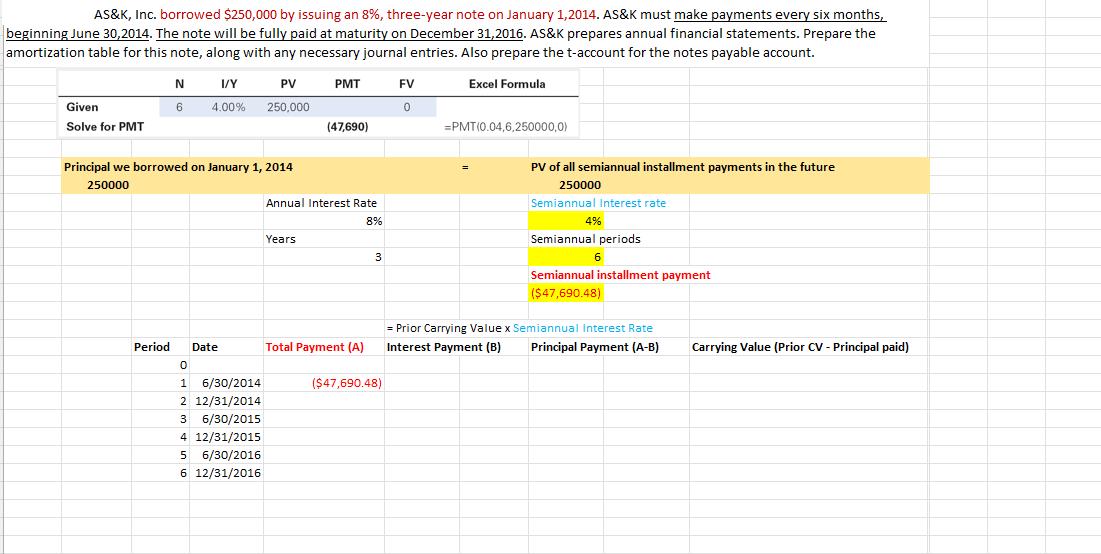

Question: AS&K, Inc. borrowed $250,000 by issuing an 8%, three-year note on January 1, 2014. AS&K must make payments every six months, beginning June 30,2014.

AS&K, Inc. borrowed $250,000 by issuing an 8%, three-year note on January 1, 2014. AS&K must make payments every six months, beginning June 30,2014. The note will be fully paid at maturity on December 31, 2016. AS&K prepares annual financial statements. Prepare the amortization table for this note, along with any necessary journal entries. Also prepare the t-account for the notes payable account. Given Solve for PMT N 6 Period I/Y 4.00% Principal we borrowed on January 1, 2014 250000 Date 0 1 6/30/2014 2 12/31/2014 PV 250,000 3 6/30/2015 4 12/31/2015 5 6/30/2016 6 12/31/2016 PMT Years (47,690) Annual Interest Rate 8% Total Payment (A) 3 ($47,690.48) FV 0 Excel Formula =PMT(0.04,6,250000.0) PV of all semiannual installment payments in the future 250000 Semiannual Interest rate 4% Semiannual periods 6 Semiannual installment payment ($47,690.48) = Prior Carrying Value x Semiannual interest Rate Interest Payment (B) Principal Payment (A-B) Carrying Value (Prior CV - Principal paid)

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

A B C D E F G H 2 3 N IY PV PMT FV Excel Formula 4 Given 6 400 25000000 0 5 Solve for PMT 4769048 PM... View full answer

Get step-by-step solutions from verified subject matter experts