Question: ASAP. Please show solution D Question 6 3 pts Nicanor met Inday in 2000. They married the following year. By 2005, Inday stayed home to

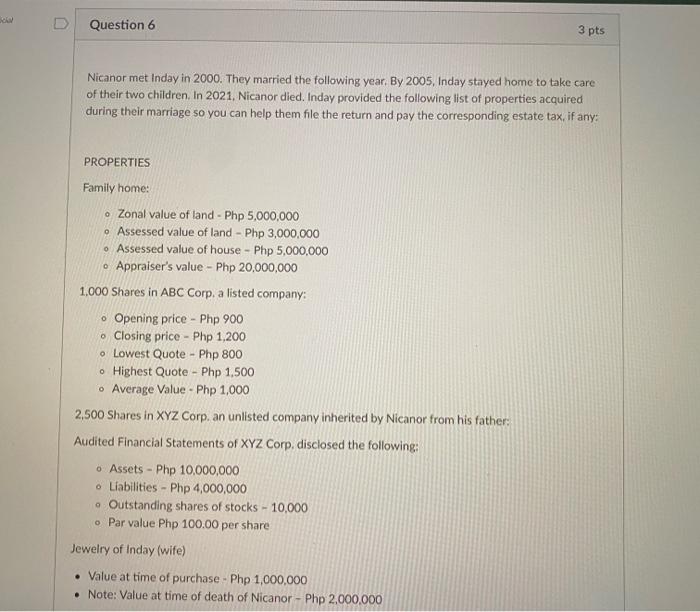

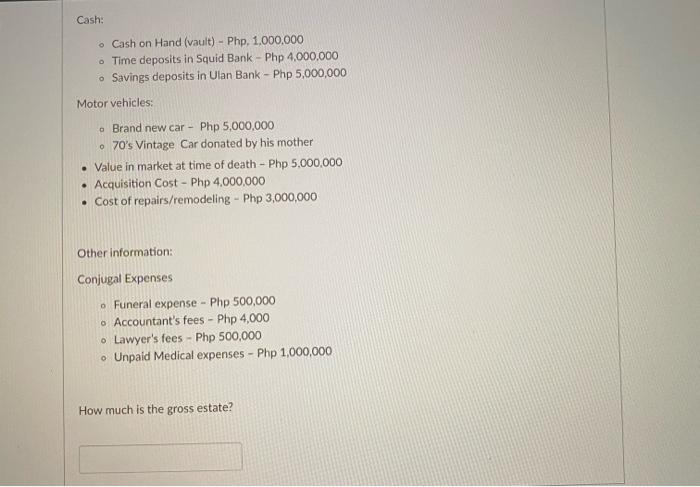

D Question 6 3 pts Nicanor met Inday in 2000. They married the following year. By 2005, Inday stayed home to take care of their two children. In 2021. Nicanor died. Inday provided the following list of properties acquired during their marriage so you can help them file the return and pay the corresponding estate tax, if any: PROPERTIES Family home: o Zonal value of land - Php 5,000,000 Assessed value of land - Php 3,000,000 Assessed value of house - Php 5,000,000 Appraiser's value - Php 20,000,000 1,000 Shares in ABC Corp. a listed company: Opening price - Php 900 Closing price - Php 1,200 o Lowest Quote - Php 800 Highest Quote - Php 1,500 Average Value - Php 1,000 2,500 Shares in XYZ Corp. an unlisted company inherited by Nicanor from his father: Audited Financial Statements of XYZ Corp, disclosed the following: o Assets - Php 10,000,000 o Liabilities - Php 4,000,000 Outstanding shares of stocks - 10,000 Par value Php 100.00 per share Jewelry of Inday (wife) Value at time of purchase - Php 1,000,000 Note: Value at time of death of Nicanor - Php 2,000,000 Cash: Cash on Hand (vault) - Php. 1,000,000 Time deposits in Squid Bank - Php 4,000,000 Savings deposits in Ulan Bank - Php 5,000,000 Motor vehicles: . Brand new car - Php 5,000,000 70's Vintage Car donated by his mother Value in market at time of death - Php 5,000,000 Acquisition Cost - Php 4,000,000 Cost of repairs/remodeling - Php 3,000,000 Other information: Conjugal Expenses Funeral expense - Php 500,000 Accountant's fees - Php 4,000 Lawyer's fees - Php 500,000 Unpaid Medical expenses - Php 1,000,000 How much is the gross estate? D Question 6 3 pts Nicanor met Inday in 2000. They married the following year. By 2005, Inday stayed home to take care of their two children. In 2021. Nicanor died. Inday provided the following list of properties acquired during their marriage so you can help them file the return and pay the corresponding estate tax, if any: PROPERTIES Family home: o Zonal value of land - Php 5,000,000 Assessed value of land - Php 3,000,000 Assessed value of house - Php 5,000,000 Appraiser's value - Php 20,000,000 1,000 Shares in ABC Corp. a listed company: Opening price - Php 900 Closing price - Php 1,200 o Lowest Quote - Php 800 Highest Quote - Php 1,500 Average Value - Php 1,000 2,500 Shares in XYZ Corp. an unlisted company inherited by Nicanor from his father: Audited Financial Statements of XYZ Corp, disclosed the following: o Assets - Php 10,000,000 o Liabilities - Php 4,000,000 Outstanding shares of stocks - 10,000 Par value Php 100.00 per share Jewelry of Inday (wife) Value at time of purchase - Php 1,000,000 Note: Value at time of death of Nicanor - Php 2,000,000 Cash: Cash on Hand (vault) - Php. 1,000,000 Time deposits in Squid Bank - Php 4,000,000 Savings deposits in Ulan Bank - Php 5,000,000 Motor vehicles: . Brand new car - Php 5,000,000 70's Vintage Car donated by his mother Value in market at time of death - Php 5,000,000 Acquisition Cost - Php 4,000,000 Cost of repairs/remodeling - Php 3,000,000 Other information: Conjugal Expenses Funeral expense - Php 500,000 Accountant's fees - Php 4,000 Lawyer's fees - Php 500,000 Unpaid Medical expenses - Php 1,000,000 How much is the gross estate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts