Question: Calculate the net after-tax cash flow effect of the following information using both the indirect and direct methods: sales, $220; expenses other than depreciation,

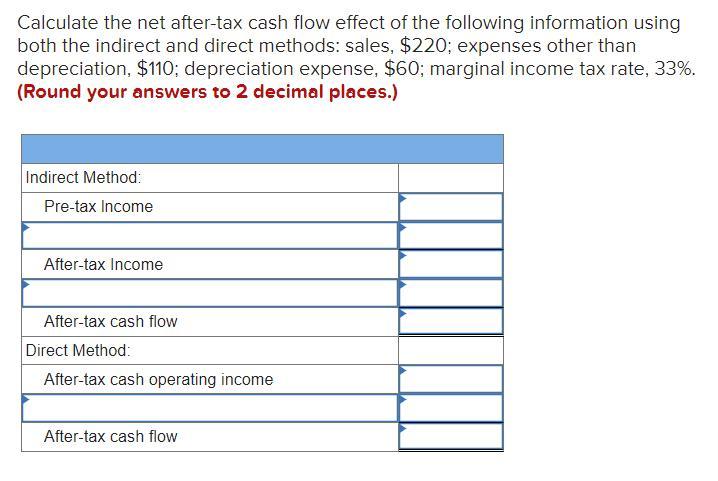

Calculate the net after-tax cash flow effect of the following information using both the indirect and direct methods: sales, $220; expenses other than depreciation, $110; depreciation expense, $60; marginal income tax rate, 33%. (Round your answers to 2 decimal places.) Indirect Method: Pre-tax Income After-tax Income After-tax cash flow Direct Method: After-tax cash operating income After-tax cash flow

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Indirect Method Pretax Income Pretax Income Sales Expenses other than de... View full answer

Get step-by-step solutions from verified subject matter experts