Question: ASAP please So I was able to solve the first part of this question the easy one but I need help on the hard one

ASAP please

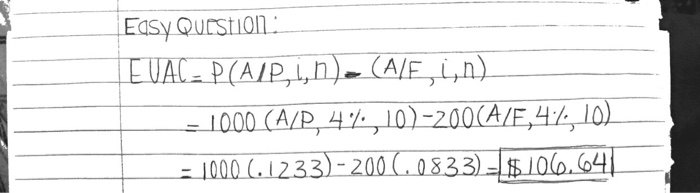

So I was able to solve the first part of this question the "easy" one but I need help on the "hard" one so for the second question we need to

-convert the 18% apr to apy

- calculate the effective annual interest rate

- are p value is 3 because it's after three years not at year 0

- and we will have another f value at year 10 because we are selling it

And please show me how to calculate the second part in terms of equation like I did with the first part

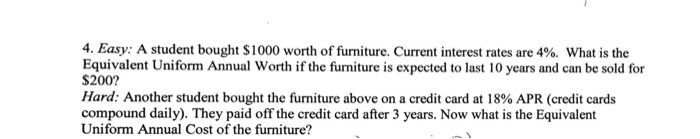

4. Easy: A student bought $1000 worth of furniture. Current interest rates are 4%. What is the Equivalent Uniform Annual Worth if the furniture is expected to last 10 years and can be sold for Hard: Another student bought the furniture above on a credit card at 18% APR (credit cards compound daily). They paid off the credit card after 3 years. Now what is the Equivalent Uniform Annual Cost of the furniture

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts