Question: ASAP - For each year, record the transactions in general journal form and post them to T-accounts. YEAR 1 A. Acquired $79,000 cash from the

ASAP - For each year, record the transactions in general journal form and post them to T-accounts.

YEAR 1

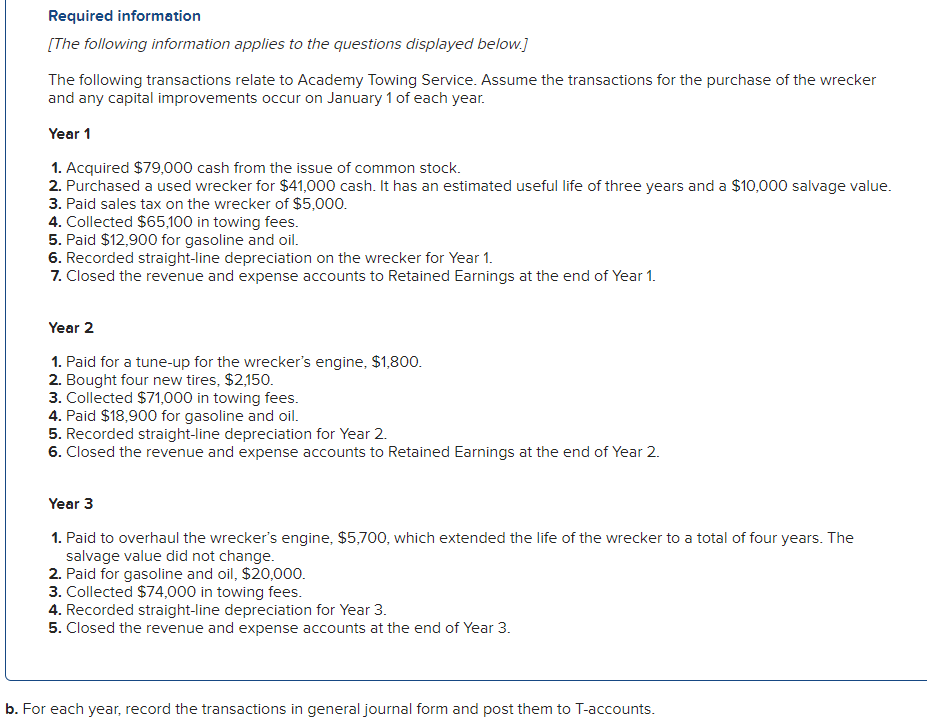

A. Acquired $79,000 cash from the issue of common stock. Record the transaction. B. Purchased a used wrecker for $41,000 cash. It has an estimated useful life of three years and a $10,000 salvage value. Record the transaction. C. Paid sales tax on the wrecker of $5,000. Record the transaction. D. Collected $65,100 in towing fees. Record the transaction. E. Paid $12,900 for gasoline and oil. Record the transaction. F. Recorded straight-line depreciation on the wrecker for Year 1. Record the transaction. G. Closed the revenue and expense accounts to retained earnings at the end of Year 1. Record the transaction.

YEAR 2

A. Paid for a tune-up for the wreckers engine, $1,800. Record the transaction. B. Bought four new tires, $2,150. Record the transaction. C. Collected $71,000 in towing fees. Record the transaction. D. Paid $18,900 for gasoline and oil. Record the transaction. E. Recorded straight-line depreciation for Year 2. Record the transaction. F. Closed the revenue and expense accounts to retained earnings at the end of Year 2. Record the transaction.

YEAR 3

A. Paid to overhaul the wreckers engine, $5,700, which extended the life of the wrecker to a total of four years. The salvage value did not change. Record the transaction. B. Paid for gasoline and oil, $20,000. Record the transaction. C. Collected $74,000 in towing fees. Record the transaction. D. Recorded straight-line depreciation for Year 3. Record the transaction. E. Closed the revenue and expense accounts at the end of Year 3. Record the transaction.

Required information [The following information applies to the questions displayed below.] The following transactions relate to Academy Towing Service. Assume the transactions for the purchase of the wrecker and any capital improvements occur on January 1 of each year. Year 1 1. Acquired $79,000 cash from the issue of common stock. 2. Purchased a used wrecker for $41,000 cash. It has an estimated useful life of three years and a $10,000 salvage value. 3. Paid sales tax on the wrecker of $5,000. 4. Collected $65,100 in towing fees. 5. Paid $12,900 for gasoline and oil. 6. Recorded straight-line depreciation on the wrecker for Year 1. 7. Closed the revenue and expense accounts to Retained Earnings at the end of Year 1. Year 2 1. Paid for a tune-up for the wrecker's engine, $1,800. 2. Bought four new tires, $2,150. 3. Collected $71,000 in towing fees. 4. Paid $18,900 for gasoline and oil. 5. Recorded straight-line depreciation for Year 2. 6. Closed the revenue and expense accounts to Retained Earnings at the end of Year 2. Year 3 1. Paid to overhaul the wrecker's engine, $5,700, which extended the life of the wrecker to a total of four years. The salvage value did not change. 2. Paid for gasoline and oil, $20,000. 3. Collected $74,000 in towing fees. 4. Recorded straight-line depreciation for Year 3. 5. Closed the revenue and expense accounts at the end of Year 3. For each year, record the transactions in general journal form and post them to T-accounts. Required information [The following information applies to the questions displayed below.] The following transactions relate to Academy Towing Service. Assume the transactions for the purchase of the wrecker and any capital improvements occur on January 1 of each year. Year 1 1. Acquired $79,000 cash from the issue of common stock. 2. Purchased a used wrecker for $41,000 cash. It has an estimated useful life of three years and a $10,000 salvage value. 3. Paid sales tax on the wrecker of $5,000. 4. Collected $65,100 in towing fees. 5. Paid $12,900 for gasoline and oil. 6. Recorded straight-line depreciation on the wrecker for Year 1. 7. Closed the revenue and expense accounts to Retained Earnings at the end of Year 1. Year 2 1. Paid for a tune-up for the wrecker's engine, $1,800. 2. Bought four new tires, $2,150. 3. Collected $71,000 in towing fees. 4. Paid $18,900 for gasoline and oil. 5. Recorded straight-line depreciation for Year 2. 6. Closed the revenue and expense accounts to Retained Earnings at the end of Year 2. Year 3 1. Paid to overhaul the wrecker's engine, $5,700, which extended the life of the wrecker to a total of four years. The salvage value did not change. 2. Paid for gasoline and oil, $20,000. 3. Collected $74,000 in towing fees. 4. Recorded straight-line depreciation for Year 3. 5. Closed the revenue and expense accounts at the end of Year 3. For each year, record the transactions in general journal form and post them to T-accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts