Question: ASAP Please!! During the current year, a company exchanged old equipment costing $64,000 with accumulated depreciation of $50,000 for a new truck. The new truck

ASAP Please!!

ASAP Please!!

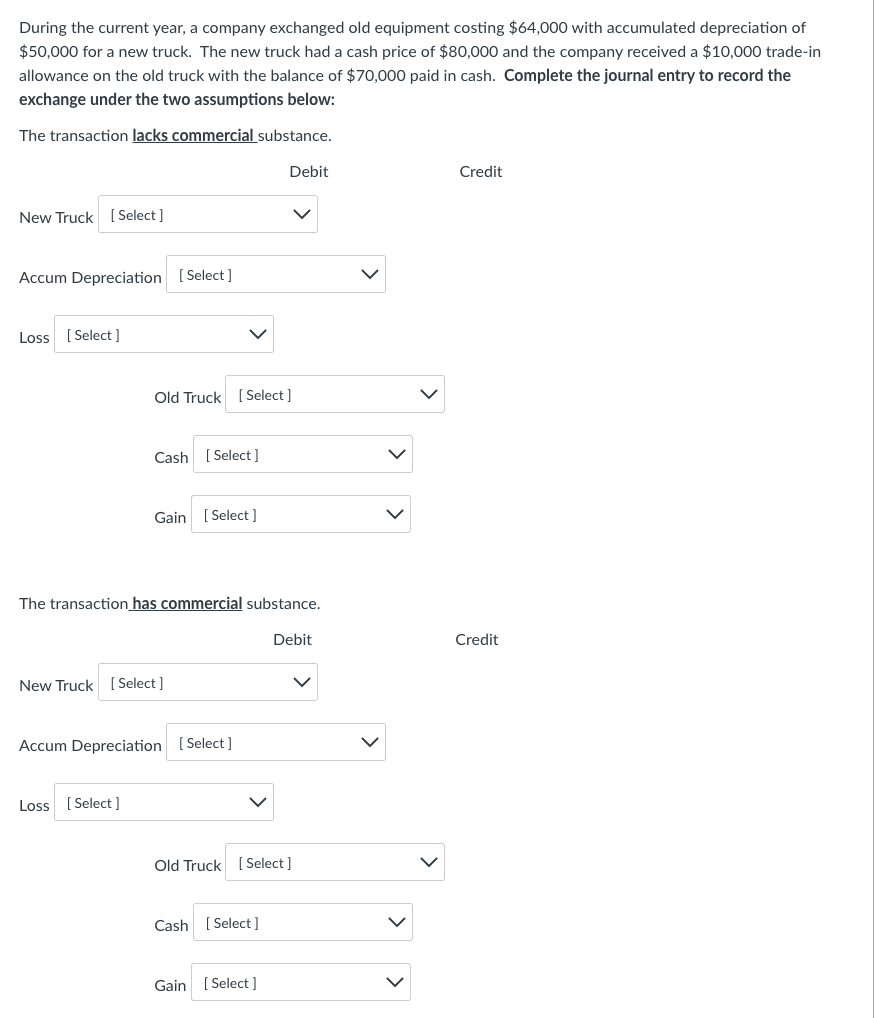

During the current year, a company exchanged old equipment costing $64,000 with accumulated depreciation of $50,000 for a new truck. The new truck had a cash price of $80,000 and the company received a $10,000 trade-in allowance on the old truck with the balance of $70,000 paid in cash. Complete the journal entry to record the exchange under the two assumptions below: The transaction lacks commercialssubstance. Debit Credit New Truck Accum Depreciation Loss Old Truck Cash Gain The transaction has commercial substance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts