Question: asap please Question 44 3.6 pts Compute the amount we should pay Today for a Capital Project that will generate $20,000 of revenue per year

asap please

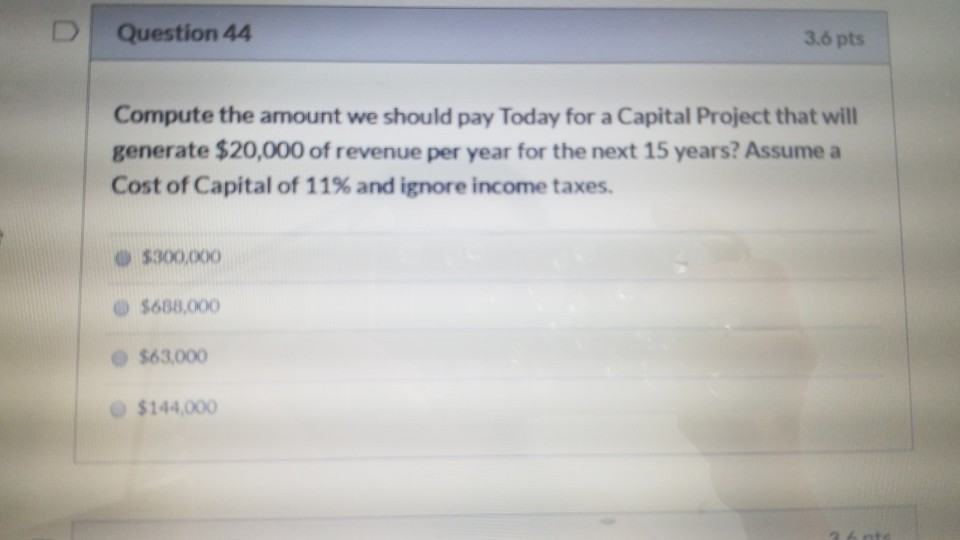

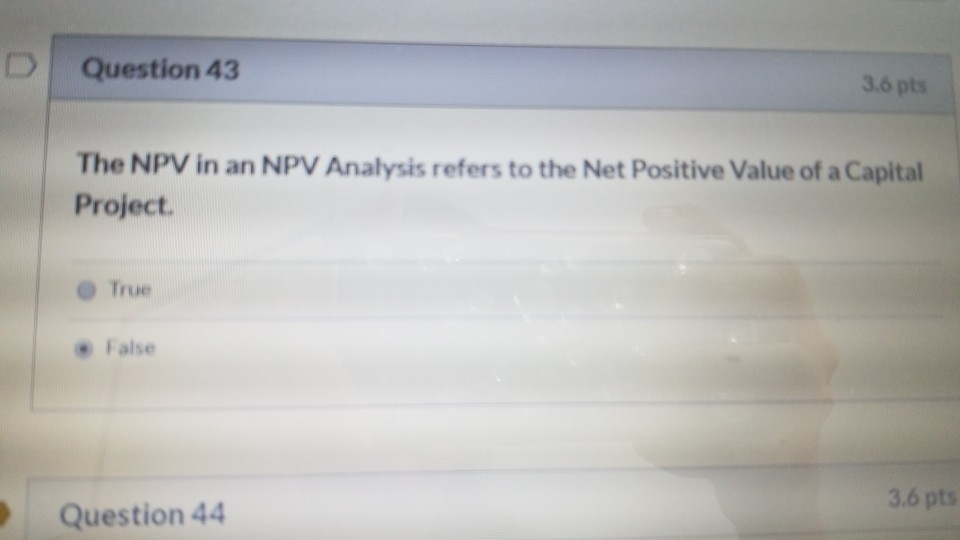

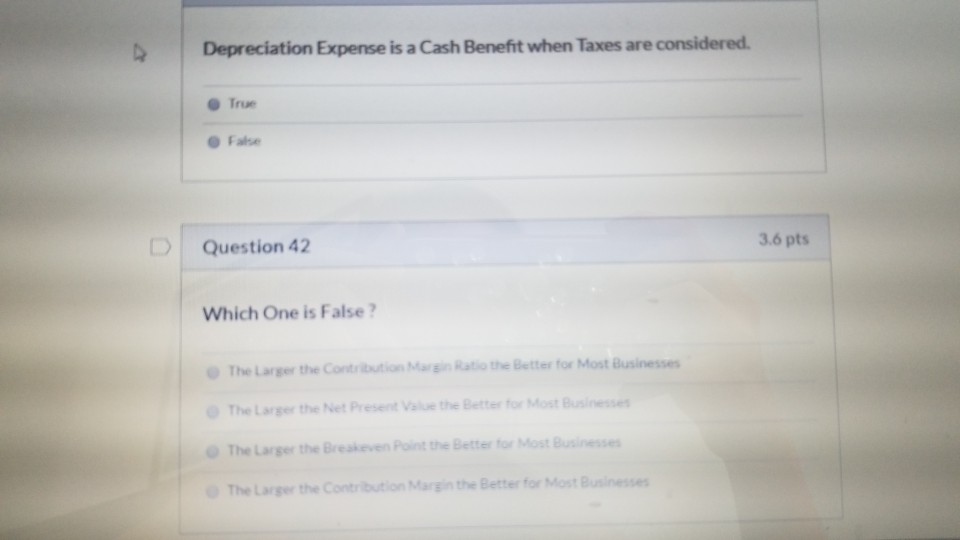

Question 44 3.6 pts Compute the amount we should pay Today for a Capital Project that will generate $20,000 of revenue per year for the next 15 years? Assume a Cost of Capital of 11% and ignore income taxes. $300,000 $688,000 $63,000 $144,000 26nte Question 43 3.6 pts The NPV in an NPV Analysis refers to the Net Positive Value of a Capital Project True False 3.6 pts Question 44 Depreciation Expense is a Cash Benefit when Taxes are considered. True Fate Question 42 3.6 pts Which one is False? The larger the Contribution Rate the Better for Most Businesses The Lathe NetPV E The larger the Brea t he Better taste The larger the Contribution Mars in the Better for Most Businesses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts