Question: ASKING THIS QUESTION AGAIN PREVIOUS RESPONSES WERE BOTH WRONG AND SO WAS WORK. Answer the following 1. Find the annualized expected holding period return for

ASKING THIS QUESTION AGAIN PREVIOUS RESPONSES WERE BOTH WRONG AND SO WAS WORK.

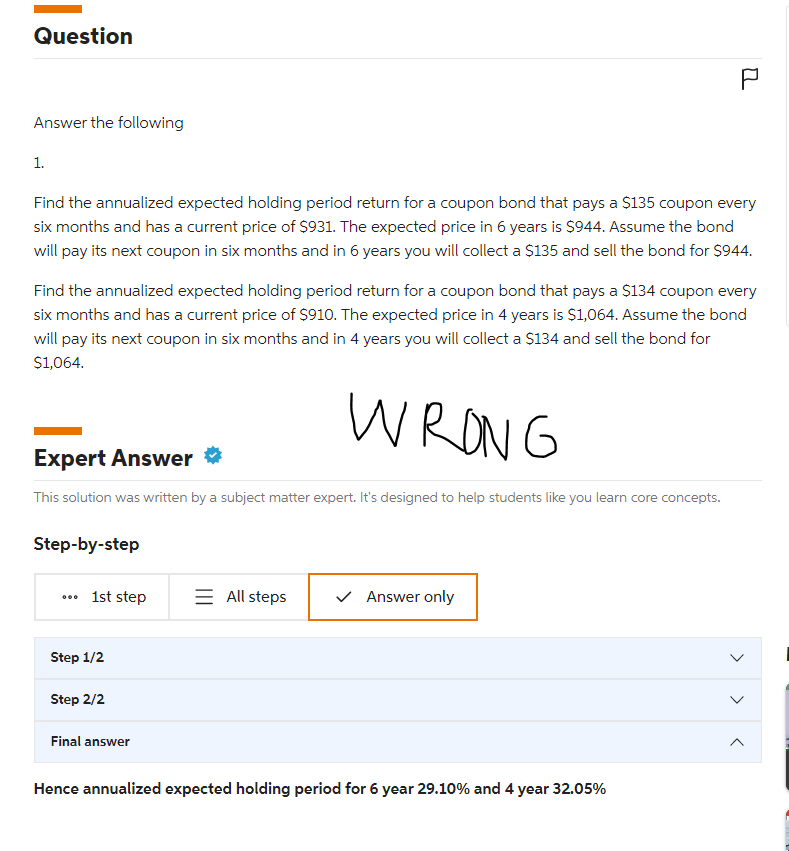

Answer the following 1. Find the annualized expected holding period return for a coupon bond that pays a $135 coupon every six months and has a current price of $931. The expected price in 6 years is $944. Assume the bond will pay its next coupon in six months and in 6 years you will collect a \$135 and sell the bond for $944. Find the annualized expected holding period return for a coupon bond that pays a $134 coupon every six months and has a current price of $910. The expected price in 4 years is $1,064. Assume the bond will pay its next coupon in six months and in 4 years you will collect a $134 and sell the bond for $1,064 Expert Answer This solution was written by a subject matter expert. It's designed to help students like you learn core concepts. Step-by-step Step 1/2 Step 2/2 Final answer Hence annualized expected holding period for 6 year 29.10% and 4 year 32.05%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts