Question: asmwer with steps thank you !!! Peter has HK$ 1 million cash. Due to the prevailing high interest rate environment and high uncertainty in the

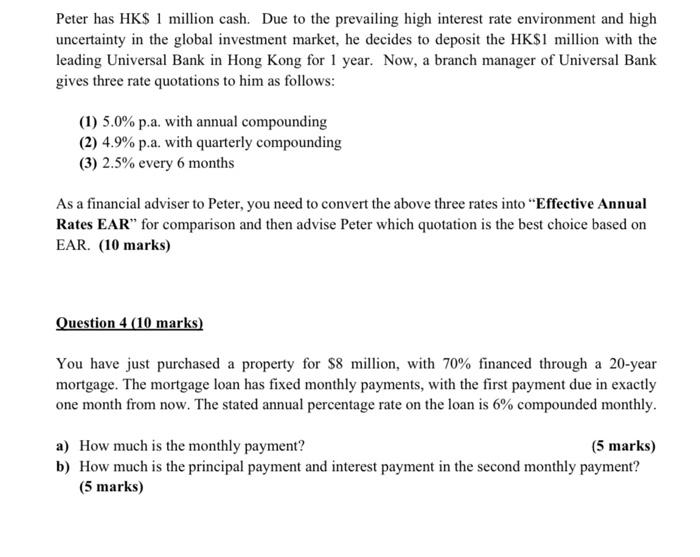

Peter has HK\$ 1 million cash. Due to the prevailing high interest rate environment and high uncertainty in the global investment market, he decides to deposit the HK\$1 million with the leading Universal Bank in Hong Kong for 1 year. Now, a branch manager of Universal Bank gives three rate quotations to him as follows: (1) 5.0% p.a. with annual compounding (2) 4.9% p.a. with quarterly compounding (3) 2.5% every 6 months As a financial adviser to Peter, you need to convert the above three rates into "Effective Annual Rates EAR" for comparison and then advise Peter which quotation is the best choice based on EAR. (10 marks) Question 4 (10 marks) You have just purchased a property for $8 million, with 70% financed through a 20 -year mortgage. The mortgage loan has fixed monthly payments, with the first payment due in exactly one month from now. The stated annual percentage rate on the loan is 6% compounded monthly. a) How much is the monthly payment? (5 marks) b) How much is the principal payment and interest payment in the second monthly payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts