Question: Asking for answers to a and b. E5-3. Condensed Statement of Net Income. Bradley Corporation provided the following account balances as of the end of

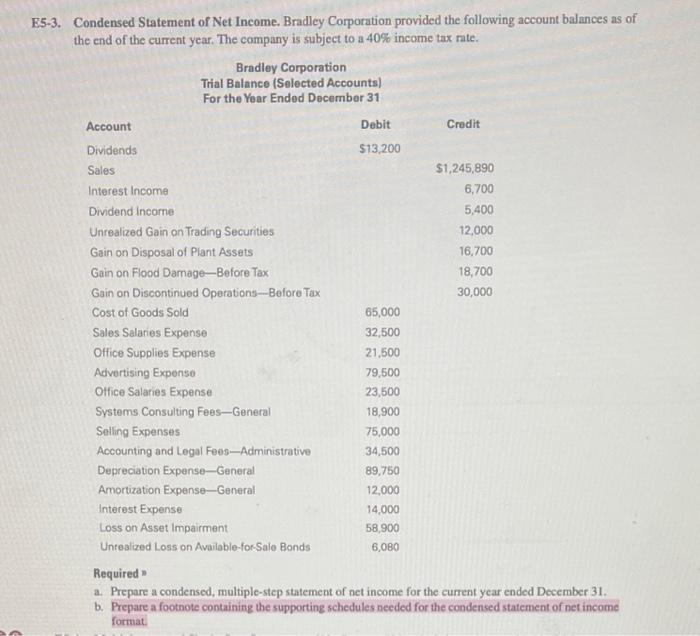

E5-3. Condensed Statement of Net Income. Bradley Corporation provided the following account balances as of the end of the current year. The company is subject to a 40% income tax rate. Bradley Corporation Trial Balance (Selected Accounts) For the Year Ended December 31 Account Debit Credit Dividends $13,200 Sales $1,245,890 Interest Income 6,700 Dividend Income 5,400 Unrealized Gain on Trading Securities 12,000 Gain on Disposal of Plant Assets 16.700 Gain on Flood Damage-Before Tax 18,700 Gain on Discontinued Operations-Before Tax 30,000 Cost of Goods Sold 65,000 Sales Salaries Expense 32,500 Office Supplies Expense 21.500 Advertising Expenso 79,500 Office Salaries Expense 23,500 Systems Consulting Fees-General 18,900 Selling Expenses 75,000 Accounting and Legal Fees-Administrative 34,500 Depreciation Expense-General 89,750 Amortization Expense-General 12.000 Interest Expense 14,000 Loss on Asset Impairment 58,900 Unrealized Loss on Available-for-Sale Bands 6,080 Required a. Prepare a condensed, multiple-step statement of net income for the current year ended December 31. b. Prepare a footnote containing the supporting schedules needed for the condensed statement of net income format

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts