Question: ASAP CAFR - HELP ME ANSWER THIS QUESTION PLEASE ASAP !! PLEASE BE ABUNDANT IN THE ANSWER AND HELP. IT IS ANSWERED WITH THE LINK

ASAP CAFR - HELP ME ANSWER THIS QUESTION PLEASE ASAP !!

PLEASE BE ABUNDANT IN THE ANSWER AND HELP. IT IS ANSWERED WITH THE LINK THAT POSTS BELOW.

IF YOU CANNOT HELP ME OR DO NOT KNOW HOW TO ANSWER IT, LET ANOTHER TUTOR HELP ME.

LINK City of Cincinnati, Ohio - for the fiscal year ended June 30, 2020:

(COPY AND PASTE THE LINK IN YOUR INTERNET !! IS A PDF)

https://www.cincinnati-oh.gov/finance/financial-reports/2020-comprehensive-annual-financial-report/

- I add some pictures about the PDF If it is not REQUIRED I CAN SEND YOU THE PDF BY EMAIL.

- Or google "CINCINNATI 2020 CAFR" AND THE SECOND LINK IN THE SEARCH IS THE PDF REQUIRED FOR THE TASK.

- What do you learn about your CAFR entity from theFund Reconciliation Reports? Also refer tothe notes to the financial statements and the RSI to assist in your postings as you 'tell the story' of your government entity's mission achievement.Based on your review of the CAFR, identify 2-3 ways that support mission achievement?

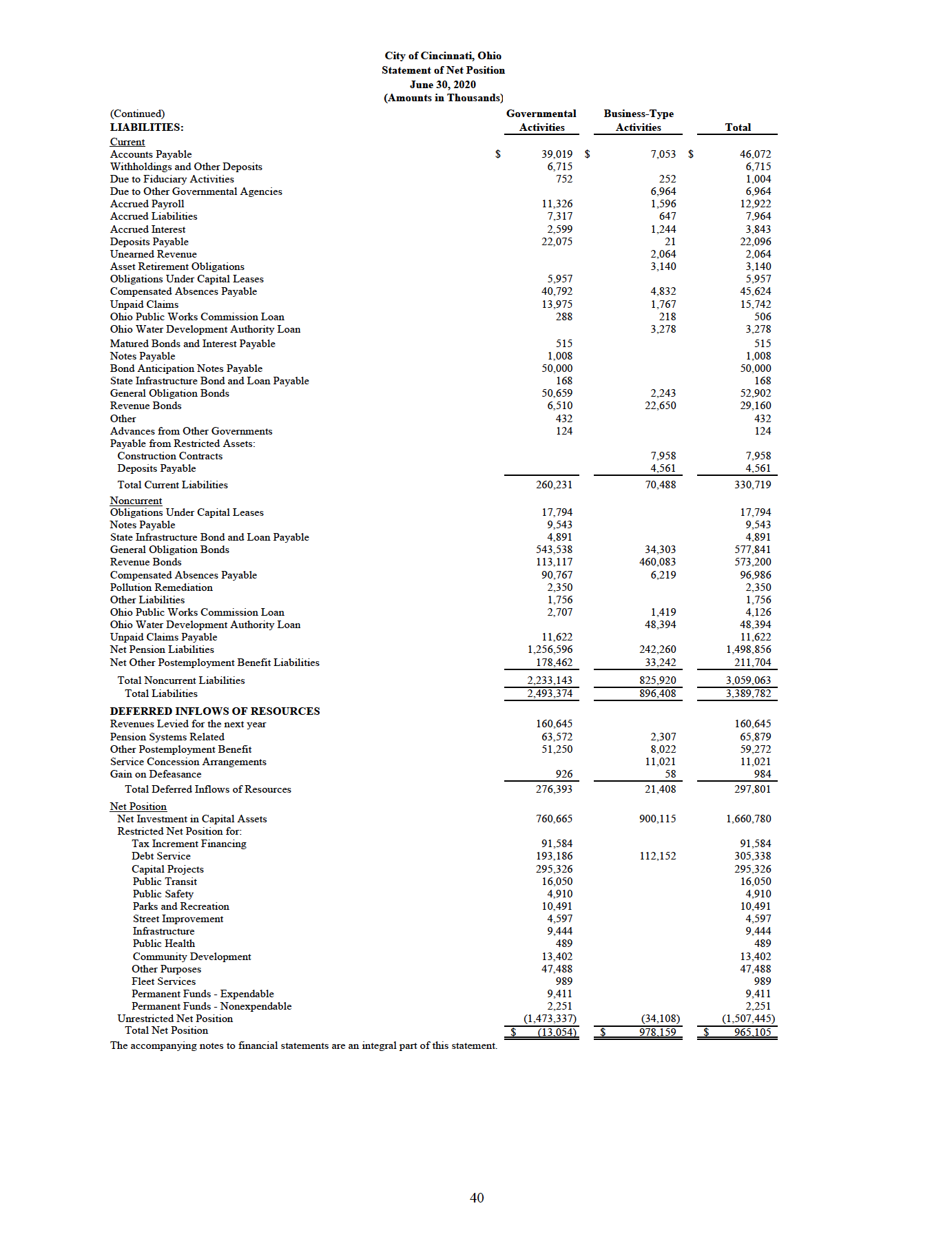

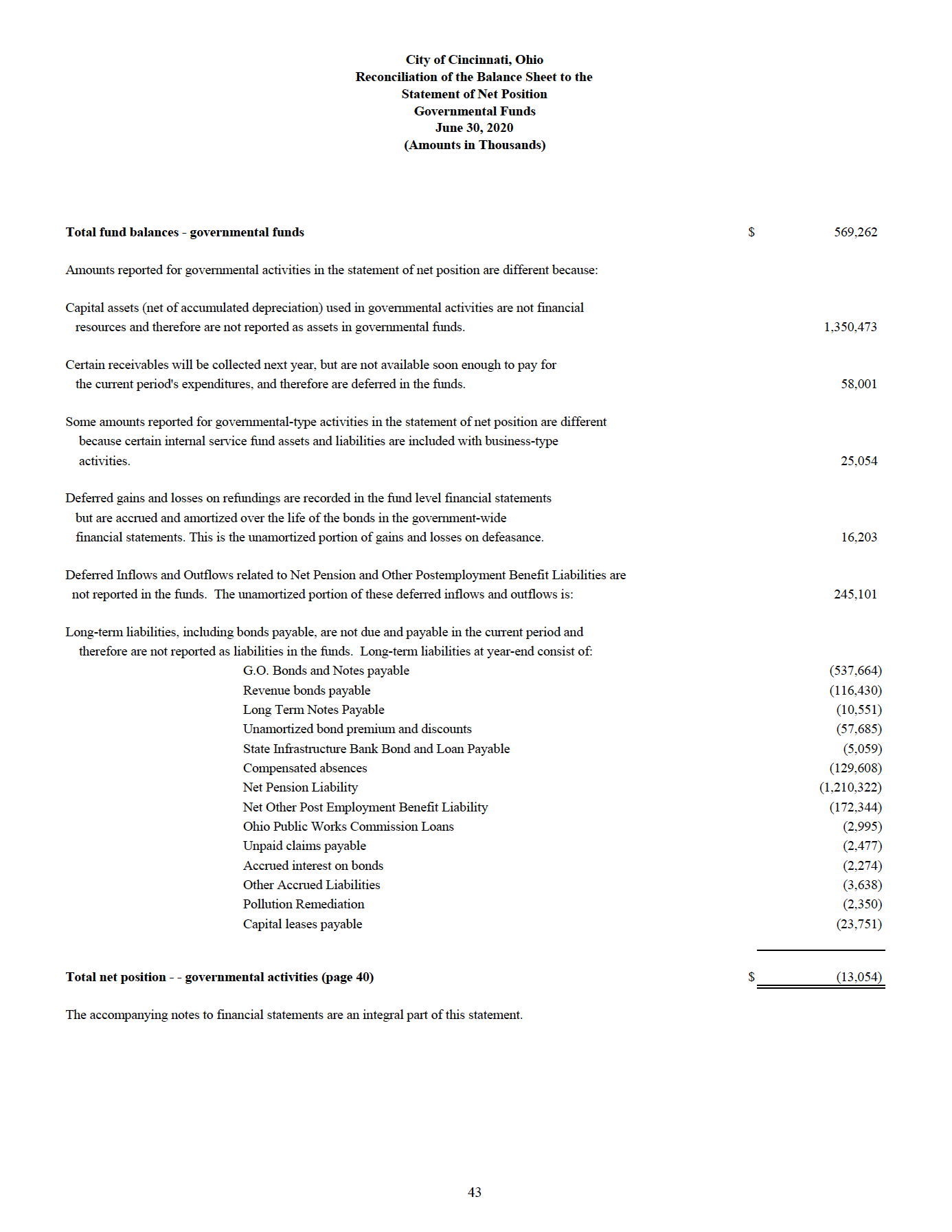

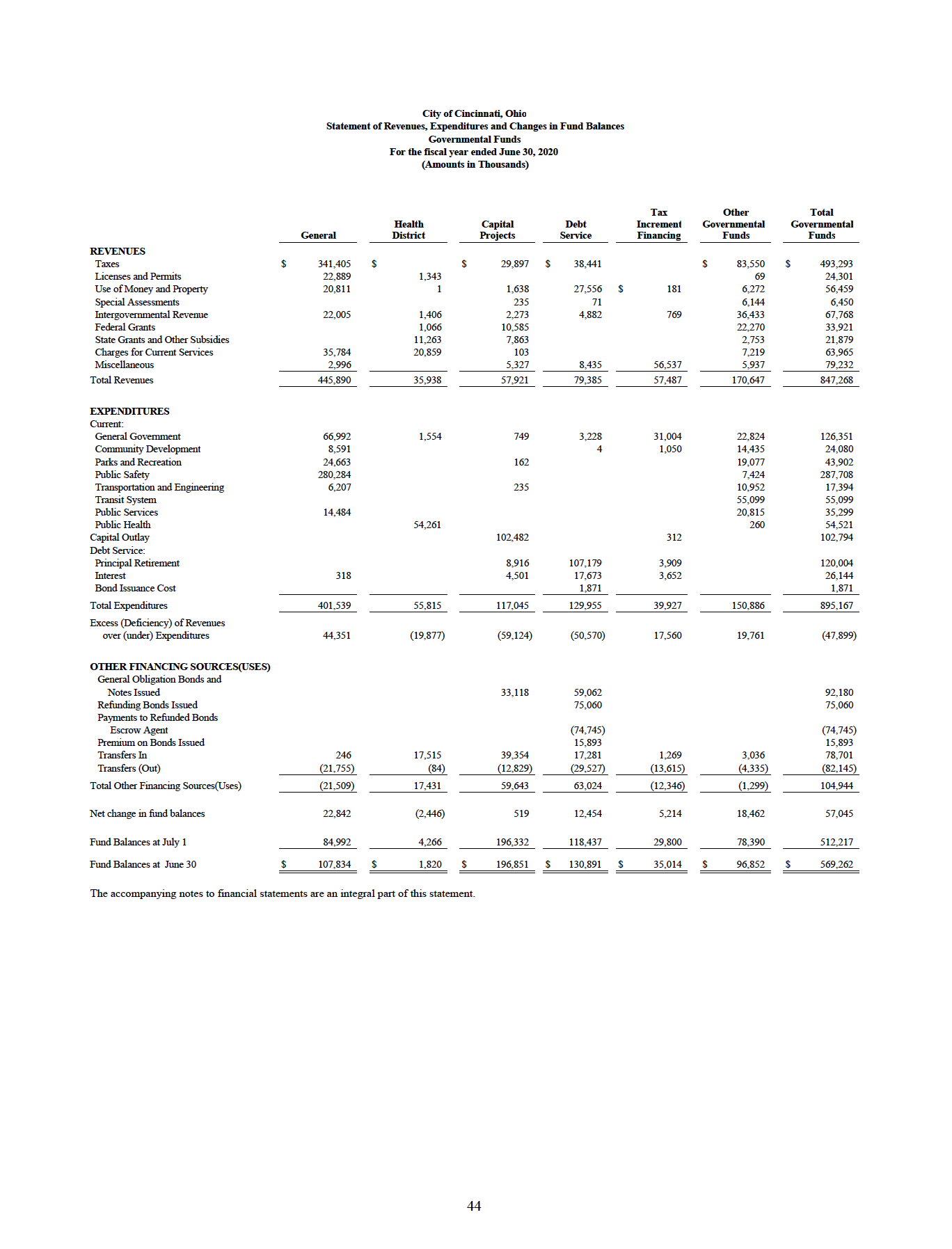

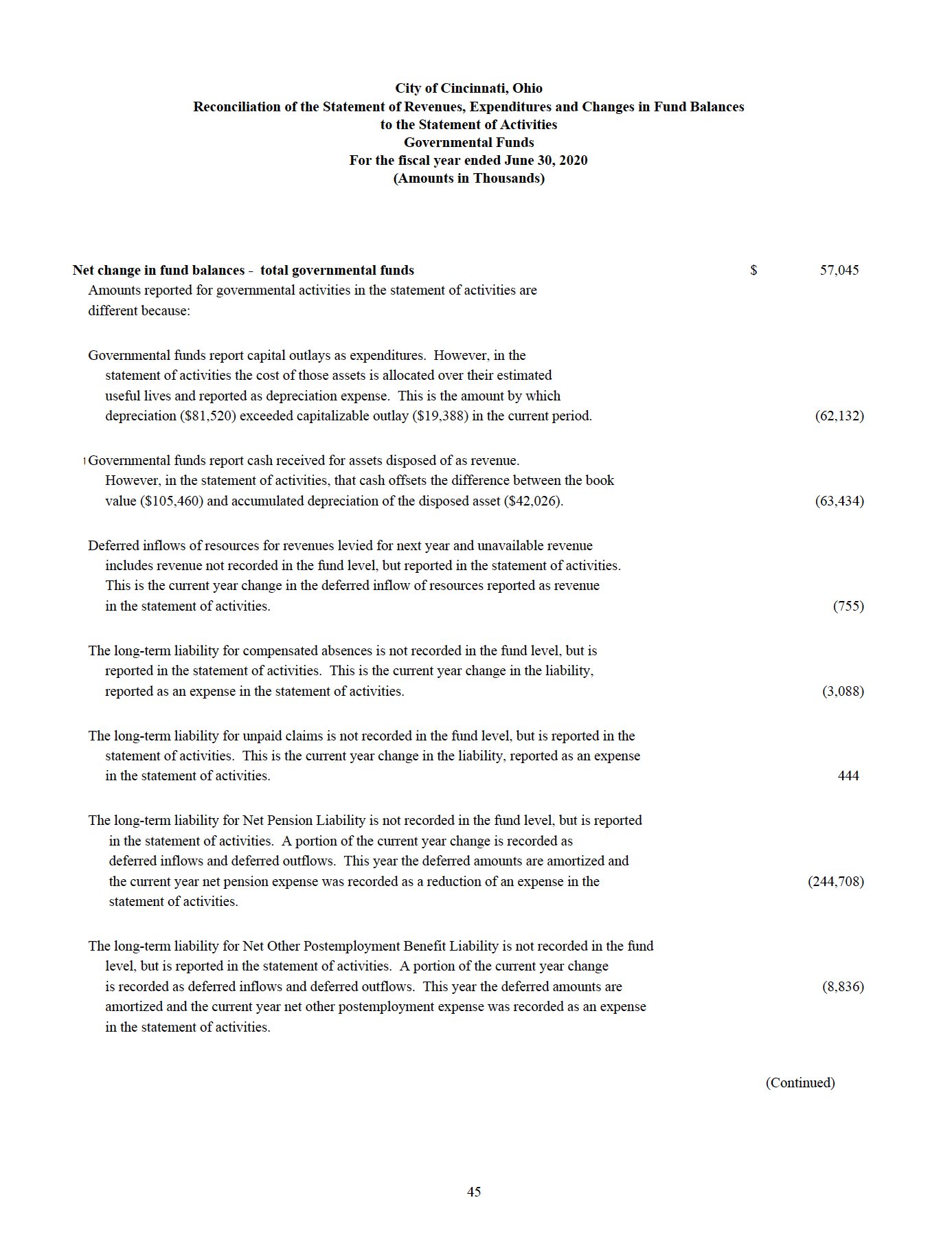

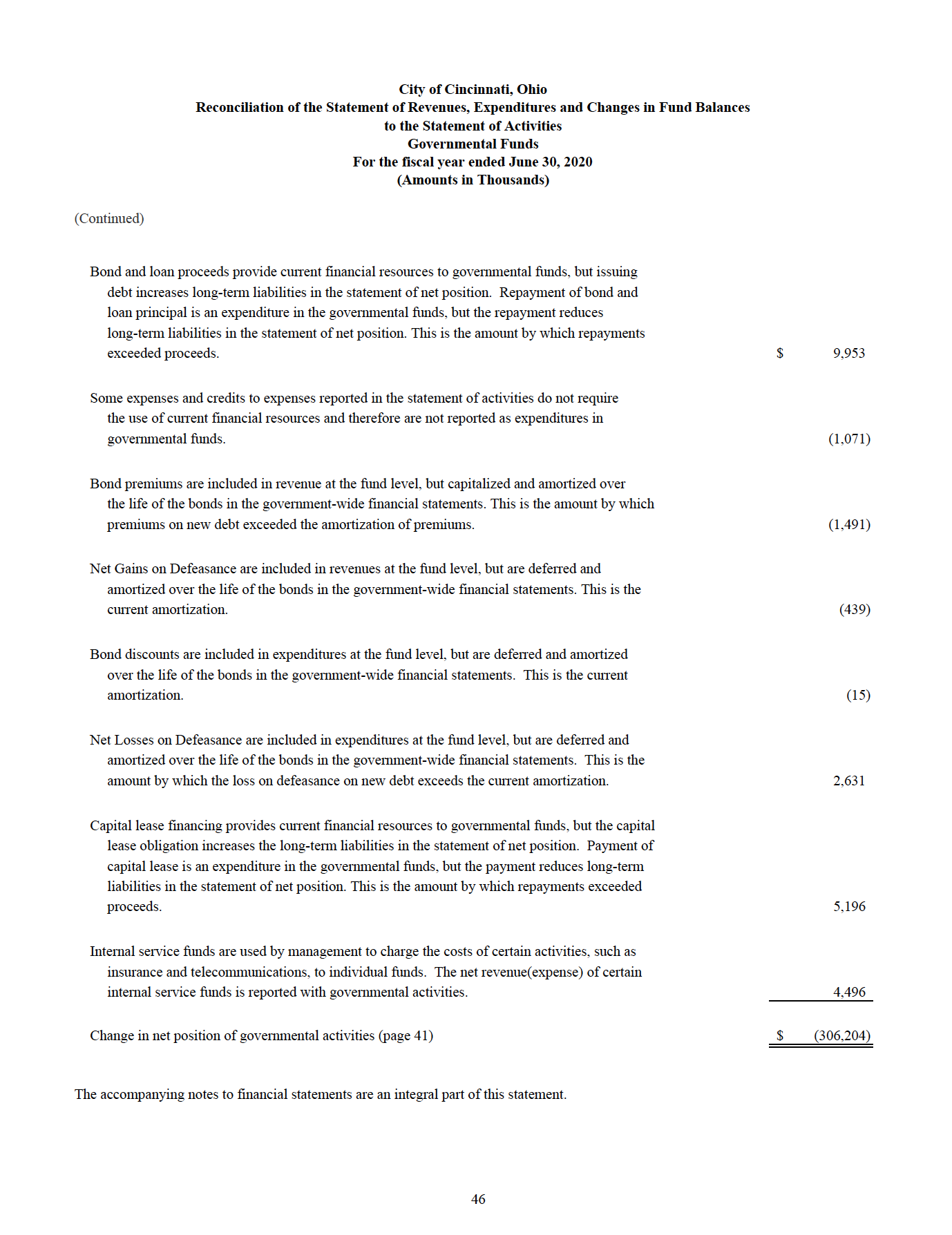

City of Cincinnati, Ohio Statement of Net Position June 30, 2020 Amounts in Thousands) (Continued) Governmental Business-Type LIABILITIES: Activities Activities Total Current Accounts Payable 9,019 $ 7,053 $ 46.072 Withholdings and Other Deposits 6,715 6,715 Due to Fiduciary Activities 752 252 1,004 Due to Other Governmental Agencies 6.964 Accrued Payroll 6,964 11,326 1,596 12,922 Accrued Liabilities 7,317 647 7,964 Accrued Interest 2,599 .244 3,843 Deposits Payable 22,075 21 22,096 Unearned Revenue 2,064 2,064 Asset Retirement Obligations 3.140 Obligations Under Capital Leases 3,140 5,957 5,957 Compensated Absences Payable 40,792 4.832 45,624 Unpaid Claims 13.975 767 15,742 Ohio Public Works Commission Loan 288 218 Ohio Water Development Authority Loan 506 3,278 3.278 Matured Bonds and Interest Payable 515 515 Notes Payable 1,008 1,008 Bond Anticipation Notes Payable 50,000 50,000 State Infrastructure Bond and Loan Payable 168 168 General Obligation Bonds 50,659 2,243 2,902 Revenue Bonds 6,510 22,650 29,160 Other 432 432 Advances from Other Governments 124 124 Payable from Restricted Assets: Construction Contracts 7,958 7.958 Deposits Payable 4,561 4,561 Total Current Liabilities 260,231 70,488 330,719 Noncurrent Obligations Under Capital Leases 17,794 7,794 Notes Payable 9.543 9 543 State Infrastructure Bond and Loan Payable 4,891 4,891 General Obligation Bonds 543,538 34,303 $77,841 Revenue Bonds 113,117 160,083 573,200 Compensated Absences Payable 90,767 6,219 96.98 Pollution Remediation 2,350 Other Liabilities 2,350 1,756 1,756 Ohio Public Works Commission Loan 2,707 1,419 Ohio Water Development Authority Loan 4,126 48,394 48,394 Unpaid Claims Payable 11,622 11,622 Net Pension Liabilities 1,256,596 242,260 1,498,856 Net Other Postemployment Benefit Liabilities 178,462 33,242 211,704 Total Noncurrent Liabilities 2,233,143 825,920 Total Liabilities 3,059,063 2,493,374 896,408 3,389,782 DEFERRED INFLOWS OF RESOURCES Revenues Levied for the next year 60,645 160,645 Pension Systems Related 63,572 2,307 65,879 Other Postemployment Benefit 51,250 8,022 59,272 Service Concession Arrangements 1,021 1,021 Gain on Defeasance 926 58 984 Total Deferred Inflows of Resources 276,393 21,408 297,801 Net Position Net Investment in Capital Assets 760,665 900,115 1,660,780 Restricted Net Position for: Tax Increment Financing 91,584 91,584 Debt Service 193,186 112,152 305,338 Capital Projects 295.326 295,326 Public Transit 16,050 16,050 Public Safety 4,910 4,910 Parks and Recreation 10,491 Street Improvement 10,491 4,597 4,597 Infrastructure 9 444 9 444 Public Health 489 489 Community Development 13,402 13,402 Other Purpose 47,488 47,488 Fleet Services 989 989 Permanent Funds - Expendable 9,411 9,411 Permanent Funds - Nonexpendable 2,251 2,251 Unrestricted Net Position Total Net Position (1.473,337) (34,108) (1,507,445) (13.054) 978.159 965.105 The accompanying notes to financial statements are an integral part of this statement. 40Government-wide Financial Statements. The government-wide financial statements are designed to provide readers with a broad overview of the City's finances, in a manner similar to a private-sector business. The government-wide financial statements can be found on pages 39 to 41 of this report. The statement of net position presents information on all of the City's assets and deferred outflows and liabilities and deferred inflows with the difference reported as net position. Over time, increases or decreases in net position may serve as a useful indicator of whether the financial position of the City is improving or deteriorating. The statement of activities presents information showing how the City's net position changed during the most recent fiscal year. All changes in net position are reported as soon as the underlying event giving rise to the change occurs, regardless of the timing of the related cash flows. Thus, revenue and expenses are reported in this statement for some items that will only result in cash flows in future fiscal periods (e.g., uncollected taxes, and earned but unused vacation leave). The government-wide financial statements (statement of net position and statement of activities) distinguish functions of the City that are principally supported by taxes and intergovernmental revenues (governmental activities) from other functions that are intended to recover all or a significant portion of their costs through user fees and charges (business-type activities). The governmental activities of the City include general government, community development, parks and recreation, public safety, transportation and engineering, transit system, public services, and public health. The business-type activities of the City include the Water Works, Parking Facilities, Convention Center, General Aviation, Municipal Golf, and Stormwater Management Funds. Fund Financial Statements. A fund is a grouping of related accounts that is used to maintain control over resources that have been segregated for specific activities or objectives. The City, like other state and local governments, uses fund accounting to ensure and demonstrate compliance with finance related legal requirements. All of the funds of the City can be divided into three categories: governmental funds, proprietary funds, and fiduciary funds. Governmental Funds. Governmental funds are used to account for essentially the same functions reported as governmental activities in the government-wide financial statements. However, unlike the government- wide financial statements, governmental fund financial statements focus on near-term inflows and outflows of spendable resources, as well as on balances of spendable resources available at the end of the fiscal year. Such information may be useful in evaluating a government's near-term financing requirements. The basic governmental fund financial statements can be found on pages 42 to 46 of this report. Because the focus of governmental funds is narrower than that of the government-wide financial statements, it is useful to compare the information presented for governmental funds with similar information presented for governmental activities in the government-wide financial statements. By doing so, readers may better understand the long-term impact of the City's near-term financing decisions. Both the governmental funds balance sheet and the governmental funds statement of revenues, expenditures, and changes in fund balances provide a reconciliation to facilitate this comparison between governmental funds and governmental activities. The City maintains 25 individual governmental funds. Information is presented separately in the governmental funds balance sheet and in the governmental funds statement of revenues, expenditures, and changes in fund balances for the general fund, the health district fund, the capital projects fund, the debt service fund and the tax increment financing fund, all of which are considered to be major funds. Data from the other 20 funds are combined into a single aggregated presentation. Individual fund data for each of these nonmajor governmental funds is provided in the form of combining statements found elsewhere in this report. 24City of Cincinnati, Ohio Reconciliation of the Balance Sheet to the Statement of Net Position Governmental Funds June 30, 202 (Amounts in Thousands) Total fund balances - governmental funds $ 569,262 Amounts reported for governmental activities in the statement of net position are different because: Capital assets (net of accumulated depreciation) used in governmental activities are not financial resources and therefore are not reported as assets in governmental funds. 1,350,473 Certain receivables will be collected next year, but are not available soon enough to pay for the current period's expenditures, and therefore are deferred in the funds. 58,001 Some amounts reported for governmental-type activities in the statement of net position are different because certain internal service fund assets and liabilities are included with business-type activities. 25,054 Deferred gains and losses on refundings are recorded in the fund level financial statements but are accrued and amortized over the life of the bonds in the government-wide financial statements. This is the unamortized portion of gains and losses on defeasance. 16.203 Deferred Inflows and Outflows related to Net Pension and Other Postemployment Benefit Liabilities are not reported in the funds. The unamortized portion of these deferred inflows and outflows is: 245,101 Long-term liabilities, including bonds payable, are not due and payable in the current period and therefore are not reported as liabilities in the funds. Long-term liabilities at year-end consist of: G.O. Bonds and Notes payable (537,664) Revenue bonds payable (116,430) Long Term Notes Payable (10,551) Unamortized bond premium and discounts (57,685) State Infrastructure Bank Bond and Loan Payable (5,059) Compensated absences (129,608) Net Pension Liability (1,210,322) Net Other Post Employment Benefit Liability (172,344) Ohio Public Works Commission Loans (2,995) Unpaid claims payable ( 2,477 ) Accrued interest on bonds (2,274 ) Other Accrued Liabilities (3,638) Pollution Remediation (2,350) Capital leases payable (23,751) Total net position - - governmental activities (page 40) (13,054) The accompanying notes to financial statements are an integral part of this statement. 43City of Cincinnati, Ohio Statement of Revenues, Expenditures and Changes in Fund Balances Governmental Funds For the fiscal year ended June 30, 2020 Amounts in Thousands) Tax Other Total Health Capital Debt Increment Governmental Governmental General District Projects Service Financing Funds Funds REVENUES Taxes 341,405 29,897 $ 38,441 83,550 $ 193,293 Licenses and Permits 22,889 1.343 69 24,301 Use of Money and Property 20,811 1,638 27,556 181 6.272 56,459 Special Assessments 235 71 6,144 6,450 Intergovernmental Revenue 22,005 1,406 2,273 4,882 769 36,433 67,768 Federal Grants 1,066 10 585 22.270 33,921 State Grants and Other Subsidies 11,263 7,863 2,753 21,879 Charges for Current Services 35,78 20,859 10 7.219 63,965 Miscellaneous 2,996 5,327 8,435 56,537 5,937 79,232 Total Revenues 145,890 35,938 57,921 79,385 $7,487 170,647 847,268 EXPENDITURES Current: General Government 66,992 1,554 749 3.228 31,004 22,824 126,351 Community Development 8.591 1,050 14,435 24,080 Parks and Recreation 24,663 162 19,077 43,902 Public Safety 280,284 7,424 287,708 Transportation and Engineering 6,207 235 10,952 7,394 Transit System $5,099 55,099 Public Services 14,484 20,815 35,299 Public Health 54,261 260 54,521 Capital Outlay 102,482 312 102,794 Debt Service: Principal Retirement 3,91 107,179 3,909 120,004 Interest 318 4,501 7.673 3,652 26.144 Bond Issuance Cost 1,871 1,871 Total Expenditures 401,539 55,815 117,045 129,955 39,927 150,886 395,167 Excess (Deficiency) of Revenues over (under) Expenditures 44.351 (19,877) (59,124) (50,570) 17,560 19,761 (47,899) OTHER FINANCING SOURCES(USES) General Obligation Bonds and Notes Issued 33,11 $9,062 92,180 Refunding Bonds Issued 75,060 75,060 Payments to Refunded Bonds Escrow Agent (74,745) (74,745 Premium on Bonds Issued 15,893 15,893 Transfers In 246 17,515 39,354 17,281 1,269 3,036 78,701 Transfers (Out) (21,755) (84) 12,829) 29,527) 13,615) (4,335) 82,145) Total Other Financing Sources(Uses) (21,509) 17,431 59,643 63,024 (12,346) (1,299) 104,944 Net change in fund balances 22,842 (2,446) 519 12,454 5,214 18,462 57,045 Fund Balances at July 1 84,992 4,266 196,332 118,437 29,800 78,390 512,217 Fund Balances at June 30 107,834 1,820 196,851 $ 130,891 35,014 96,852 569,262 The accompanying notes to financial statements are an integral part of this statement 44City of Cincinnati, Ohio Reconciliation of the Statement of Revenues, Expenditures and Changes in Fund Balances to the Statement of Activities Governmental Funds For the scal year ended June 30, 2020 (Amounts in Thousands) Net change in fund balances 7 total governmental funds Amounts reported for governmental activities in the statement of activities are different because: Governmental funds report capital outlays as expenditures. However, in the statement of activities the cost of those assets is allocated over their estimated useil lives and reported as depreciation expense. This is the amount by which depreciation ($81,520) exceeded capitalizable outlay ($19,388) in the current period. IGovernmental funds report cash received for assets disposed of as revenue. However, in the statement of activities, that cash offsets the difference between the book value ($105,460) and accumulated depreciation of the disposed asset ($42,026). Deferred inows of resources for revenues levied for next year and unavailable revenue includes revenue not recorded in the nd level, but reported in the statement of activities. This is the current year change in the deferred inow of resources reported as revenue in the statement of activities. The long-term liability for compensated absences is not recorded in the fund level, but is reported in the statement of activities. This is the current year change in the liability, reported as an expense in the statement of activities. The long-term liability for unpaid claims is not recorded in the fund level, but is reported in the statement of activities. This is the current year change in the liability, reported as an expense in the statement of activities. The long-term liability for Net Pension Liability is not recorded in the fund level, but is reported in the statement of activities. A portion of the current year change is recorded as deferred inows and deferred outows. This year the deferred amounts are amortized and the current year net pension expense was recorded as a reduction of an expense in the statement of activities. The long-term liability for Net Other Postemployment Benet Liability is not recorded in the fund level, but is reported in the statement of activities. A portion of the current year change is recorded as defelred inows and deferred outows. This year the deferred amounts are amortized and the current year net other postemployment expense was recorded as an expense in the statement of activities. 45 $ 57,045 (62,132) (63 ,43 4) (755) (3,088) (244,708) (8,836) (Continued) City of Cincinnati, Ohio Reconciliation of the Statement of Revenues, Expenditures and Changes in Fund Balances to the Statement of Activities Governmental Funds For the fiscal year ended June 30, 2020 (Amounts in Thousands) Continued) Bond and loan proceeds provide current financial resources to governmental funds, but issuing debt increases long-term liabilities in the statement of net position. Repayment of bond and loan principal is an expenditure in the governmental funds, but the repayment reduces long-term liabilities in the statement of net position. This is the amount by which repayments exceeded proceeds. $ 9,953 Some expenses and credits to expenses reported in the statement of activities do not require the use of current financial resources and therefore are not reported as expenditures in governmental funds. (1,071) Bond premiums are included in revenue at the fund level, but capitalized and amortized over he life of the bonds in the government-wide financial statements. This is the amount by which premiums on new debt exceeded the amortization of premiums. (1,491) Net Gains on Defeasance are included in revenues at the fund level, but are deferred and amortized over the life of the bonds in the government-wide financial statements. This is the current amortization. (439) Bond discounts are included in expenditures at the fund level, but are deferred and amortized over the life of the bonds in the government-wide financial statements. This is the current amortization (15) Net Losses on Defeasance are included in expenditures at the fund level, but are deferred and amortized over the life of the bonds in the government-wide financial statements. This is the amount by which the loss on defeasance on new debt exceeds the current amortization 2,631 Capital lease financing provides current financial resources to governmental funds, but the capital lease obligation increases the long-term liabilities in the statement of net position. Payment of capital lease is an expenditure in the governmental funds, but the payment reduces long-term liabilities in the statement of net position. This is the amount by which repayments exceeded proceeds. 5,196 Internal service funds are used by management to charge the costs of certain activities, such as nsurance and telecommunications, to individual funds. The net revenue(expense) of certain internal service funds is reported with governmental activities. 4,496 Change in net position of governmental activities (page 41) (306,204) The accompanying notes to financial statements are an integral part of this statement. 46

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts