Question: ASAP Assignment 2 (Chapters 4, 6 & 7) Seved Help Save & Exit Submit 2 Note 1: On April 1 of the current year, Warren

ASAP

ASAP

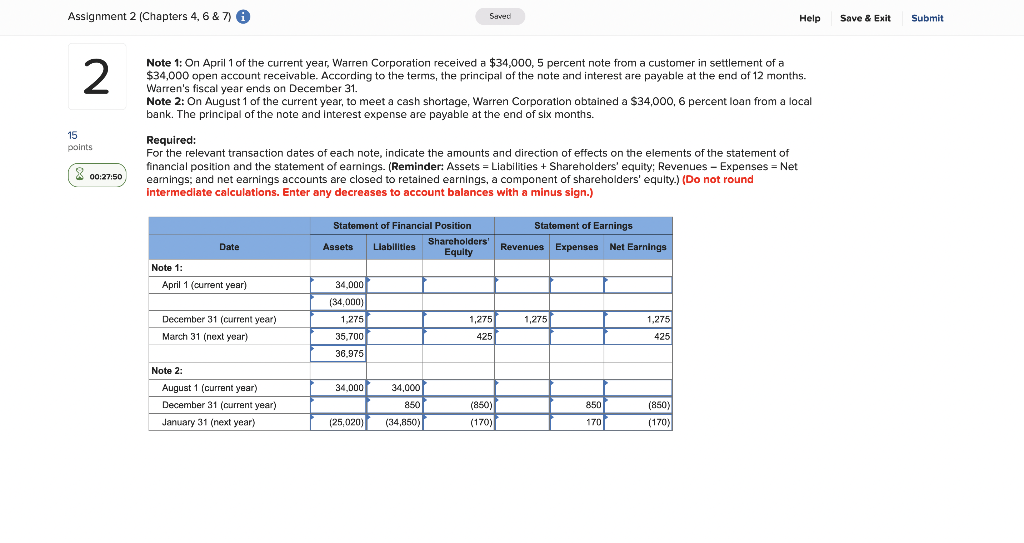

Assignment 2 (Chapters 4, 6 & 7) Seved Help Save & Exit Submit 2 Note 1: On April 1 of the current year, Warren Corporation received a $34,000, 5 percent note from a customer in settlement of a $34,000 open account receivable. According to the terms, the principal of the note and interest are payable at the end of 12 months. Warren's fiscal year ends on December 31. Note 2: On August 1 of the current year, to meet a cash shortage, Warren Corporation obtained a $34,000, 6 percent loan from a local bank. The principal of the note and Interest expense are payable at the end of six months. 15 points 8 Required: For the relevant transaction dates of each note, indicate the amounts and direction of effects on the elements of the statement of financial position and the statement of earnings. (Reminder: Assets = Liabilities + Shareholders' equity; Revenues - Expenses = Net = earnings, and net earnings accounts are closed to retained earnings, a component of shareholders' equity.) (Do not round intermediate calculations. Enter any decreases to account balances with a minus sign.) 00:27:50 Statement of Financial Position Statement of Earnings Date Assets Liabilities Shareholders ' Equity Revenues Expenses Net Earnings Note 1: April 1 (current year) 34,000 (34,000) 1,275 1,275 1,275 1.275 December 31 (current year) March 31 (next year) 425 425 35,700 36.975 34,000 34,000 Note 2: August 1 (current year) December 31 (current year) January 31 (next year) 850 850 (850) (170) (850) (170) (25,020) (34,850) 1701

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts