Question: Ask an expert Note: Parentheses indicate a credit balance. Required: a . Prepare a worksheet to consolidate the separate 2 0 2 4 financial statements

Ask an expert

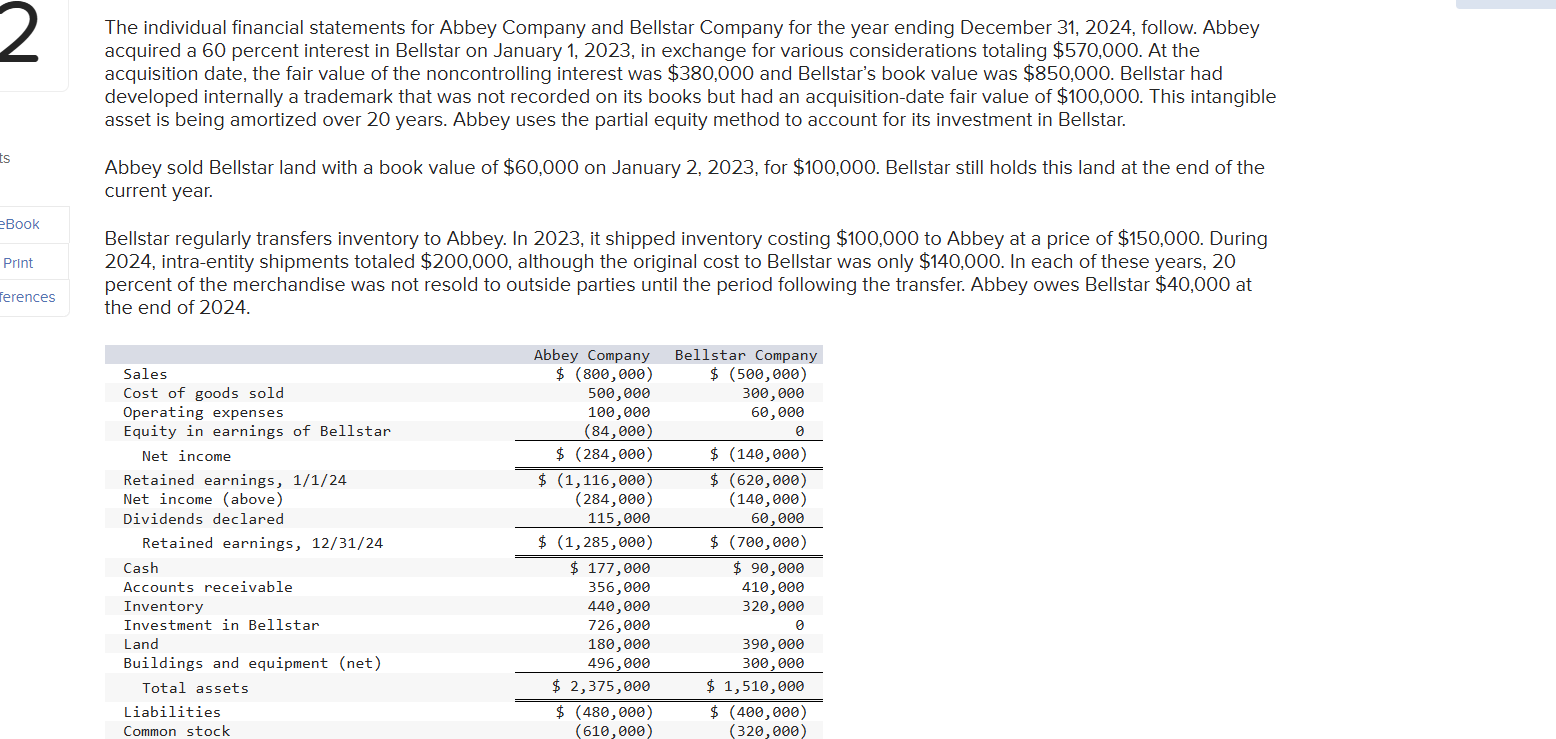

Note: Parentheses indicate a credit balance.

Required:

a Prepare a worksheet to consolidate the separate financial statements for Abbey and Bellstar.

b How would the consolidation entries in requirement a have differed if Abbey had sold a building on January with a

$$ $ instead of land, as the problem reports? Assume that the building

had a year remaining life at the date of transfer.

Complete this question by entering your answers in the tabs below.

Prepare a worksheet to consolidate the separate financial statements for Abbey and Bellstar.

Note: Do not round intermediate calculations. For accounts where multiple consolidation entries are required, combine all debit entries into one

amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in

the credit column of the worksheet. Input all amounts as positive values.

ABBEY AND BELLSTAR

Consolidation Worksheet

For the Year Ending December

Consolidation Entries

tableAccountsAbbeyBellstarDebitCreditNoncontrolling Interest,Consolidated TotalsSales$ $ $ $ oints,Cost of goods soldOperating expenses,Equity in earnings of Bellstar,Separate company net income,$ $ eBookConsolidated net income$ To noncontrolling interest,PrintTo Abbey Company$ ReferencesRetained earnings Abbey$ $ Retained earnings BellstarNet income,Dividends declared,Retained earnings$ $ Cash$ $ Accounts receivable,InventoryInvestment in Bellstar,LandBuildings and equipment netTrademarkTotal assets,$ $ Liabilities$ $ Common stock,Additional paidin capital, PLEASE SOLVE AND FILL IN EACH COLUMN ACCORDINGLY

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock