Question: Ask an expert 7 2 3 ? 2 4 , 1 1 : 1 0 AM QuickBooks Exam Flashcards | Quizlet The default tax status

Ask an expert

: AM

QuickBooks Exam Flashcards Quizlet

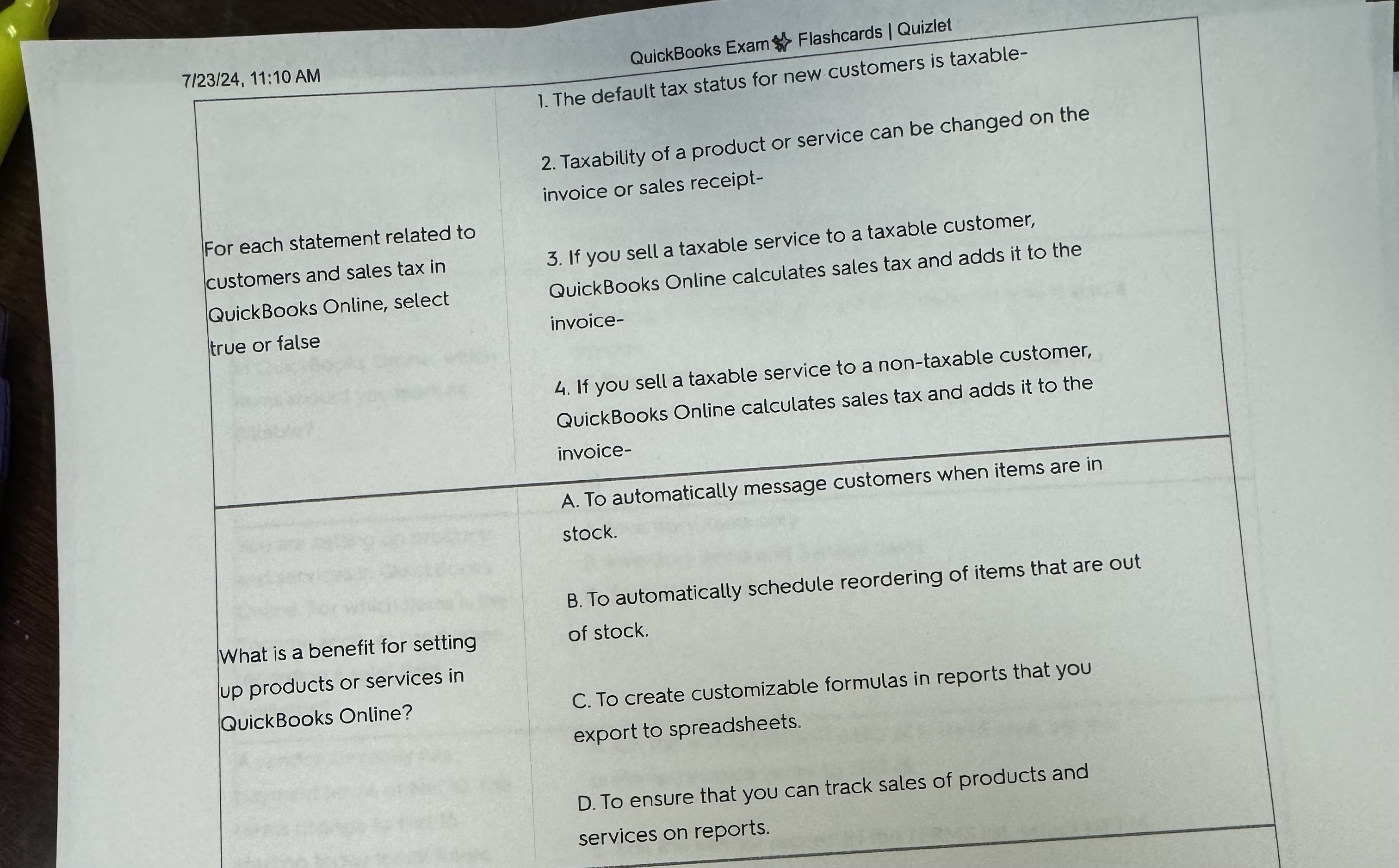

The default tax status for new customers is taxable

For each statement related to customers and sales tax in QuickBooks Online, select true or false

Taxability of a product or service can be changed on the invoice or sales receipt

If you sell a taxable service to a taxable customer, QuickBooks Online calculates sales tax and adds it to the invoice

If you sell a taxable service to a nontaxable customer, QuickBooks Online calculates sales tax and adds it to the invoice

A To automatically message customers when items are in stock.

What is a benefit for setting up products or services in QuickBooks Online?

The changed on the invoice or sales receipt

If you sell a taxable service to a taxable calculates sales tax and adds it to the QuickBooks Online cals invoice

If you sell a taxable service to a nonlates sales tax and adds it to the QuickBooks Online calculates invoice

A To automatically message customers when items are in stock.

B To automatically schedule reordering of items that are out of stock.

C To create customizable formulas in reports that you export to spreadsheets.

D To ensure that you can track sales of products and services on reports.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock