Question: Asking about these question below. Please give me detailed explanation and proper answer in Excel. Thanks so much! 2. You own a call option on

Asking about these question below. Please give me detailed explanation and proper answer in Excel. Thanks so much!

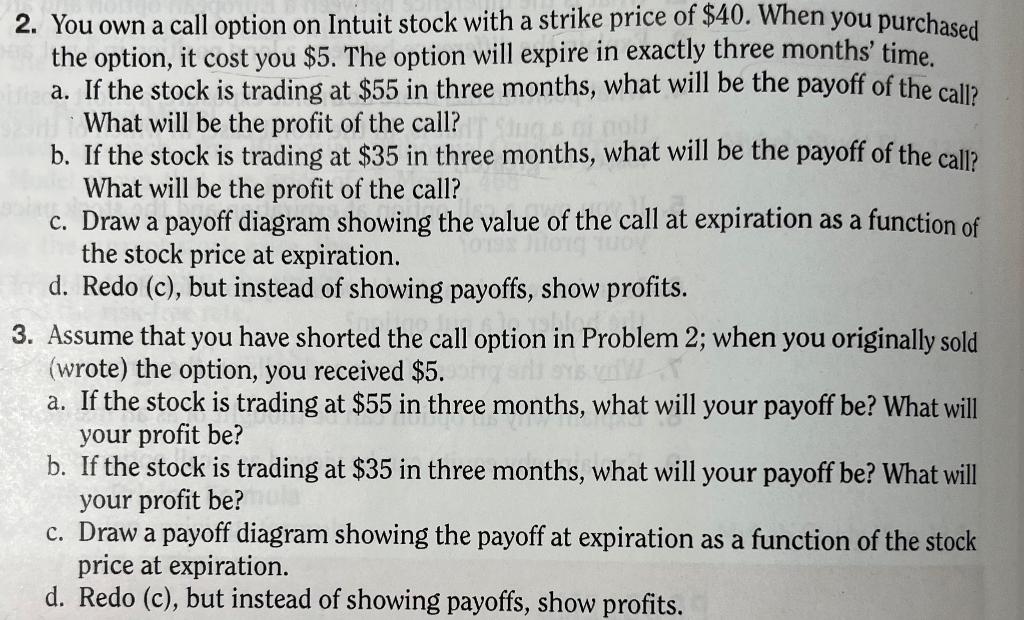

2. You own a call option on Intuit stock with a strike price of $40. When you purchased the option, it cost you $5. The option will expire in exactly three months' time. a. If the stock is trading at $55 in three months, what will be the payoff of the call? What will be the profit of the call? b. If the stock is trading at $35 in three months, what will be the payoff of the call? What will be the profit of the call? c. Draw a payoff diagram showing the value of the call at expiration as a function of the stock price at expiration. d. Redo (c), but instead of showing payoffs, show profits. 3. Assume that you have shorted the call option in Problem 2; when you originally sold (wrote) the option, you received $5. a. If the stock is trading at $55 in three months, what will your payoff be? What will your profit be? b. If the stock is trading at $35 in three months, what will your payoff be? What will your profit be? c. Draw a payoff diagram showing the payoff at expiration as a function of the stock price at expiration. d. Redo (c), but instead of showing payoffs, show profits. 2. You own a call option on Intuit stock with a strike price of $40. When you purchased the option, it cost you $5. The option will expire in exactly three months' time. a. If the stock is trading at $55 in three months, what will be the payoff of the call? What will be the profit of the call? b. If the stock is trading at $35 in three months, what will be the payoff of the call? What will be the profit of the call? c. Draw a payoff diagram showing the value of the call at expiration as a function of the stock price at expiration. d. Redo (c), but instead of showing payoffs, show profits. 3. Assume that you have shorted the call option in Problem 2; when you originally sold (wrote) the option, you received $5. a. If the stock is trading at $55 in three months, what will your payoff be? What will your profit be? b. If the stock is trading at $35 in three months, what will your payoff be? What will your profit be? c. Draw a payoff diagram showing the payoff at expiration as a function of the stock price at expiration. d. Redo (c), but instead of showing payoffs, show profits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts