Question: Asking again because my previous answer was wrong. Please don't answer if you don't know it. Need part a and b The management of Madeira

Asking again because my previous answer was wrong. Please don't answer if you don't know it. Need part a and b

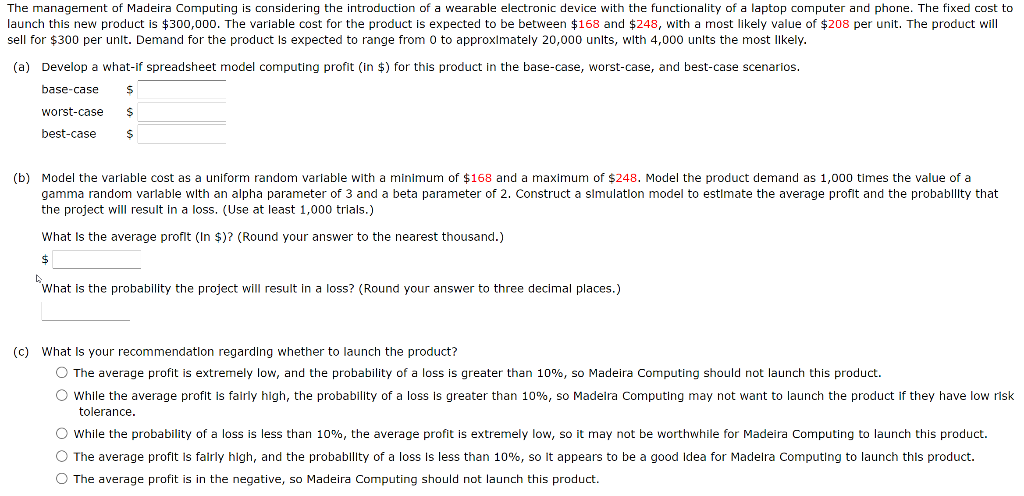

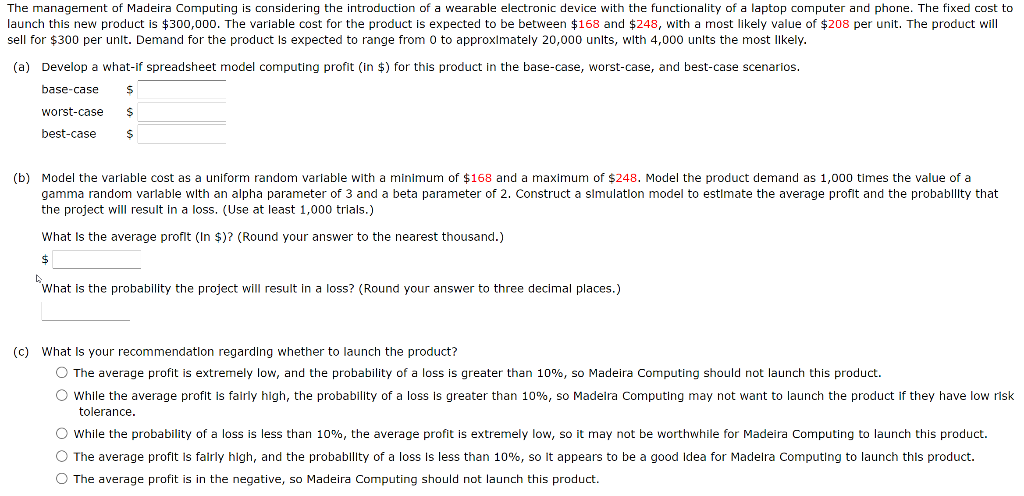

The management of Madeira Computing is considering the introduction of a wearable electronic device with the functionality of a laptop computer and phone. The fixed cost to launch this new product is $300,000. The variable cost for the product is expected to be between $168 and $248, with a most likely value of $208 per unit. The product will sell for $300 per unit. Demand for the product is expected to range from 0 to approximately 20,000 units, with 4,000 units the most likely. (a) Develop a what-if spreadsheet model computing profit (in $) for this product in the base-case, worst-case, and best-case scenarios. base-case S worst-case S best-case S (b) Model the variable cost as a uniform random variable with a minimum of $168 and a maximum of $248. Model the product demand as 1,000 times the value of a gamma random variable with an alpha parameter of 3 and a beta parameter of 2. Construct a simulation model to estimate the average profit and the probability that the project will result in a loss. (Use at least 1,000 trials.) What is the average profit (In $)? (Round your answer to the nearest thousand.) $ "What is the probability the project will result in a loss? (Round your answer to three decimal places.) (c) What is your recommendation regarding whether to launch the product? The average profit is extremely low, and the probability of a loss is greater than 10%, so Madeira Computing should not launch this product. While the average profit is fairly high, the probability of a loss is greater than 10%, so Madeira Computing may not want to launch the product if they have low risk tolerance. O while the probability of a loss is less than 10%, the average profit extremely low, so it may not be worthwhile for Madeira Computing to launch this product. The average profit is fairly high, and the probability of a loss is less than 10%, so it appears to be a good idea for Madeira Computing to launch this product. The average profit is in the negative, so Madeira Computing should not launch this product