Question: ASAP PROBLEM 8: Laxmi Pvt. Ltd., a registered supplier, is engaged in the manufacture of taxable goods. The company provides the following information pertaining to

ASAP

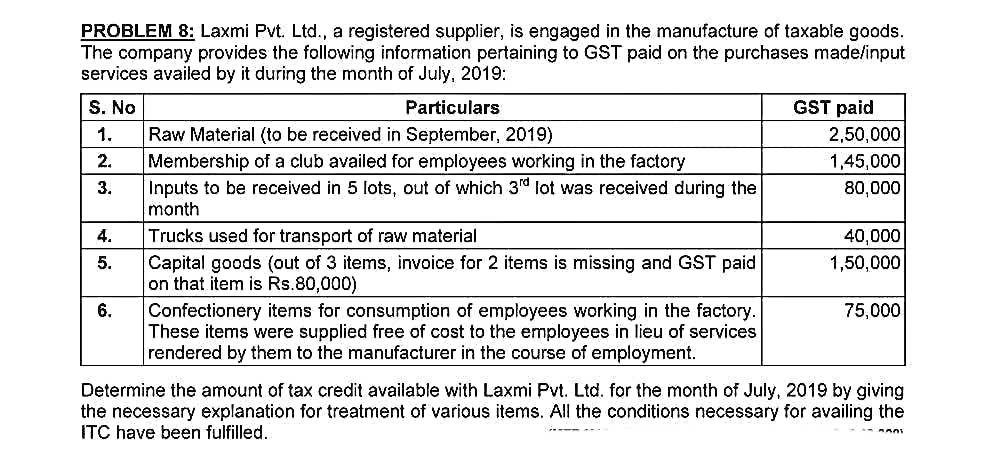

PROBLEM 8: Laxmi Pvt. Ltd., a registered supplier, is engaged in the manufacture of taxable goods. The company provides the following information pertaining to GST paid on the purchases made/input services availed by it during the month of July, 2019: S. No Particulars GST paid 1. Raw Material (to be received in September, 2019) 2,50,000 2. Membership of a club availed for employees working in the factory 1,45,000 3. Inputs to be received in 5 lots, out of which 3rd lot was received during the 80,000 month 4. Trucks used for transport of raw material 40,000 5. Capital goods (out of 3 items, invoice for 2 items is missing and GST paid 1,50,000 on that item is Rs. 80,000) 6. Confectionery items for consumption of employees working in the factory. 75,000 These items were supplied free of cost to the employees in lieu of services rendered by them to the manufacturer in the course of employment. Determine the amount of tax credit available with Laxmi Pvt. Ltd. for the month of July, 2019 by giving the necessary explanation for treatment of various items. All the conditions necessary for availing the ITC have been fulfilled. RADU

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts