Question: ASC EXERCISE ERROR CORRECTION & CHANGE IN DEPRECIATION METHOD GENERAL MANUFACTURERS INC. purchased and installed a large piece of equipment at the beginning of 2019

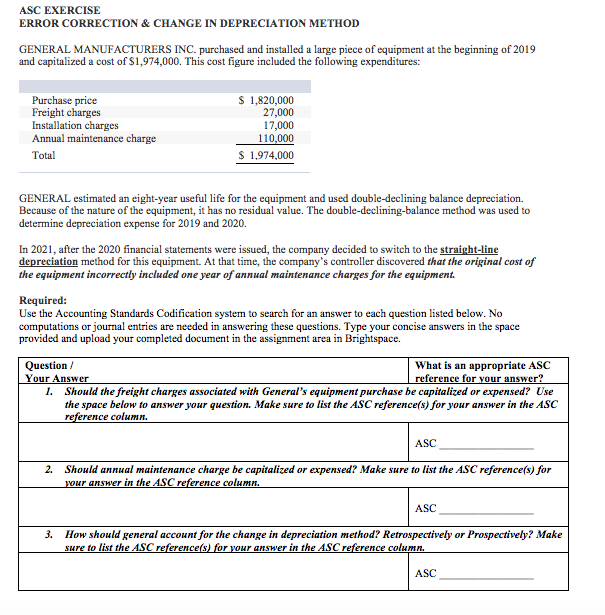

ASC EXERCISE ERROR CORRECTION & CHANGE IN DEPRECIATION METHOD GENERAL MANUFACTURERS INC. purchased and installed a large piece of equipment at the beginning of 2019 and capitalized a cost of $1,974,000. This cost figure included the following expenditures: Purchase price Freight charges Installation charges Annual maintenance charge Total $ 1,820,000 27,000 17,000 110,000 $ 1.974.000 GENERAL estimated an eight-year useful life for the equipment and used double-declining balance depreciation. Because of the nature of the equipment, it has no residual value. The double-declining-balance method was used to determine depreciation expense for 2019 and 2020. In 2021, after the 2020 financial statements were issued, the company decided to switch to the straight-line depreciation method for this equipment. At that time, the company's controller discovered that the original cost of the equipment incorrectly included one year of annual maintenance charges for the equipment. Required: Use the Accounting Standards Codification system to search for an answer to each question listed below. No computations or journal entries are needed in answering these questions. Type your concise answers in the provided and upload your completed document in the assignment area in Brightspace. Question What is an appropriate ASC Your Answer reference for your answer? 1. Should the freight charges associated with General's equipment purchase be capitalized or expensed? Use the space below to answer your question. Make sure to list the ASC reference(s) for your answer in the ASC reference column. space ASC 2. Should annual maintenance charge be capitalized or expensed? Make sure to list the ASC reference(s) for your answer in the ASC reference column. ASC 3. How should general account for the change in depreciation method? Retrospectively or Prospectively? Make sure to list the ASC reference(s) for your answer in the ASC reference column. ASC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts