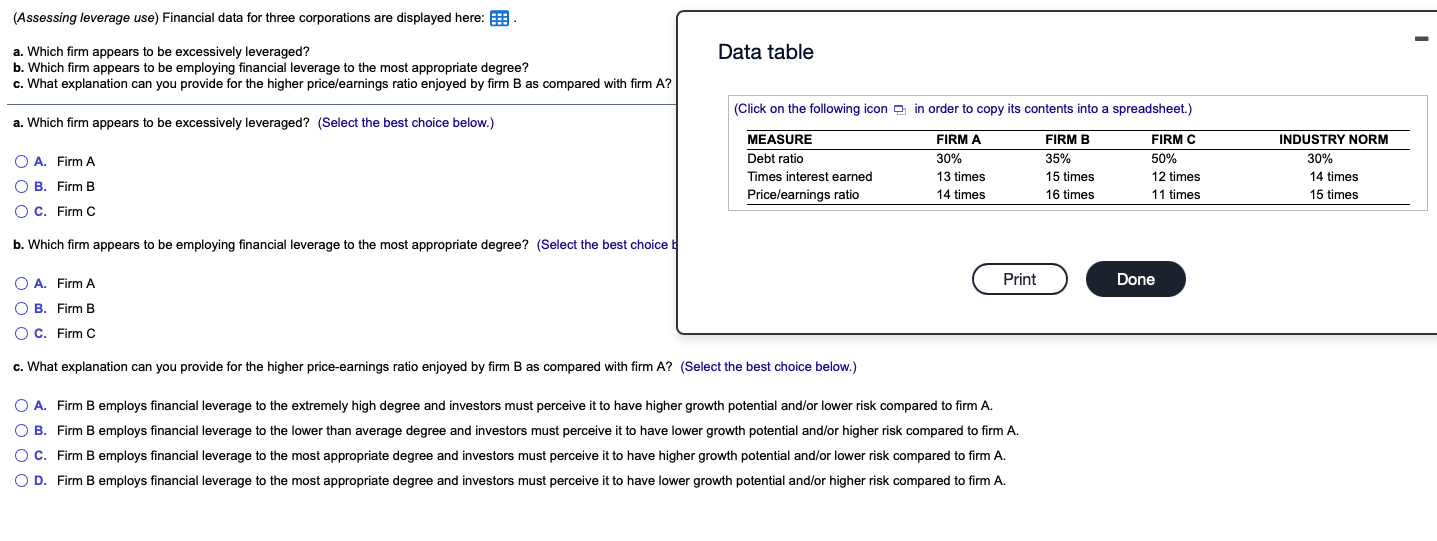

Question: (Assessing leverage use) Financial data for three corporations are displayed here: - Data table a. Which firm appears to be excessively leveraged? b. Which firm

(Assessing leverage use) Financial data for three corporations are displayed here: - Data table a. Which firm appears to be excessively leveraged? b. Which firm appears to be employing financial leverage to the most appropriate degree? c. What explanation can you provide for the higher price/earnings ratio enjoyed by firm B as compared with firm A? (Click on the following icon 2 in order to copy its contents into a spreadsheet.) a. Which firm appears to be excessively leveraged? (Select the best choice below.) O A. Firm A MEASURE Debt ratio Times interest earned Price/earnings ratio FIRMA 30% 13 times 14 times FIRM B 35% 15 times 16 times FIRM C 50% 12 times 11 times INDUSTRY NORM 30% 14 times 15 times OB. Firm B O C. Firm C b. Which firm appears to be employing financial leverage to the most appropriate degree? (Select the best choice O A. Firm A Print Done OB. Firm B O C. Firm C c. What explanation can you provide for the higher price-earnings ratio enjoyed by firm B as compared with firm A? (Select the best choice below.) O A. Firm B employs financial leverage to the extremely high degree and investors must perceive it to have higher growth potential and/or lower risk compared to firm A. O B. Firm B employs financial leverage to the lower than average degree and investors must perceive it to have lower growth potential and/or higher risk compared to firm A. O C. Firm B employs financial leverage to the most appropriate degree and investors must perceive it to have higher growth potential and/or lower risk compared to firm A. OD. Firm B employs financial leverage to the most appropriate degree and investors must perceive it to have lower growth potential and/or higher risk compared to firm A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts