Question: asked this question earlier they came up with the same answer as me can someone ,please explain why it's wrong. Determine the amount of the

asked this question earlier they came up with the same answer as me can someone ,please explain why it's wrong.

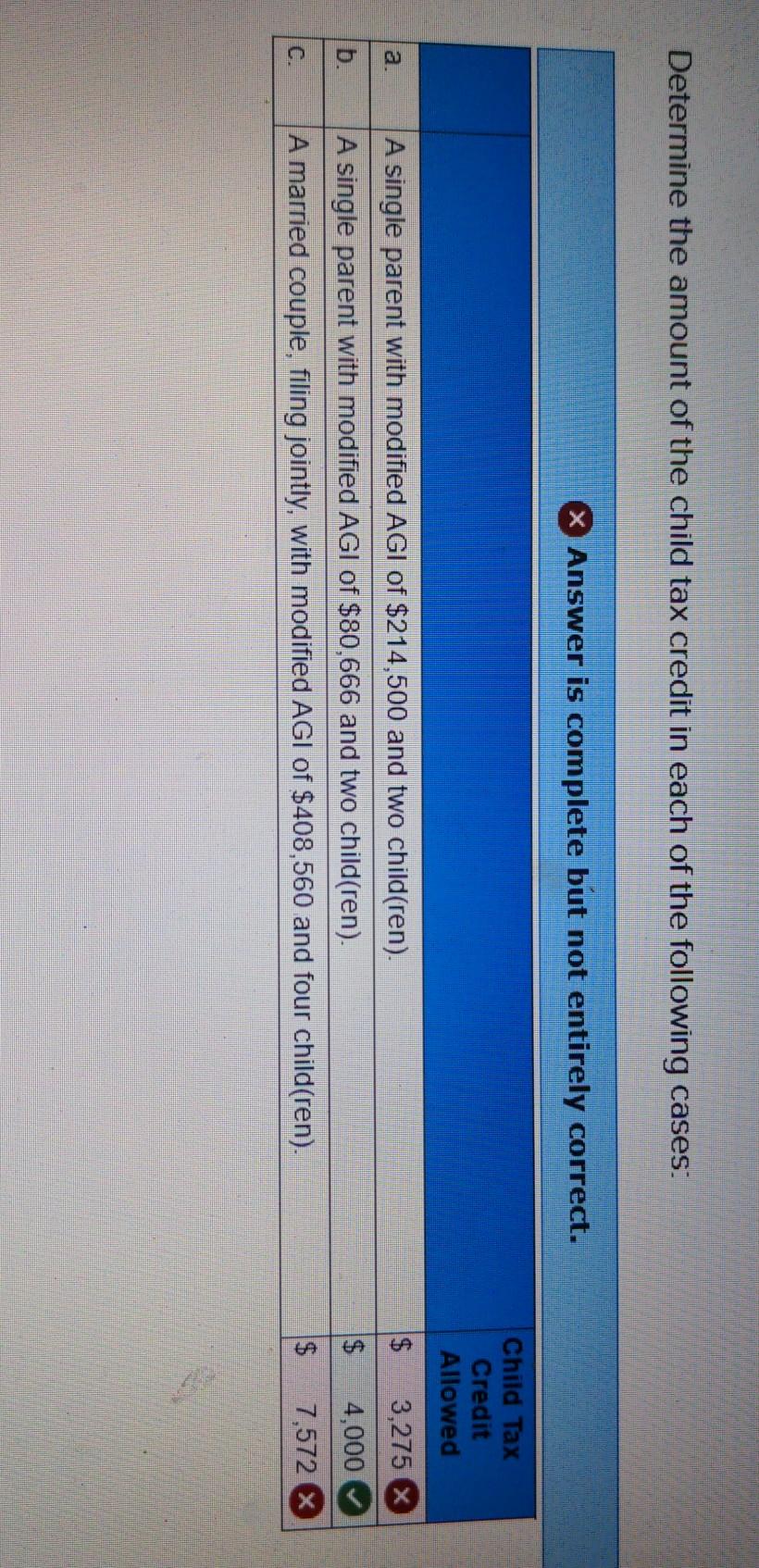

Determine the amount of the child tax credit in each of the following cases: X Answer is complete but not entirely correct. Child Tax Credit Allowed a. $ 3,275 A single parent with modified AGI of $214,500 and two child(ren). A single parent with modified AGI of $80,666 and two child(ren). A married couple, filing jointly, with modified AGI of $408,560 and four child(ren). 4,000 7,572 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts