Question: ASAP pls!! Just answer, no need explanation! Thanks so much!! ori (Body 11 IU X, X DA A- A A Font =-=-=-= = = 2!

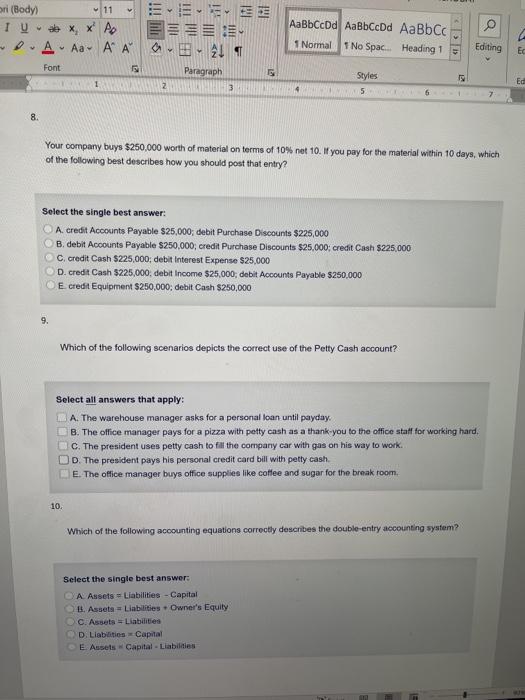

ori (Body 11 IU X, X DA A- A A Font =-=-=-= = = 2! Paragraph 5 2 3 AaBbCcDd AaBbCcDd AaBbc 1 Normal 1 No Spac... Heading 1 Editing EC 1 Styles 45 Ed 6 7 8. Your company buys $250,000 worth of material on terms of 10% net 10. If you pay for the material within 10 days, which of the following best describes how you should post that entry? Select the single best answer: A. credit Accounts Payable $25,000; debit Purchase Discounts $225,000 B. debit Accounts Payable $250,000, credit Purchase Discounts $25,000; credit Cash $225,000 C. credit Cash $225,000, debit Interest Expense $25,000 D. credit Cash $225,000, debit Income $25,000, debit Accounts Payable $250,000 E credit Equipment $250,000; debit Cash $250,000 Which of the following scenarios depicts the correct use of the Petty Cash account? Select all answers that apply: A. The warehouse manager asks for a personal loan until payday B. The office manager pays for a pizza with petty cash as a thank you to the office staff for working hard, C. The president uses petty cash to fill the company car with gas on his way to work. D. The president pays his personal credit card bill with petty cash e. The office manager buys office supplies like coffee and sugar for the break room 10. Which of the following accounting equations correctly describes the double entry accounting system? Select the single best answer: A Assets = Liabilities - Capital B. Assets Liabilities. Owner's Equity C. Assets Liabilities D Liabilities Capital E Assets Capital - Liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts