Question: ASAPPPPPPP PLEASE PLEASE 10 pt (Decision Tree Problem) A manufacturing company is considering expanding its production capacity to meet a growing demand for its product

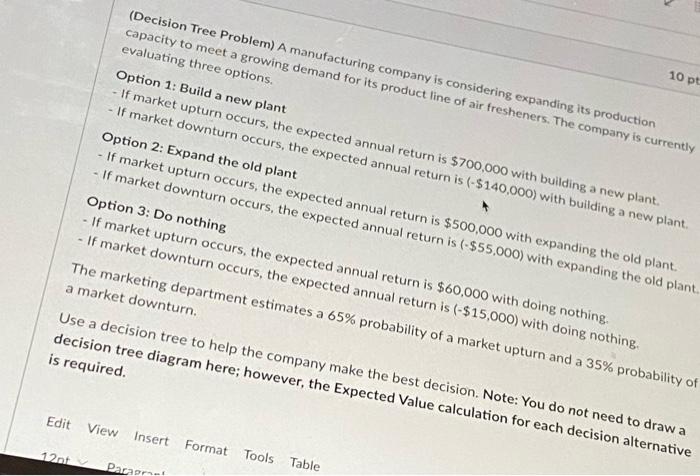

10 pt (Decision Tree Problem) A manufacturing company is considering expanding its production capacity to meet a growing demand for its product line of air fresheners. The company is currently evaluating three options. Option 1: Build a new plant - If market upturn occurs, the expected annual return is $700,000 with building a new plant. - If market downturn occurs, the expected annual return is (-$140,000) with building a new plant. Option 2: Expand the old plant - If market upturn occurs, the expected annual return is $500,000 with expanding the old plant. If market downturn occurs, the expected annual return is (-$55,000) with expanding the old plant Option 3: Do nothing - If market upturn occurs, the expected annual return is $60,000 with doing nothing. - If market downturn occurs, the expected annual return is (-$15,000) with doing nothing. The marketing department estimates a 65% probability of a market upturn and a 35% probability of a market downturn Use a decision tree to help the company make the best decision. Note: You do not need to draw a decision tree diagram here; however, the Expected Value calculation for each decision alternative is required. Edit View Insert Format 1201 Tools Table Parapro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts