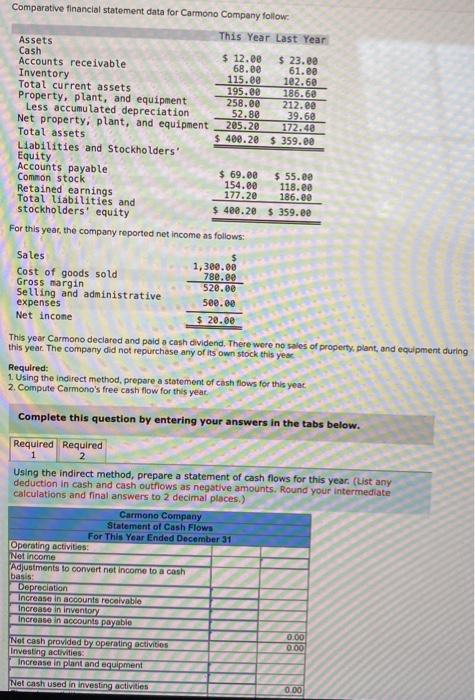

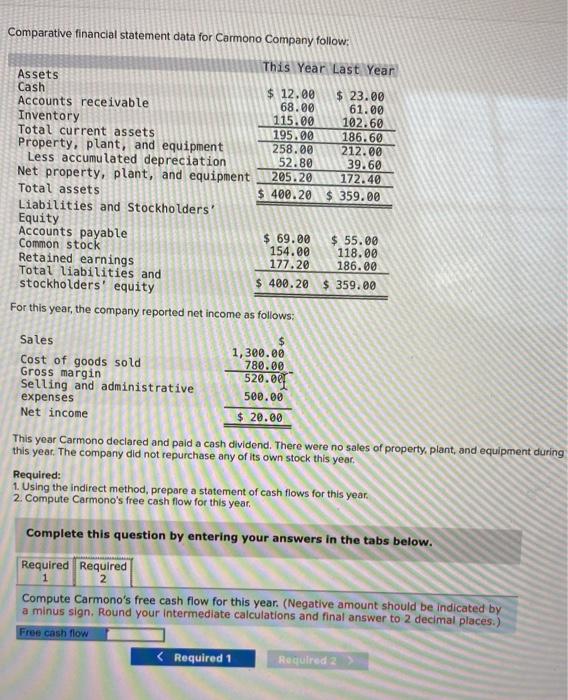

Question: ASAP NEED HELP PLEASE!! Comparative financial statement data for Carmono Company follow Assets Cash Accounts receivable Inventory Total current assets Property, plant, and equipment Less

Comparative financial statement data for Carmono Company follow Assets Cash Accounts receivable Inventory Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Total assets Sales Cost of goods sold. Gross margin Selling and administrative expenses Net income Liabilities and Stockholders' Equity Accounts payable Common stock Retained earnings Total liabilities and stockholders' equity For this year, the company reported net income as follows: This Year Last Year $ 12.00 $ 23.00 68.00 61.00 115.00 102.60 195.00 186.60 212.00 39.60 172.40 258.00 52.80 205.20 $ 400.20 $ 359.00 This year Carmono declared and paid a cash dividend. There were no sales of property, plant, and equipment during this year. The company did not repurchase any of its own stock this year Operating activities: Net income Adjustments to convert net income to a cash basis: $69.00 $ 55.00 154.00 118.00 177.20 186.00 $ 400.20 $ 359.00 Required: 1. Using the indirect method, prepare a statement of cash flows for this year 2. Compute Carmono's free cash flow for this year. Complete this question by entering your answers in the tabs below. Required Required 1 2 Depreciation Increase in accounts receivable Increase in inventory Increase in accounts payable 1,300.00 780.00 520.00 500.00 $20.00 Using the indirect method, prepare a statement of cash flows for this year. (List any deduction in cash and cash outflows as negative amounts. Round your intermediate calculations and final answers to 2 decimal places.) Net cash provided by operating activities Investing activities: Increase in plant and equipment Net cash used in investing activities Carmono Company Statement of Cash Flows For This Year Ended December 31 0.00 0.00 0.00 Comparative financial statement data for Carmono Company follow: Assets Cash Accounts receivable Inventory This Year Last Year $ 23.00 61.00 102.60 186.60 212.00 39.60 172.40 $ 400.20 $ 359.00 Total current assets 195.00 Property, plant, and equipment 258.00 Less accumulated depreciation 52.80 Net property, plant, and equipment 205.20 Total assets Sales Cost of goods sold Gross margin Selling and administrative expenses Net income $12.00 68.00 115.00 Liabilities and Stockholders' Equity Accounts payable Common stock Retained earnings Total liabilities and stockholders' equity For this year, the company reported net income as follows: $ 1,300.00 780.00 520.00 500.00 $20.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts