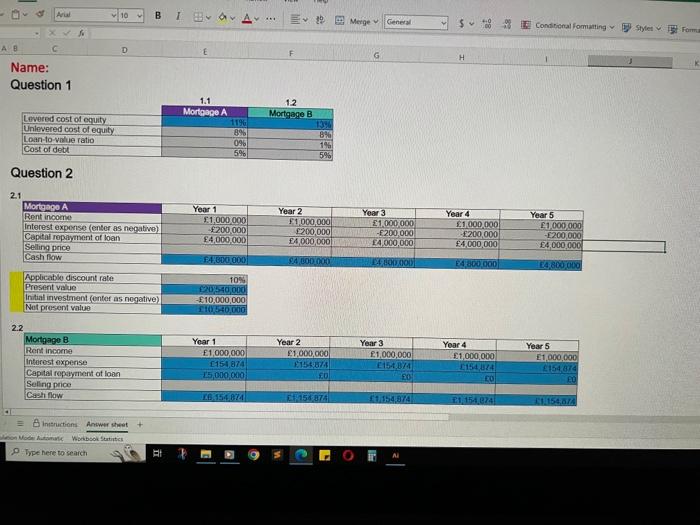

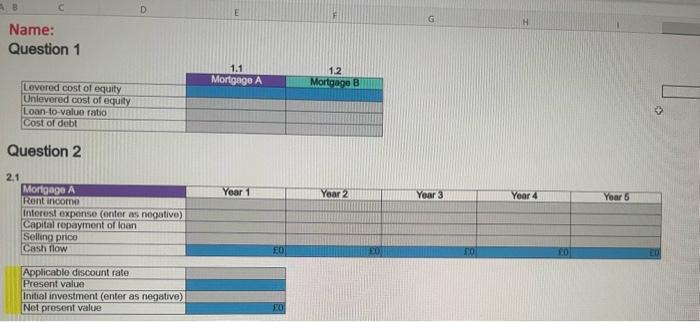

Question 1

1.1 Assuming that mortgage A is selcted, calculate the levered cost of equity.

1.2 Assuming that mortgage B is selected, calculate the levered cost of equity

(answer the question in the corresponding area of the Answer sheet)

Question 2

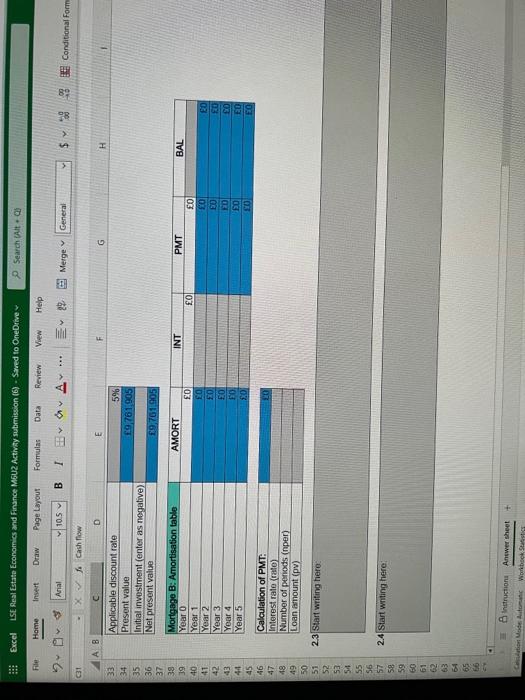

2.1 Assuming that mortgage A is selected, calculate the net present Value of the investment. Use the cost of the equity that you calculated in Question 1.1 as the appropriate discount rate. Round your calculated answer to the nearest pond.

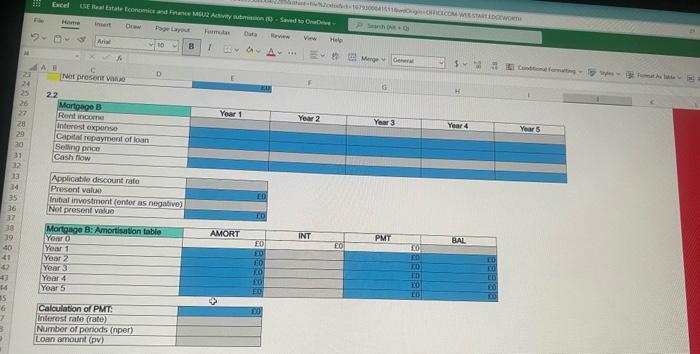

2.2 Assuming that mortgage B is selected, calculate the net present Value of the investment. Use the cost of the equity that you calculated in Question 1.2 as the appropriate discount rate. Round your calculated answer to the nearest pond.

2.3 Based on your answer in 2.1 and 2.2, state which mortgage you would choose, abd justify your answer. limit your Answer to 50 words

2.4 Now assume that the net present value of the investment is indentical with either mortgage (i.e ignore your answer to 2.1 and 2.2). What would the advantage be of opting for Mortgage A? justify your answer. Limit your answer to 100 words.

(Answer the question in the corresponding area of the Answer sheet)

hope to and wishing to receive the reply ASAP

Wiw can ebter brucce De purture of he buldog wing neen Question 1 Question 2 Question 2 23 Start writing hero: Name: Question 1 Question 2 Figure 1: The efficient frantier