Question: ASAP need help! please explain steps! always upvote Problem 3-35 Ratio Analysis (LG3-1, LG3-2, LG3-3, LG3-4, LG3-5) Current ratio = 2.6 times Credit sales =

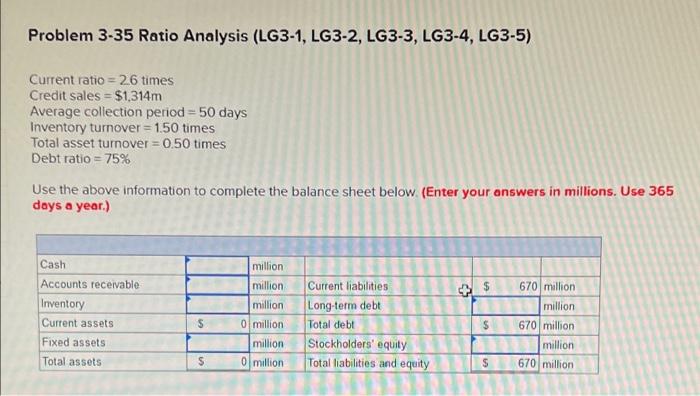

Problem 3-35 Ratio Analysis (LG3-1, LG3-2, LG3-3, LG3-4, LG3-5) Current ratio = 2.6 times Credit sales = $1,314m Average collection period = 50 days Inventory turnover = 1.50 times Total asset turnover = 0.50 times Debt ratio = 75% Use the above information to complete the balance sheet below. (Enter your answers in millions. Use 365 days a year.) Cash Accounts receivable Inventory Current assets Fixed assets Total assets S S million million million 0 million million 0 million Current liabilities Long-term debt Total debt Stockholders' equity Total liabilities and equity 25 $ LA $ en $ 670 million million 670 million million 670 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts