Question: ASAP PLEASE WILL GIVE THUMBS UP -Perform a comparative analysis between both firms taking into account consideration of your Debt Ratio, in a minimum of

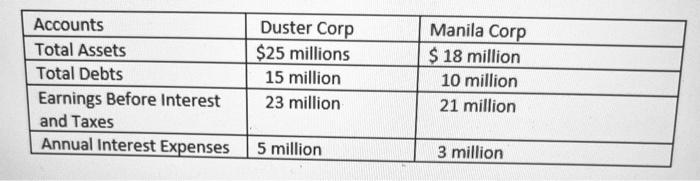

Accounts Total Assets Total Debts Earnings Before Interest and Taxes Annual Interest Expenses Duster Corp $25 millions 15 million 23 million Manila Corp $ 18 million 10 million 21 million 5 million 3 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts