Question: ASAP - Consolidation Working Paper, Simple Example Below are the condensed balance sheets of Princecraft and Sylvan Companies just prior to Princecraft s acquisition of

ASAP Consolidation Working Paper, Simple Example

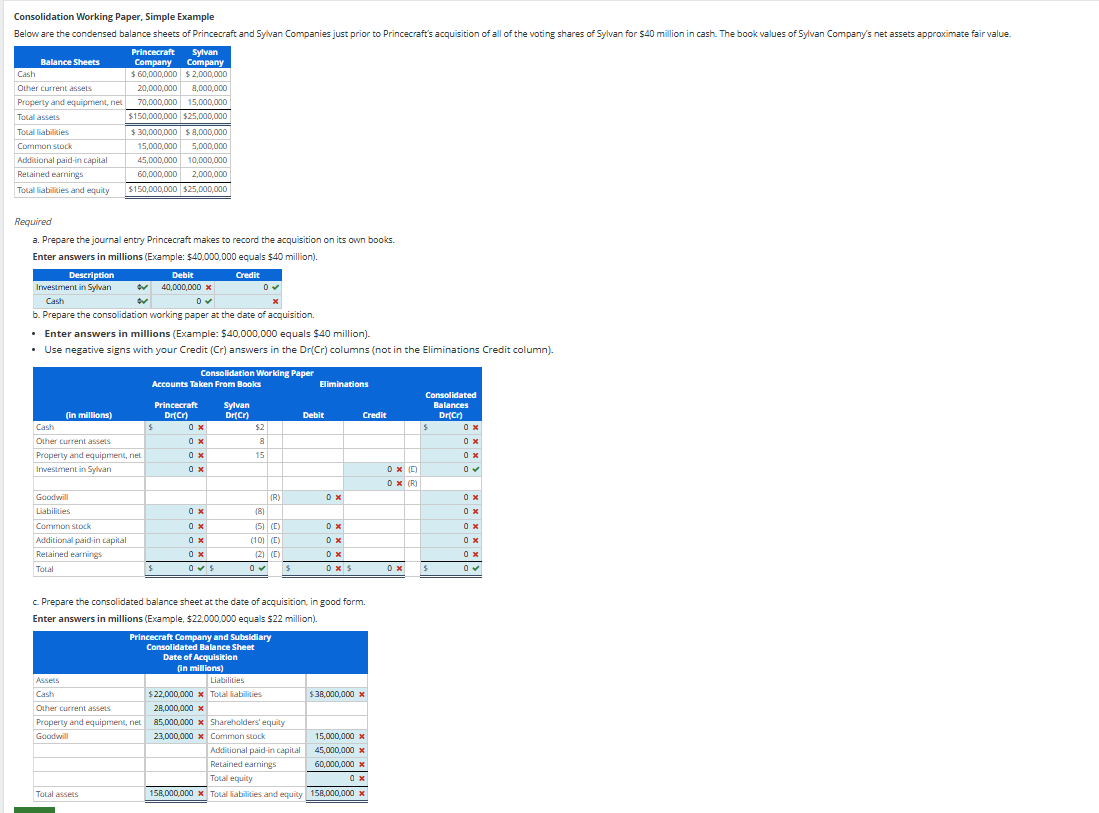

Below are the condensed balance sheets of Princecraft and Sylvan Companies just prior to Princecrafts acquisition of all of the voting shares of Sylvan for $ million in cash. The book values of Sylvan Companys net assets approximate fair value.

Balance SheetsPrincecraft

CompanySylvan

CompanyCash$ $ Other current assetsProperty and equipment, netTotal assets$$Total liabilities$ $ Common stockAdditional paidin capitalRetained earningsTotal liabilities and equity$$

Required

a Prepare the journal entry Princecraft makes to record the acquisition on its own books.

Enter answers in millions Example: $ equals $ million

DescriptionDebitCreditAnswer CashCommon stockGoodwillInvestment in SylvanRetained earnings

Answer

Answer

Answer CashCommon stockGoodwillInvestment in SylvanRetained earnings

Answer

Answer

b Prepare the consolidation working paper at the date of acquisition.

Enter answers in millionsExample: $ equals $ million

Use negative signs with your Credit Cr answers in the DrCr columns not in the Eliminations Credit column

Consolidation Working PaperAccounts Taken From BooksEliminationsin millionsPrincecraft

DrCrSylvan

DrCrDebitCreditConsolidated

Balances DrCrCashAnswer

$Answer

Other current assetsAnswer

Answer

Property and equipment, netAnswer

Answer

Investment in SylvanAnswer

Answer

EAnswer

Answer

RGoodwillRAnswer

Answer

LiabilitiesAnswer

Answer

Common stockAnswer

EAnswer

Answer

Additional paidin capitalAnswer

EAnswer

Answer

Retained earningsAnswer

EAnswer

Answer

TotalAnswer

Answer

Answer

Answer

Answer

c Prepare the consolidated balance sheet at the date of acquisition, in good form.

Enter answers in millions Example $ equals $ million

Princecraft Company and Subsidiary

Consolidated Balance Sheet

Date of Acquisitionin millionsAssetsLiabilitiesCashAnswer

Total liabilitiesAnswer

Other current assetsAnswer

Property and equipment, netAnswer

Shareholders equityGoodwillAnswer

Common stockAnswer

Additional paidin capitalAnswer

Retained earningsAnswer

Total equityAnswer

Total assetsAnswer

Total liabilities and equityAnswer

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock