Question: ASAP please please choose the correct answer. this is the question of international business class Question 32 1 pts Assume the US government security with

ASAP

please

please choose the correct answer. this is the question of international business class

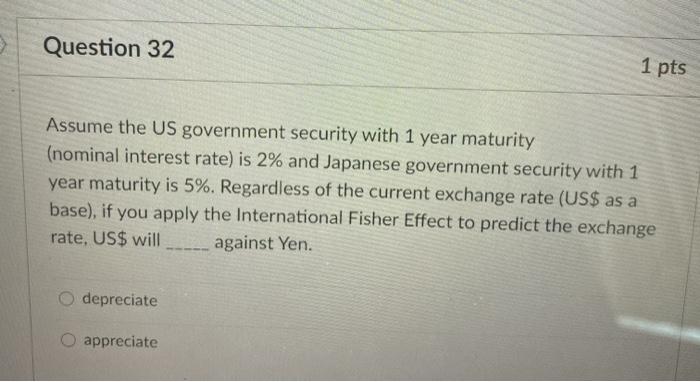

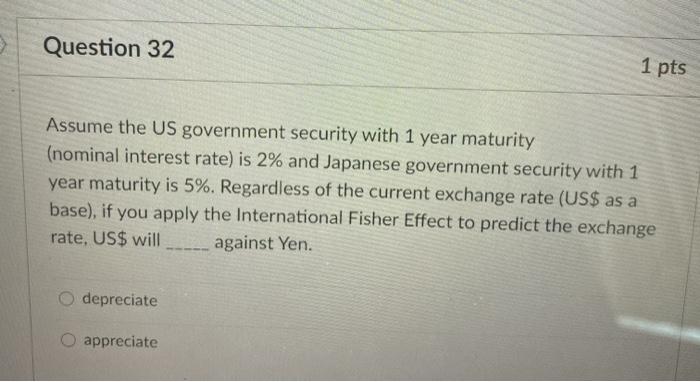

Question 32 1 pts Assume the US government security with 1 year maturity (nominal interest rate) is 2% and Japanese government security with 1 year maturity is 5%. Regardless of the current exchange rate (US$ as a base), if you apply the International Fisher Effect to predict the exchange rate, US$ will against Yen. depreciate O appreciate Assume the BigMac is sold at US$4 in US and 4 Euro in Germany. Let's assume the current spot exchange rate is 1.21 US$/Euro. If we believe in th PPP theory, US$ should against Euro. depreciate O appreciate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock