Question: ASAP please pleasee plesaeeeeee 2. No. 2 DD Co has a dividend payout ratio of 40% and has maintained this payout ratio for several years.

ASAP please pleasee plesaeeeeee

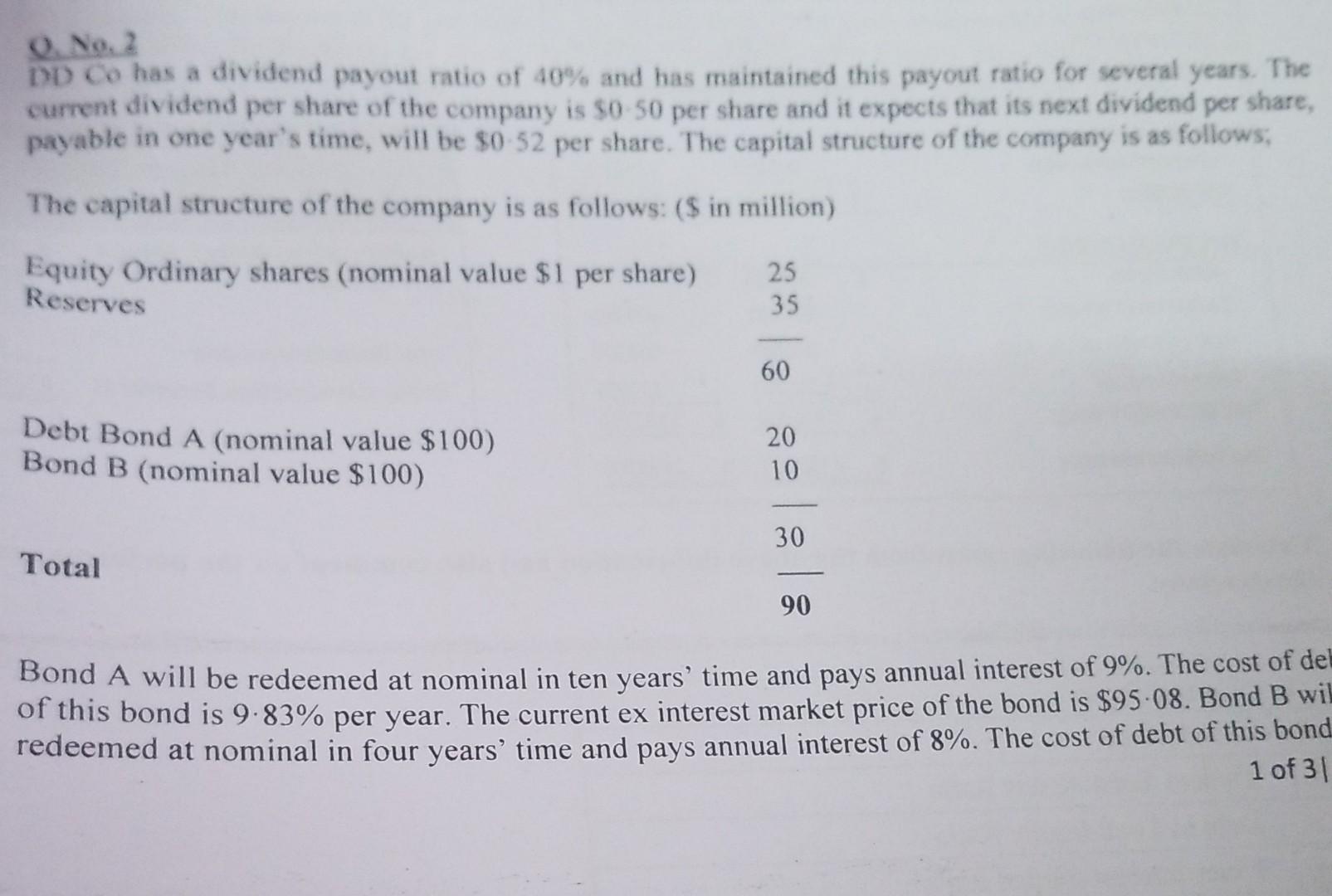

2. No. 2 DD Co has a dividend payout ratio of 40% and has maintained this payout ratio for several years. The current dividend per share of the company is $0 50 per share and it expects that its next dividend per share, payable in one year's time, will be $0 52 per share. The capital structure of the company is as follows, The capital structure of the company is as follows: ($ in million) Equity Ordinary shares (nominal value $1 per share) Reserves 25 35 60 Debt Bond A (nominal value $100) Bond B (nominal value $100) 20 10 30 Total 90 Bond A will be redeemed at nominal in ten years' time and pays annual interest of 9%. The cost of de of this bond is 9.83% per year. The current ex interest market price of the bond is $95-08. Bond B wil redeemed at nominal in four years' time and pays annual interest of 8%. The cost of debt of this bond 1 of 31 2. No. 2 DD Co has a dividend payout ratio of 40% and has maintained this payout ratio for several years. The current dividend per share of the company is $0 50 per share and it expects that its next dividend per share, payable in one year's time, will be $0 52 per share. The capital structure of the company is as follows, The capital structure of the company is as follows: ($ in million) Equity Ordinary shares (nominal value $1 per share) Reserves 25 35 60 Debt Bond A (nominal value $100) Bond B (nominal value $100) 20 10 30 Total 90 Bond A will be redeemed at nominal in ten years' time and pays annual interest of 9%. The cost of de of this bond is 9.83% per year. The current ex interest market price of the bond is $95-08. Bond B wil redeemed at nominal in four years' time and pays annual interest of 8%. The cost of debt of this bond 1 of 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts