Question: Assessment 4, Parts 1 - 2 Solve the given problem based on rhe following information: Solve the given problem based on the following information: Jordan

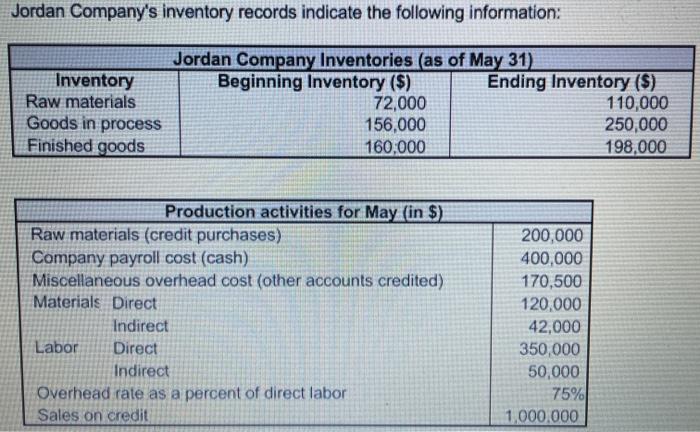

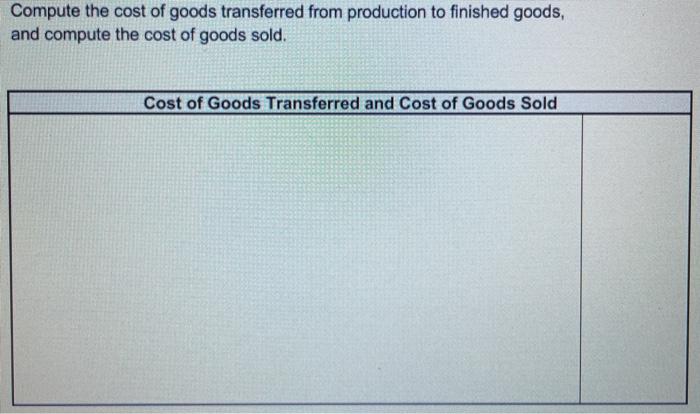

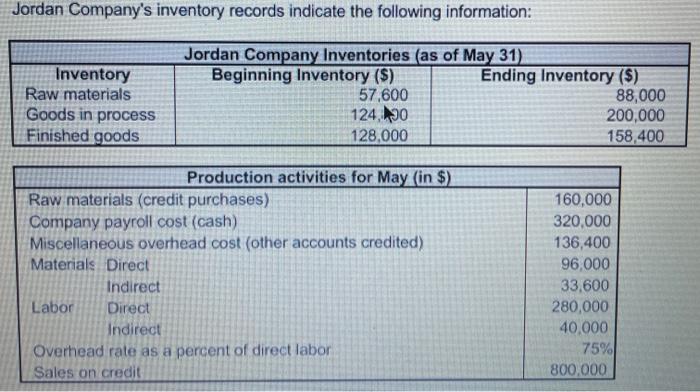

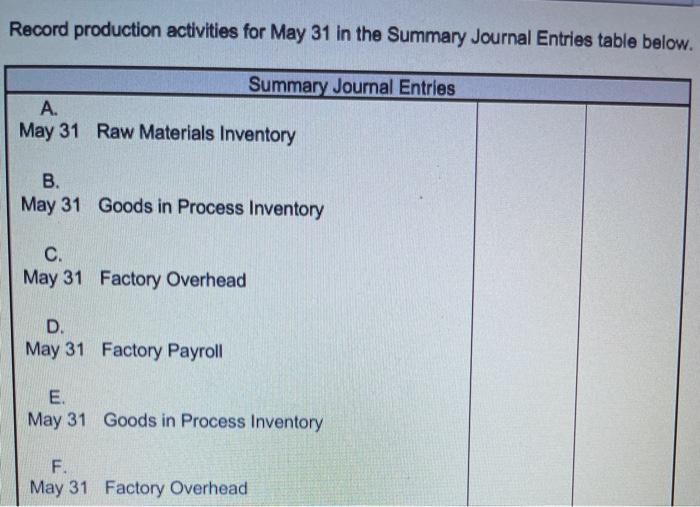

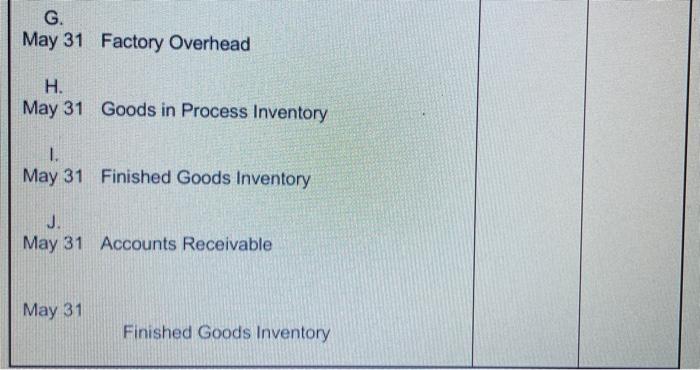

Jordan Company's inventory records indicate the following information: Inventory Raw materials Goods in process Finished goods Jordan Company Inventories (as of May 31) Beginning Inventory ($) Ending Inventory ($) 72,000 110,000 156,000 250,000 160,000 198,000 Production activities for May (in $) Raw materials (credit purchases) Company payroll cost (cash) Miscellaneous overhead cost (other accounts credited) Materials Direct Indirect Labor Direct Indirect Overhead rate as a percent of direct labor Sales on credit 200,000 400,000 170,500 120,000 42,000 350,000 50,000 75% 1,000,000 Compute the cost of goods transferred from production to finished goods, and compute the cost of goods sold. Cost of Goods Transferred and Cost of Goods Sold Jordan Company's inventory records indicate the following information: Inventory Raw materials Goods in process Finished goods Jordan Company Inventories (as of May 31). Beginning Inventory (S) Ending Inventory (5) 57,600 88,000 124,90 200,000 128,000 158,400 Production activities for May (in $) Raw materials (credit purchases) Company payroll cost (cash) Miscellaneous overhead cost other accounts credited) Materials Direct Indirect Labor Direct Indirect Overhead rate as a percent of direct labor Sales on credit 160,000 320,000 136,400 96,000 33.600 280,000 40,000 75% 800,000 Record production activities for May 31 in the Summary Journal Entries table below. Summary Journal Entries A. May 31 Raw Materials Inventory B. May 31 Goods in Process Inventory C. May 31 Factory Overhead D. May 31 Factory Payroll E May 31 Goods in Process Inventory F. May 31 Factory Overhead G. May 31 Factory Overhead H. May 31 Goods in Process Inventory 1. May 31 Finished Goods Inventory J. May 31 Accounts Receivable May 31 Finished Goods Inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts