Question: Assessment Description This is a Collaborative Learning Community (CLC) assignment. The purpose of this assignment is to assess the cash flow of a company by

Assessment Description

This is a Collaborative Learning Community (CLC) assignment.

The purpose of this assignment is to assess the cash flow of a company by reviewing operating, investing, and financing activities.

Operating, investing, and financing activities all deal with the cash activities of the company. The cash activities provide insight into how the income, investments, and liabilities of the company will ultimately affect the statement of cash flows.

Utilizing the annual report, refer to the Notes to the Financial Statements and analyze the companys financial statements for the last 3 years.

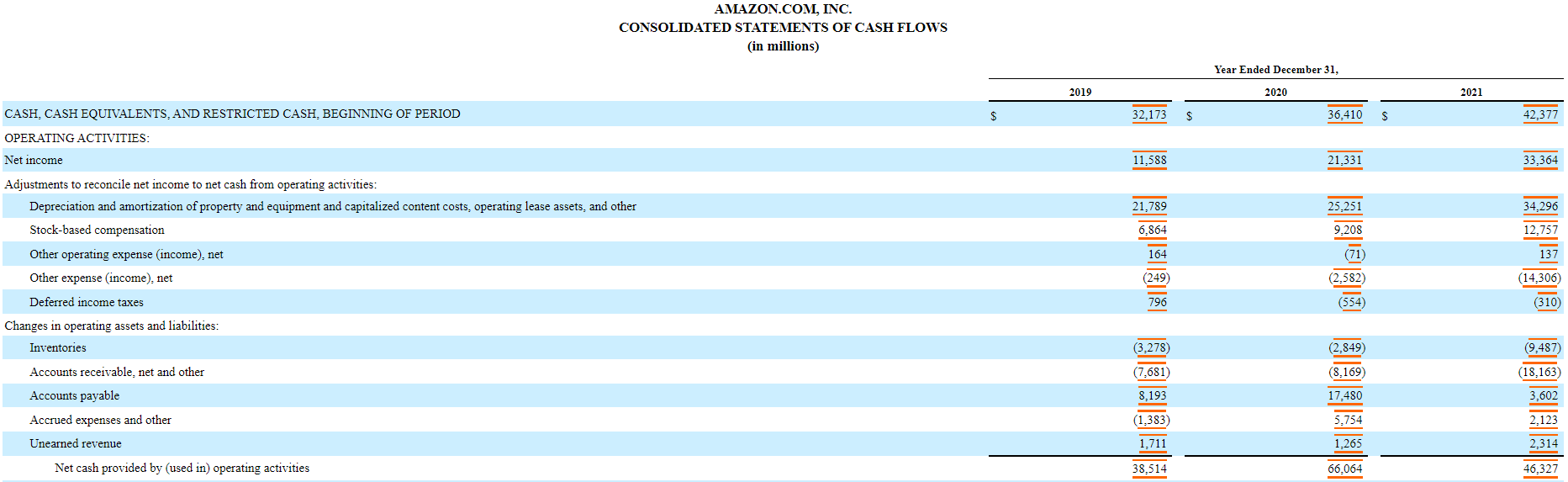

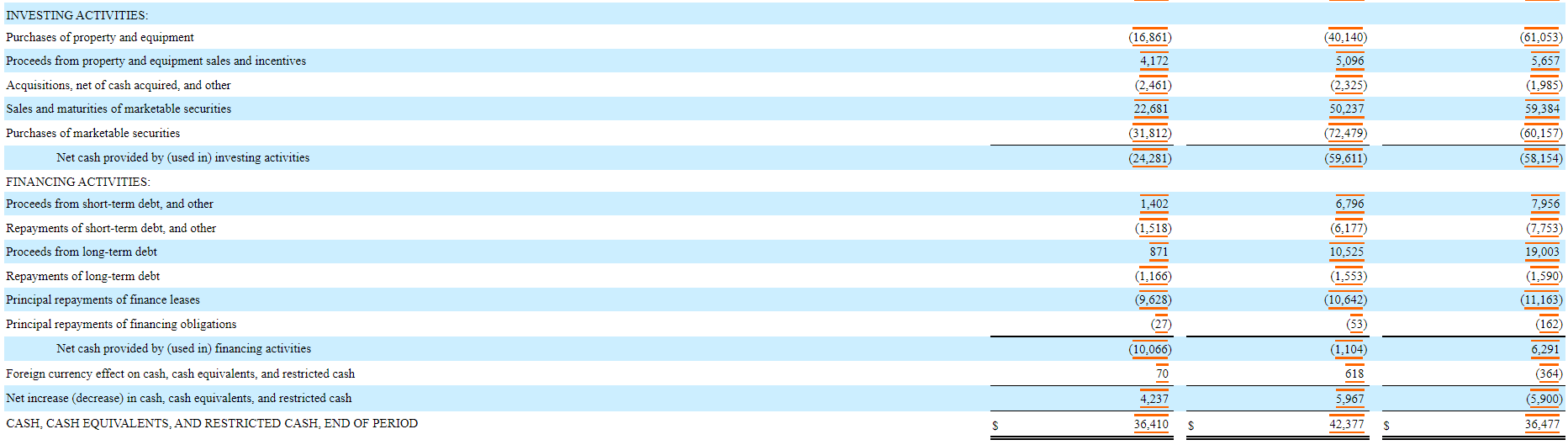

Analyze the changes in operating, investing, and financing activities of your company for the last 3 years using indirect methods.

Operating Activities

1.) Review the current asset balances and explain how accounts receivables and inventory have affected the cash balance for the current fiscal year.

2.) Review the current liability balances and explain how accounts payable, prepaid expenses and accrued liabilities have affected the cash balance for the current fiscal year.

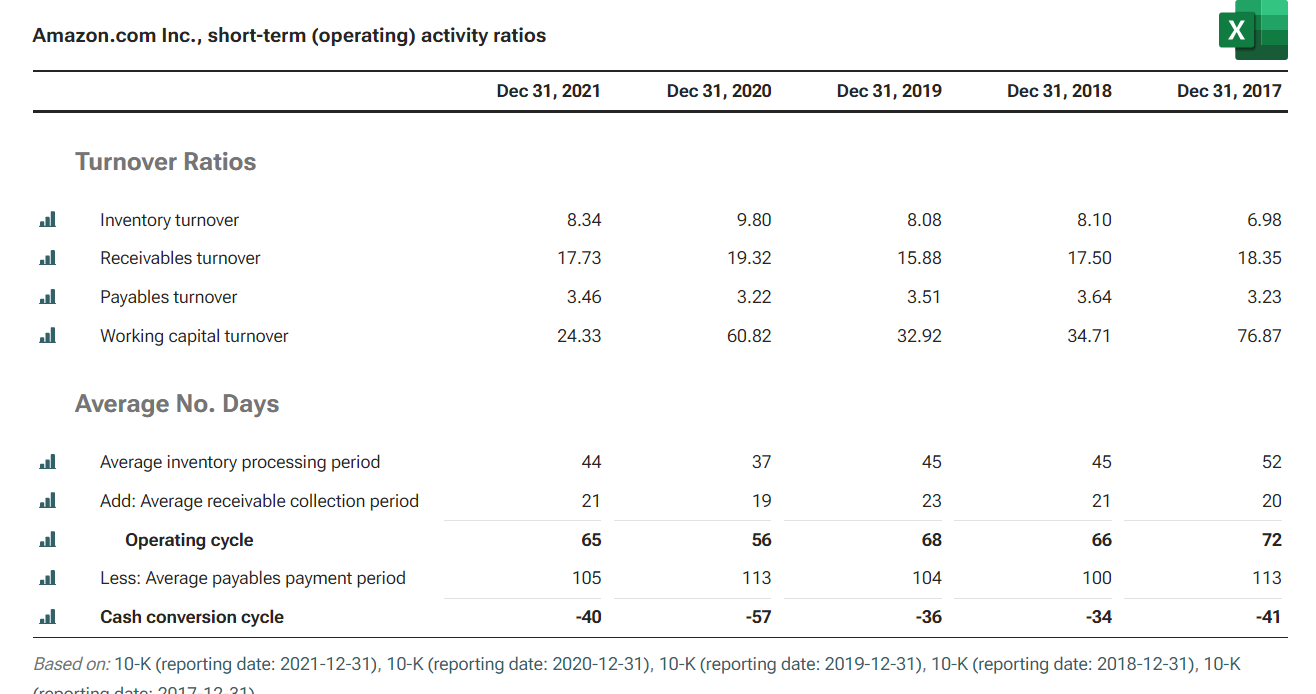

3.) Indicate whether the company generates enough cash to meet its operating cash needs. Provide examples of a few ways in which management could increase operating cash flows (Hint: the operating cycle/ cash cycle).

4.) From the perspective of a supplier considering selling product through the selected company, evaluate the request to purchase product on account. What is the primary concern for selling product on account to the selected company?

Rubric

Discussion of operating activities (including explanation of how accounts receivable, inventory, accounts payable, prepaid expenses, and accrued liabilities affect cash balance; whether the company can meet operating cash needs; an evaluation of the request to purchase product on account from the seller perspective, along with the primary concern for selling product on account to the company) is thorough and includes substantial explanation and relevant supporting details.

You need to zoom in with your browser to see the numbers.

AMAZON.COM, INC. INVESTING ACTIVITIES: Purchases of property and equipment Proceeds from property and equipment sales and incentives Acquisitions, net of cash acquired, and other Sales and maturities of marketable securities Purchases of marketable securities Net cash provided by (used in) investing activities FINANCING ACTIVITIES: Proceeds from short-term debt, and other Repayments of short-term debt, and other Proceeds from long-term debt Repayments of long-term debt Principal repayments of finance leases Principal repayments of financing obligations Foreign currency effect on cash, cash equivalents, and restricted cash Net increase (decrease) in cash, cash equivalents, and restricted cash CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, END OF PERIOD Amazon.com Inc., short-term (operating) activity ratios AMAZON.COM, INC. INVESTING ACTIVITIES: Purchases of property and equipment Proceeds from property and equipment sales and incentives Acquisitions, net of cash acquired, and other Sales and maturities of marketable securities Purchases of marketable securities Net cash provided by (used in) investing activities FINANCING ACTIVITIES: Proceeds from short-term debt, and other Repayments of short-term debt, and other Proceeds from long-term debt Repayments of long-term debt Principal repayments of finance leases Principal repayments of financing obligations Foreign currency effect on cash, cash equivalents, and restricted cash Net increase (decrease) in cash, cash equivalents, and restricted cash CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, END OF PERIOD Amazon.com Inc., short-term (operating) activity ratios

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts