Question: Assessment Details and Submission Guidelines Trimester T1 2021 Unit Code HI5002 Unit Title Finance for Business Assessment Type Group Assignment Assessment Title Reflective Journal, Fact

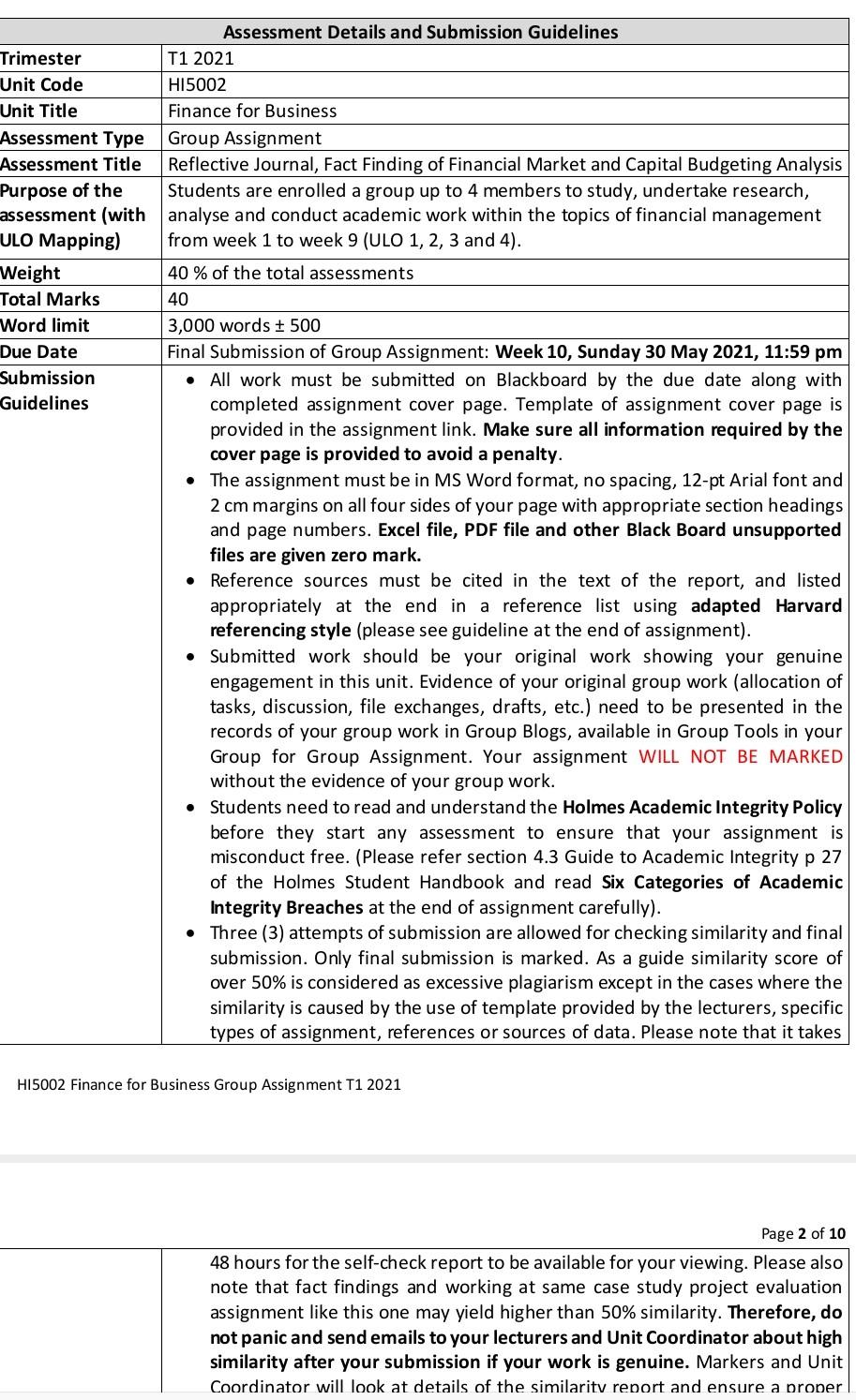

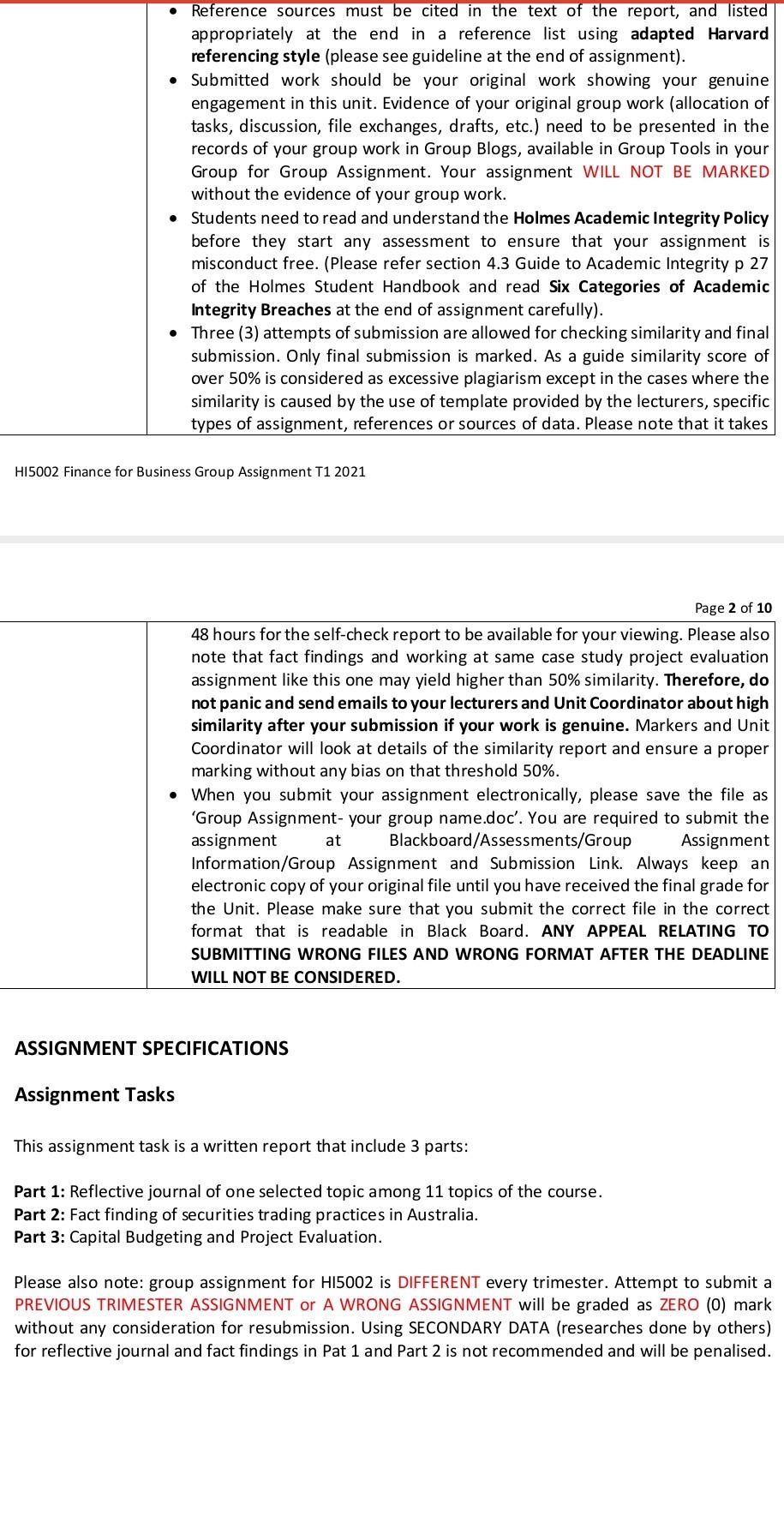

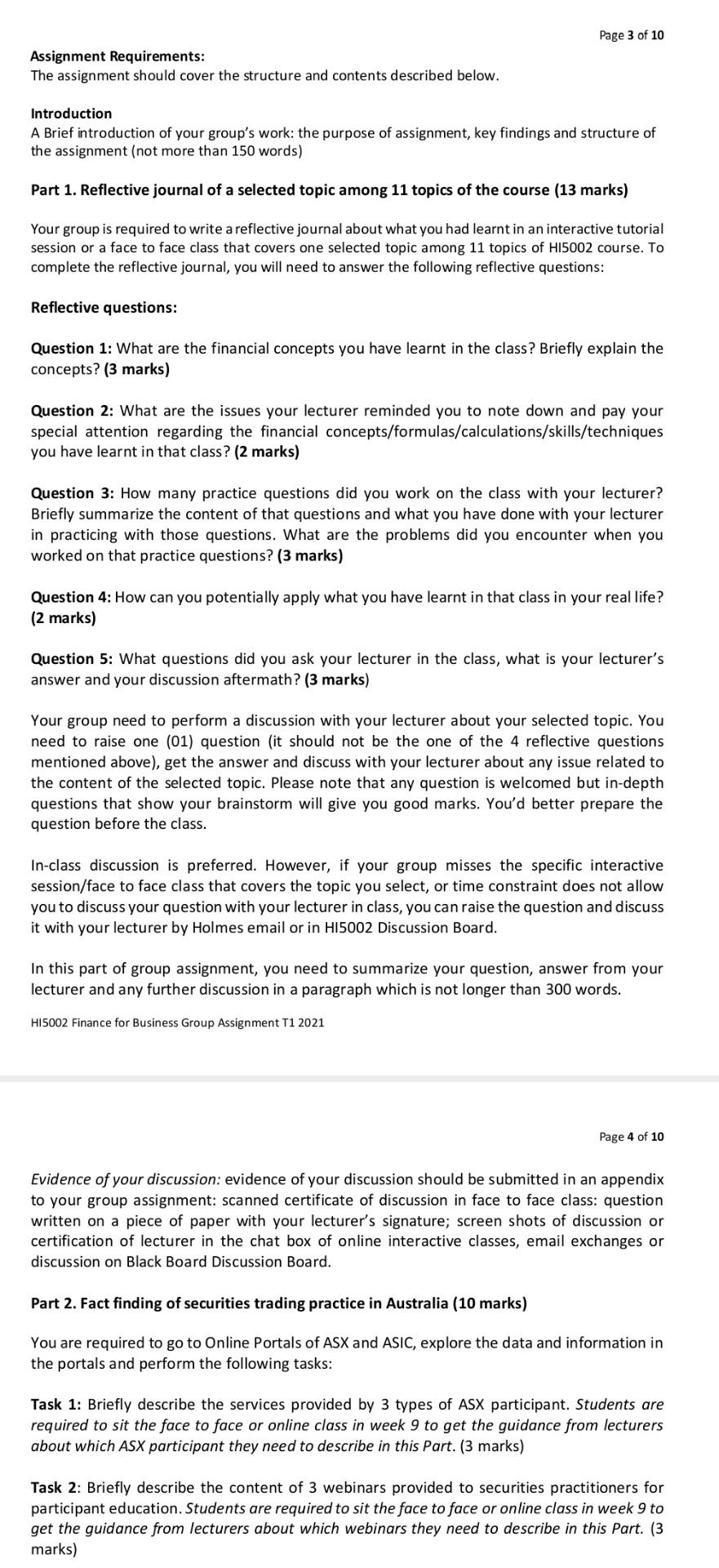

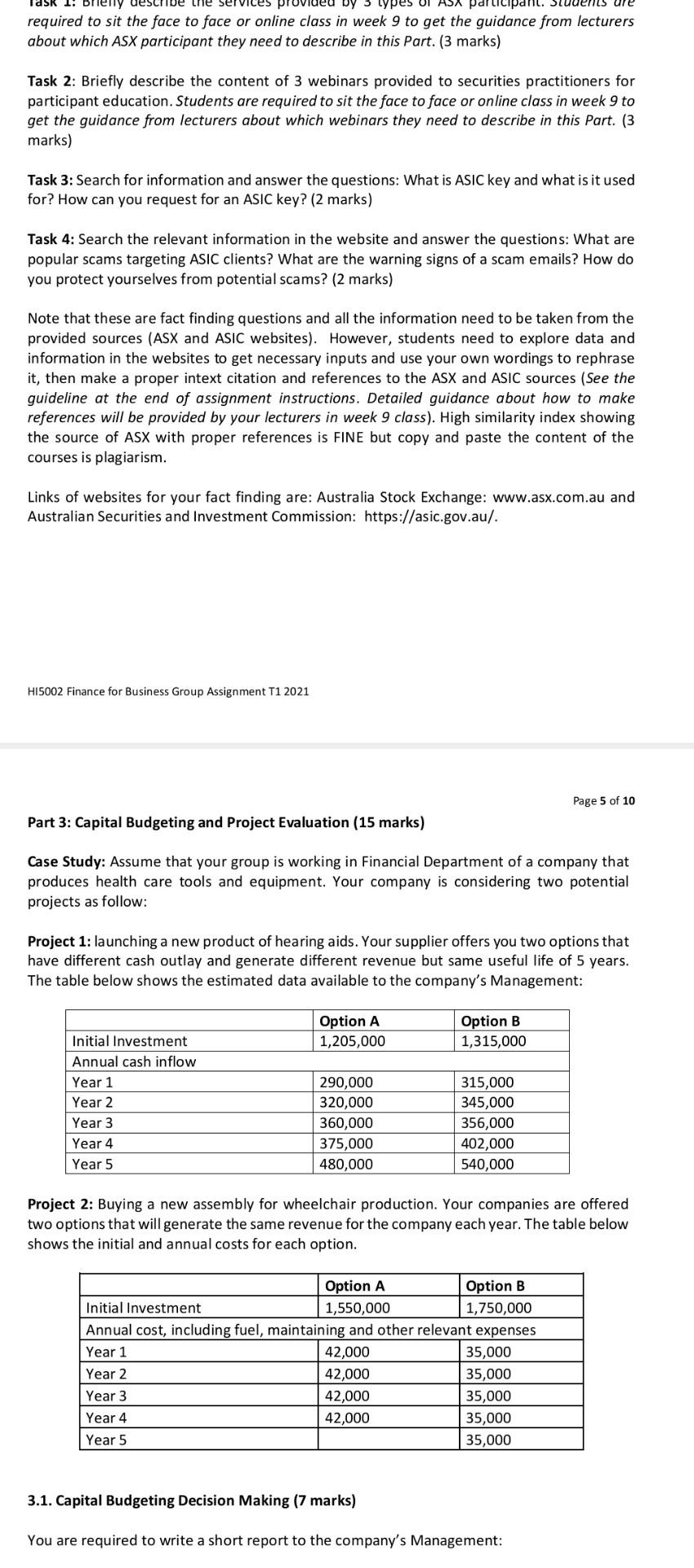

Assessment Details and Submission Guidelines Trimester T1 2021 Unit Code HI5002 Unit Title Finance for Business Assessment Type Group Assignment Assessment Title Reflective Journal, Fact Finding of Financial Market and Capital Budgeting Analysis Purpose of the Students are enrolled a group up to 4 members to study, undertake research, assessment (with analyse and conduct academic work within the topics of financial management ULO Mapping) from week 1 to week 9 (ULO 1, 2, 3 and 4). Weight 40% of the total assessments Total Marks 40 Word limit 3,000 words + 500 Due Date Final Submission of Group Assignment: Week 10, Sunday 30 May 2021, 11:59 pm Submission All work must be submitted on Blackboard by the due date along with Guidelines completed assignment cover page. Template of assignment cover page is provided in the assignment link. Make sure all information required by the cover page is provided to avoid a penalty. The assignment must be in MS Word format, no spacing, 12-pt Arial font and 2 cm margins on all four sides of your page with appropriate section headings and page numbers. Excel file, PDF file and other Black Board unsupported files are given zero mark. Reference sources must be cited in the text of the report, and listed appropriately at the end in a reference list using adapted Harvard referencing style (please see guideline at the end of assignment). Submitted work should be your original work showing your genuine engagement in this unit. Evidence of your original group work (allocation of tasks, discussion, file exchanges, drafts, etc.) need to be presented in the records of your group work in Group Blogs, available in Group Tools in your Group for Group Assignment. Your assignment WILL NOT BE MARKED without the evidence of your group work. Students need to read and understand the Holmes Academic Integrity Policy before they start any assessment to ensure that your assignment is misconduct free. (Please refer section 4.3 Guide to Academic Integrity p 27 of the Holmes Student Handbook and read Six Categories of Academic Integrity Breaches at the end of assignment carefully). Three (3) attempts of submission are allowed for checking similarity and final submission. Only final submission is marked. As a guide similarity score of over 50% is considered as excessive plagiarism except in the cases where the similarity is caused by the use of template provided by the lecturers, specific types of assignment, references or sources of data. Please note that it takes H15002 Finance for Business Group Assignment T1 2021 Page 2 of 10 48 hours for the self-check report to be available for your viewing. Please also note that fact findings and working at same case study project evaluation assignment like this one may yield higher than 50% similarity. Therefore, do not panic and send emails to your lecturers and Unit Coordinator about high similarity after your submission if your work is genuine. Markers and Unit Coordinator will look at details of the similarity report and ensure a proper Reference sources must be cited in the text of the report, and listed appropriately at the end in a reference list using adapted Harvard referencing style (please see guideline at the end of assignment). Submitted work should be your original work showing your genuine engagement in this unit. Evidence of your original group work (allocation of tasks, discussion, file exchanges, drafts, etc.) need to be presented in the records of your group work in Group Blogs, available in Group Tools in your Group for Group Assignment. Your assignment WILL NOT BE MARKED without the evidence of your group work. Students need to read and understand the Holmes Academic Integrity Policy before they start any assessment to ensure that your assignment is misconduct free. (Please refer section 4.3 Guide to Academic Integrity p 27 of the Holmes Student Handbook and read Six Categories of Academic Integrity Breaches at the end of assignment carefully). Three (3) attempts of submission are allowed for checking similarity and final submission. Only final submission is marked. As a guide similarity score of over 50% is considered as excessive plagiarism except in the cases where the similarity is caused by the use of template provided by the lecturers, specific types of assignment, references or sources of data. Please note that it takes H15002 Finance for Business Group Assignment T1 2021 Page 2 of 10 48 hours for the self-check report to be available for your viewing. Please also note that fact findings and working at same case study project evaluation assignment like this one may yield higher than 50% similarity. Therefore, do not panic and send emails to your lecturers and Unit Coordinator about high similarity after your submission if your work is genuine. Markers and Unit Coordinator will look at details of the sim ity report and ensure a proper marking without any bias on that threshold 50%. When you submit your assignment electronically, please save the file as 'Group Assignment- your group name.doc'. You are required to submit the assignment at Blackboard/Assessments/Group Assignment Information/Group Assignment and Submission Link. Always keep an electronic copy of your original file until you have received the final grade for the Unit. Please make sure that you submit the correct file in the correct format that is readable in Black Board. ANY APPEAL RELATING TO SUBMITTING WRONG FILES AND WRONG FORMAT AFTER THE DEADLINE WILL NOT BE CONSIDERED. ASSIGNMENT SPECIFICATIONS Assignment Tasks This assignment task is a written report that include 3 parts: Part 1: Reflective journal of one selected topic among 11 topics of the course. Part 2: Fact finding of securities trading practices in Australia. Part 3: Capital Budgeting and Project Evaluation. Please also note: group assignment for H15002 is DIFFERENT every trimester. Attempt to submit a PREVIOUS TRIMESTER ASSIGNMENT or A WRONG ASSIGNMENT will be graded as ZERO (0) mark without any consideration for resubmission. Using SECONDARY DATA (researches done by others) for reflective journal and fact findings in Pat 1 and Part 2 is not recommended and will be penalised. Page 3 of 10 Assignment Requirements: The assignment should cover the structure and contents described below. Introduction A Brief introduction of your group's work: the purpose of assignment, key findings and structure of the assignment (not more than 150 words) Part 1. Reflective journal of a selected topic among 11 topics of the course (13 marks) Your group is required to write a reflective journal about what you had learnt in an interactive tutorial session or a face to face class that covers one selected topic among 11 topics of H15002 course. To complete the reflective journal, you will need to answer the following reflective questions: Reflective questions: Question 1: What are the financial concepts you have learnt in the class? Briefly explain the concepts? (3 marks) Question 2: What are the issues your lecturer reminded you to note down and pay your special attention regarding the financial concepts/formulas/calculations/skills/techniques you have learnt in that class? (2 marks) Question 3: How many practice questions did you work on the class with your lecturer? Briefly summarize the content of that questions and what you have done with your lecturer in practicing with those questions. What are the problems did you encounter when you worked on that practice questions? (3 marks) Question 4: How can you potentially apply what you have learnt in that class in your real life? (2 marks) Question 5: What questions did you ask your lecturer in the class, what is your lecturer's answer and your discussion aftermath? (3 marks) Your group need to perform a discussion with your lecturer about your selected topic. You need to raise one (01) question (it should not be the one of the 4 reflective questions mentioned above), get the answer and discuss with your lecturer about any issue related to the content of the selected topic. Please note that any question is welcomed but in-depth questions that show your brainstorm will give you good marks. You'd better prepare the question before the class. In-class discussion is preferred. However, if your group misses the specific interactive session/face to face class that covers the topic you select, or time constraint does not allow you to discuss your question with your lecturer in class, you can raise the question and discuss it with your lecturer by Holmes email or in H15002 Discussion Board. In this part of group assignment, you need to summarize your question, answer from your lecturer and any further discussion in a paragraph which is not longer than 300 words. HI5002 Finance for Business Group Assignment T1 2021 Page 4 of 10 Evidence of your discussion: evidence of your discussion should be submitted in an appendix to your group assignment: scanned certificate of discussion in face to face class: question written on a piece of paper with your lecturer's signature; screen shots of discussion or certification of lecturer in the chat box of online interactive classes, email exchanges or discussion on Black Board Discussion Board. Part 2. Fact finding of securities trading practice in Australia (10 marks) You are required to go to Online Portals of ASX and ASIC, explore the data and information in the portals and perform the following tasks: Task 1: Briefly describe the services provided by 3 types of ASX participant. Students are required to sit the face to face or online class in week 9 to get the guidance from lecturers about which ASX participant they need to describe in this part. (3 marks) Task 2: Briefly describe the content of 3 webinars provided to securities practitioners for participant education. Students are required to sit the face to face or online class in week 9 to get the guidance from lecturers about which webinars they need to describe in this part. (3 marks) ribe tre CNS ure ded by olypes Ol ASA participant required to sit the face to face or online class in week 9 to get the guidance from lecturers about which ASX participant they need to describe in this part. (3 marks) Task 2: Briefly describe the content of 3 webinars provided to securities practitioners for participant education. Students are required to sit the face to face or online class in week 9 to get the guidance from lecturers about which webinars they need to describe in this part. (3 marks) Task 3: Search for information and answer the questions: What is ASIC key and what is it used for? How can you request for an ASIC key? (2 marks) Task 4: Search the relevant information in the website and answer the questions: What are popular scams targeting ASIC clients? What are the warning signs of a scam emails? How do you protect yourselves from potential scams? (2 marks) Note that these are fact finding questions and all the information need to be taken from the provided sources (ASX and ASIC websites). However, students need to explore data and information in the websites to get necessary inputs and use your own wordings to rephrase it, then make a proper and references to the ASX and ASIC sources (See the guideline at the end of assignment instructions. Detailed guidance about how to make references will be provided by your lecturers in week 9 class). High similarity index showing the source of ASX with proper references is FINE but copy and paste the content of the courses is plagiarism. Links of websites for your fact finding are: Australia Stock Exchange: www.asx.com.au and Australian Securities and Investment Commission: https://asic.gov.au/. H15002 Finance for Business Group Assignment T1 2021 Page 5 of 10 Part 3: Capital Budgeting and Project Evaluation (15 marks) Case Study: Assume that your group is working in Financial Department of a company that produces health care tools and equipment. Your company is considering two potential projects as follow: Project 1: launching a new product of hearing aids. Your supplier offers you two options that have different cash outlay and generate different revenue but same useful life of 5 years. The table below shows the estimated data available to the company's Management: Option A 1,205,000 Option B 1,315,000 Initial Investment Annual cash inflow Year 1 Year 2 Year 3 Year 4 Year 5 290,000 320,000 360,000 375,000 480,000 315,000 345,000 356,000 402,000 540,000 Project 2: Buying a new assembly for wheelchair production. Your companies are offered two options that will generate the same revenue for the company each year. The table below shows the initial and annual costs for each option. Option A Option B Initial Investment 1,550,000 1,750,000 Annual cost, including fuel, maintaining and other relevant expenses Year 1 42,000 35,000 Year 2 42,000 35,000 Year 3 42,000 35,000 Year 4 42,000 35,000 Year 5 35,000 3.1. Capital Budgeting Decision Making (7 marks) You are required to write a short report to the company's Management: 42,000 Year 4 Year 5 35,000 35,000 3.1. Capital Budgeting Decision Making (7 marks) You are required to write a short report to the company's Management: 1) To select a relevant method among five investment criteria of Net Present Value (NPV), Equivalent Annual Cost (EAC), profitability Index (PI), Internal Rate of Return (IRR), Simple Payback Period, and Discounted Payback Period for each project, given the market required rate of return for all project is 9.5% and the company's benchmark of payback is maximum 3 years. Your recommendation must include your justification on why you choose the specific method based on its pros and cons compared to other methods. (Note: you cannot use the same method for both projects) (2 marks) H15002 Finance for Business Group Assignment T1 2021 Page 6 of 10 2) To perform the selected method and present the outcome of your project evaluation and recommend the option A or B should the company choose for each project. Your justification must include calculation steps and numerical outcomes. (5 marks) Students are compulsorily required to sit the face to face or online class in week 8 to know how to work on these capital budgeting questions with correct terminologies, templates and calculations. 3.2. Risk Analysis and Project evaluation: NPV break-even analysis (8 marks) Assume that for Project 2, the company finally chose Option B. It expects to sell 8,500 wheelchairs for an average price of $750 per unit. The assembly in Option B has a residual value of $350 000 at the end of the project. The company will need to add $ 850 000 in working capital which is expected to be fully retrieved at the end of the project. Other information is available below: Depreciation method: straight line Variable cost per unit: $120 Cash fixed costs per year: $35,000 of annual cost for assembly operation + $20,000 other fixed cost Corporate marginal tax: 30% Upon the forecast of unexpected economic conditions that may be caused by the current breakout of corona virus, the company management requires your Team to prepare a risk analysis for the case where the unit price of this product decreases by 25%. Required: perform an NPV break-even analysis to identify break-even sales of the project when the unit price decreases by 25%. Conclusion Summarize / Reflection the outcomes of your group's works (not more than 150 words) Assignment Preparation guideline/ Important Note: Students are required to attend Interactive Tutorial Session Week 8 (topic 6) and Week 9 (Topic 7) for inputs to answer the questions in Part 1 and 2, and training on how to work with correct capital budgeting technique, proper format, structure, calculation tables and terminologies. Assignments with different templates, terminologies and calculations from the solution templates and guidance provided to you in the sessions will be investigated as potential contract cheater done assignments. HI5002 Finance for Business Group Assignment T1 2021 Page 7 of 10 Guidelines - Adapted Harvard Referencing 1. Reference sources in assignments are limited to sources which provide full text Page 7 of 10 Guidelines - Adapted Harvard Referencing 1. Reference sources in assignments are limited to sources which provide full text access to the source's content for lecturers and markers. 2. The Reference list should be located on a separate page at the end of the assignment and titled: References. 3. It should include the details of all the in-text citations, arranged alphabetically A-Z by author surname. In addition, it MUST include a hyperlink to the full text of the cited reference source. For example; P Hawking, B McCarthy, A Stein (2004), Second Wave ERP Education, Journal of Information Systems Education, Fall, http://jise.org/Volume 153/JISEv15n3p327.pdf 4. All assignments will require additional in-text reference details which will consist of the surname of the author/authors or name of the authoring body, year of publication, page number of contents, paragraph where the content can be found. For example; The company decided to implement an enterprise wide data warehouse business intelligence strategies (Hawking et al, 2004, p3(4))." author year page (Hawking et al, 2004, p3(4)) paragraph Non-Adherence to Referencing Guidelines Where students do not follow the above guidelines: 1. Students who submit assignments which do not comply with the guidelines will be asked to resubmit their assignments. 2. Late penalties will apply, as per the Student Handbook each day, after the student/s have been notified of the resubmission requirements. 3. Students who comply with guidelines but the citations are "fake" will be reported for academic misconduct. HI5002 Finance for Business Group Assignment T1 2021 Page 8 of 10 Weighting Marking criteria Marking criteria Part 1. Reflective journal of a selected topic among 11 topics of the course (13 marks) Question 1 Question 2 Question 3 Question 4 Question 5 3% 2% 3% 2% 3% 2. Fact finding of securities trading practice in Australia (10 marks) Task 1 Task 2 Task 3 Task 4 3% 3% 2% 2% 3. Capital Budgeting and Project Evaluation (1 5 marks) 3.1. Capital Budgeting Decision Making 3.2. Risk Analysis and Project evaluation-NPV break-even analysis 7% 8% 4. Academic Writing: Presentation, structure and academic writing (2 marks) Total weight of written report 2% 40% Assessment Details and Submission Guidelines Trimester T1 2021 Unit Code HI5002 Unit Title Finance for Business Assessment Type Group Assignment Assessment Title Reflective Journal, Fact Finding of Financial Market and Capital Budgeting Analysis Purpose of the Students are enrolled a group up to 4 members to study, undertake research, assessment (with analyse and conduct academic work within the topics of financial management ULO Mapping) from week 1 to week 9 (ULO 1, 2, 3 and 4). Weight 40% of the total assessments Total Marks 40 Word limit 3,000 words + 500 Due Date Final Submission of Group Assignment: Week 10, Sunday 30 May 2021, 11:59 pm Submission All work must be submitted on Blackboard by the due date along with Guidelines completed assignment cover page. Template of assignment cover page is provided in the assignment link. Make sure all information required by the cover page is provided to avoid a penalty. The assignment must be in MS Word format, no spacing, 12-pt Arial font and 2 cm margins on all four sides of your page with appropriate section headings and page numbers. Excel file, PDF file and other Black Board unsupported files are given zero mark. Reference sources must be cited in the text of the report, and listed appropriately at the end in a reference list using adapted Harvard referencing style (please see guideline at the end of assignment). Submitted work should be your original work showing your genuine engagement in this unit. Evidence of your original group work (allocation of tasks, discussion, file exchanges, drafts, etc.) need to be presented in the records of your group work in Group Blogs, available in Group Tools in your Group for Group Assignment. Your assignment WILL NOT BE MARKED without the evidence of your group work. Students need to read and understand the Holmes Academic Integrity Policy before they start any assessment to ensure that your assignment is misconduct free. (Please refer section 4.3 Guide to Academic Integrity p 27 of the Holmes Student Handbook and read Six Categories of Academic Integrity Breaches at the end of assignment carefully). Three (3) attempts of submission are allowed for checking similarity and final submission. Only final submission is marked. As a guide similarity score of over 50% is considered as excessive plagiarism except in the cases where the similarity is caused by the use of template provided by the lecturers, specific types of assignment, references or sources of data. Please note that it takes H15002 Finance for Business Group Assignment T1 2021 Page 2 of 10 48 hours for the self-check report to be available for your viewing. Please also note that fact findings and working at same case study project evaluation assignment like this one may yield higher than 50% similarity. Therefore, do not panic and send emails to your lecturers and Unit Coordinator about high similarity after your submission if your work is genuine. Markers and Unit Coordinator will look at details of the similarity report and ensure a proper Reference sources must be cited in the text of the report, and listed appropriately at the end in a reference list using adapted Harvard referencing style (please see guideline at the end of assignment). Submitted work should be your original work showing your genuine engagement in this unit. Evidence of your original group work (allocation of tasks, discussion, file exchanges, drafts, etc.) need to be presented in the records of your group work in Group Blogs, available in Group Tools in your Group for Group Assignment. Your assignment WILL NOT BE MARKED without the evidence of your group work. Students need to read and understand the Holmes Academic Integrity Policy before they start any assessment to ensure that your assignment is misconduct free. (Please refer section 4.3 Guide to Academic Integrity p 27 of the Holmes Student Handbook and read Six Categories of Academic Integrity Breaches at the end of assignment carefully). Three (3) attempts of submission are allowed for checking similarity and final submission. Only final submission is marked. As a guide similarity score of over 50% is considered as excessive plagiarism except in the cases where the similarity is caused by the use of template provided by the lecturers, specific types of assignment, references or sources of data. Please note that it takes H15002 Finance for Business Group Assignment T1 2021 Page 2 of 10 48 hours for the self-check report to be available for your viewing. Please also note that fact findings and working at same case study project evaluation assignment like this one may yield higher than 50% similarity. Therefore, do not panic and send emails to your lecturers and Unit Coordinator about high similarity after your submission if your work is genuine. Markers and Unit Coordinator will look at details of the sim ity report and ensure a proper marking without any bias on that threshold 50%. When you submit your assignment electronically, please save the file as 'Group Assignment- your group name.doc'. You are required to submit the assignment at Blackboard/Assessments/Group Assignment Information/Group Assignment and Submission Link. Always keep an electronic copy of your original file until you have received the final grade for the Unit. Please make sure that you submit the correct file in the correct format that is readable in Black Board. ANY APPEAL RELATING TO SUBMITTING WRONG FILES AND WRONG FORMAT AFTER THE DEADLINE WILL NOT BE CONSIDERED. ASSIGNMENT SPECIFICATIONS Assignment Tasks This assignment task is a written report that include 3 parts: Part 1: Reflective journal of one selected topic among 11 topics of the course. Part 2: Fact finding of securities trading practices in Australia. Part 3: Capital Budgeting and Project Evaluation. Please also note: group assignment for H15002 is DIFFERENT every trimester. Attempt to submit a PREVIOUS TRIMESTER ASSIGNMENT or A WRONG ASSIGNMENT will be graded as ZERO (0) mark without any consideration for resubmission. Using SECONDARY DATA (researches done by others) for reflective journal and fact findings in Pat 1 and Part 2 is not recommended and will be penalised. Page 3 of 10 Assignment Requirements: The assignment should cover the structure and contents described below. Introduction A Brief introduction of your group's work: the purpose of assignment, key findings and structure of the assignment (not more than 150 words) Part 1. Reflective journal of a selected topic among 11 topics of the course (13 marks) Your group is required to write a reflective journal about what you had learnt in an interactive tutorial session or a face to face class that covers one selected topic among 11 topics of H15002 course. To complete the reflective journal, you will need to answer the following reflective questions: Reflective questions: Question 1: What are the financial concepts you have learnt in the class? Briefly explain the concepts? (3 marks) Question 2: What are the issues your lecturer reminded you to note down and pay your special attention regarding the financial concepts/formulas/calculations/skills/techniques you have learnt in that class? (2 marks) Question 3: How many practice questions did you work on the class with your lecturer? Briefly summarize the content of that questions and what you have done with your lecturer in practicing with those questions. What are the problems did you encounter when you worked on that practice questions? (3 marks) Question 4: How can you potentially apply what you have learnt in that class in your real life? (2 marks) Question 5: What questions did you ask your lecturer in the class, what is your lecturer's answer and your discussion aftermath? (3 marks) Your group need to perform a discussion with your lecturer about your selected topic. You need to raise one (01) question (it should not be the one of the 4 reflective questions mentioned above), get the answer and discuss with your lecturer about any issue related to the content of the selected topic. Please note that any question is welcomed but in-depth questions that show your brainstorm will give you good marks. You'd better prepare the question before the class. In-class discussion is preferred. However, if your group misses the specific interactive session/face to face class that covers the topic you select, or time constraint does not allow you to discuss your question with your lecturer in class, you can raise the question and discuss it with your lecturer by Holmes email or in H15002 Discussion Board. In this part of group assignment, you need to summarize your question, answer from your lecturer and any further discussion in a paragraph which is not longer than 300 words. HI5002 Finance for Business Group Assignment T1 2021 Page 4 of 10 Evidence of your discussion: evidence of your discussion should be submitted in an appendix to your group assignment: scanned certificate of discussion in face to face class: question written on a piece of paper with your lecturer's signature; screen shots of discussion or certification of lecturer in the chat box of online interactive classes, email exchanges or discussion on Black Board Discussion Board. Part 2. Fact finding of securities trading practice in Australia (10 marks) You are required to go to Online Portals of ASX and ASIC, explore the data and information in the portals and perform the following tasks: Task 1: Briefly describe the services provided by 3 types of ASX participant. Students are required to sit the face to face or online class in week 9 to get the guidance from lecturers about which ASX participant they need to describe in this part. (3 marks) Task 2: Briefly describe the content of 3 webinars provided to securities practitioners for participant education. Students are required to sit the face to face or online class in week 9 to get the guidance from lecturers about which webinars they need to describe in this part. (3 marks) ribe tre CNS ure ded by olypes Ol ASA participant required to sit the face to face or online class in week 9 to get the guidance from lecturers about which ASX participant they need to describe in this part. (3 marks) Task 2: Briefly describe the content of 3 webinars provided to securities practitioners for participant education. Students are required to sit the face to face or online class in week 9 to get the guidance from lecturers about which webinars they need to describe in this part. (3 marks) Task 3: Search for information and answer the questions: What is ASIC key and what is it used for? How can you request for an ASIC key? (2 marks) Task 4: Search the relevant information in the website and answer the questions: What are popular scams targeting ASIC clients? What are the warning signs of a scam emails? How do you protect yourselves from potential scams? (2 marks) Note that these are fact finding questions and all the information need to be taken from the provided sources (ASX and ASIC websites). However, students need to explore data and information in the websites to get necessary inputs and use your own wordings to rephrase it, then make a proper and references to the ASX and ASIC sources (See the guideline at the end of assignment instructions. Detailed guidance about how to make references will be provided by your lecturers in week 9 class). High similarity index showing the source of ASX with proper references is FINE but copy and paste the content of the courses is plagiarism. Links of websites for your fact finding are: Australia Stock Exchange: www.asx.com.au and Australian Securities and Investment Commission: https://asic.gov.au/. H15002 Finance for Business Group Assignment T1 2021 Page 5 of 10 Part 3: Capital Budgeting and Project Evaluation (15 marks) Case Study: Assume that your group is working in Financial Department of a company that produces health care tools and equipment. Your company is considering two potential projects as follow: Project 1: launching a new product of hearing aids. Your supplier offers you two options that have different cash outlay and generate different revenue but same useful life of 5 years. The table below shows the estimated data available to the company's Management: Option A 1,205,000 Option B 1,315,000 Initial Investment Annual cash inflow Year 1 Year 2 Year 3 Year 4 Year 5 290,000 320,000 360,000 375,000 480,000 315,000 345,000 356,000 402,000 540,000 Project 2: Buying a new assembly for wheelchair production. Your companies are offered two options that will generate the same revenue for the company each year. The table below shows the initial and annual costs for each option. Option A Option B Initial Investment 1,550,000 1,750,000 Annual cost, including fuel, maintaining and other relevant expenses Year 1 42,000 35,000 Year 2 42,000 35,000 Year 3 42,000 35,000 Year 4 42,000 35,000 Year 5 35,000 3.1. Capital Budgeting Decision Making (7 marks) You are required to write a short report to the company's Management: 42,000 Year 4 Year 5 35,000 35,000 3.1. Capital Budgeting Decision Making (7 marks) You are required to write a short report to the company's Management: 1) To select a relevant method among five investment criteria of Net Present Value (NPV), Equivalent Annual Cost (EAC), profitability Index (PI), Internal Rate of Return (IRR), Simple Payback Period, and Discounted Payback Period for each project, given the market required rate of return for all project is 9.5% and the company's benchmark of payback is maximum 3 years. Your recommendation must include your justification on why you choose the specific method based on its pros and cons compared to other methods. (Note: you cannot use the same method for both projects) (2 marks) H15002 Finance for Business Group Assignment T1 2021 Page 6 of 10 2) To perform the selected method and present the outcome of your project evaluation and recommend the option A or B should the company choose for each project. Your justification must include calculation steps and numerical outcomes. (5 marks) Students are compulsorily required to sit the face to face or online class in week 8 to know how to work on these capital budgeting questions with correct terminologies, templates and calculations. 3.2. Risk Analysis and Project evaluation: NPV break-even analysis (8 marks) Assume that for Project 2, the company finally chose Option B. It expects to sell 8,500 wheelchairs for an average price of $750 per unit. The assembly in Option B has a residual value of $350 000 at the end of the project. The company will need to add $ 850 000 in working capital which is expected to be fully retrieved at the end of the project. Other information is available below: Depreciation method: straight line Variable cost per unit: $120 Cash fixed costs per year: $35,000 of annual cost for assembly operation + $20,000 other fixed cost Corporate marginal tax: 30% Upon the forecast of unexpected economic conditions that may be caused by the current breakout of corona virus, the company management requires your Team to prepare a risk analysis for the case where the unit price of this product decreases by 25%. Required: perform an NPV break-even analysis to identify break-even sales of the project when the unit price decreases by 25%. Conclusion Summarize / Reflection the outcomes of your group's works (not more than 150 words) Assignment Preparation guideline/ Important Note: Students are required to attend Interactive Tutorial Session Week 8 (topic 6) and Week 9 (Topic 7) for inputs to answer the questions in Part 1 and 2, and training on how to work with correct capital budgeting technique, proper format, structure, calculation tables and terminologies. Assignments with different templates, terminologies and calculations from the solution templates and guidance provided to you in the sessions will be investigated as potential contract cheater done assignments. HI5002 Finance for Business Group Assignment T1 2021 Page 7 of 10 Guidelines - Adapted Harvard Referencing 1. Reference sources in assignments are limited to sources which provide full text Page 7 of 10 Guidelines - Adapted Harvard Referencing 1. Reference sources in assignments are limited to sources which provide full text access to the source's content for lecturers and markers. 2. The Reference list should be located on a separate page at the end of the assignment and titled: References. 3. It should include the details of all the in-text citations, arranged alphabetically A-Z by author surname. In addition, it MUST include a hyperlink to the full text of the cited reference source. For example; P Hawking, B McCarthy, A Stein (2004), Second Wave ERP Education, Journal of Information Systems Education, Fall, http://jise.org/Volume 153/JISEv15n3p327.pdf 4. All assignments will require additional in-text reference details which will consist of the surname of the author/authors or name of the authoring body, year of publication, page number of contents, paragraph where the content can be found. For example; The company decided to implement an enterprise wide data warehouse business intelligence strategies (Hawking et al, 2004, p3(4))." author year page (Hawking et al, 2004, p3(4)) paragraph Non-Adherence to Referencing Guidelines Where students do not follow the above guidelines: 1. Students who submit assignments which do not comply with the guidelines will be asked to resubmit their assignments. 2. Late penalties will apply, as per the Student Handbook each day, after the student/s have been notified of the resubmission requirements. 3. Students who comply with guidelines but the citations are "fake" will be reported for academic misconduct. HI5002 Finance for Business Group Assignment T1 2021 Page 8 of 10 Weighting Marking criteria Marking criteria Part 1. Reflective journal of a selected topic among 11 topics of the course (13 marks) Question 1 Question 2 Question 3 Question 4 Question 5 3% 2% 3% 2% 3% 2. Fact finding of securities trading practice in Australia (10 marks) Task 1 Task 2 Task 3 Task 4 3% 3% 2% 2% 3. Capital Budgeting and Project Evaluation (1 5 marks) 3.1. Capital Budgeting Decision Making 3.2. Risk Analysis and Project evaluation-NPV break-even analysis 7% 8% 4. Academic Writing: Presentation, structure and academic writing (2 marks) Total weight of written report 2% 40%

Step by Step Solution

There are 3 Steps involved in it

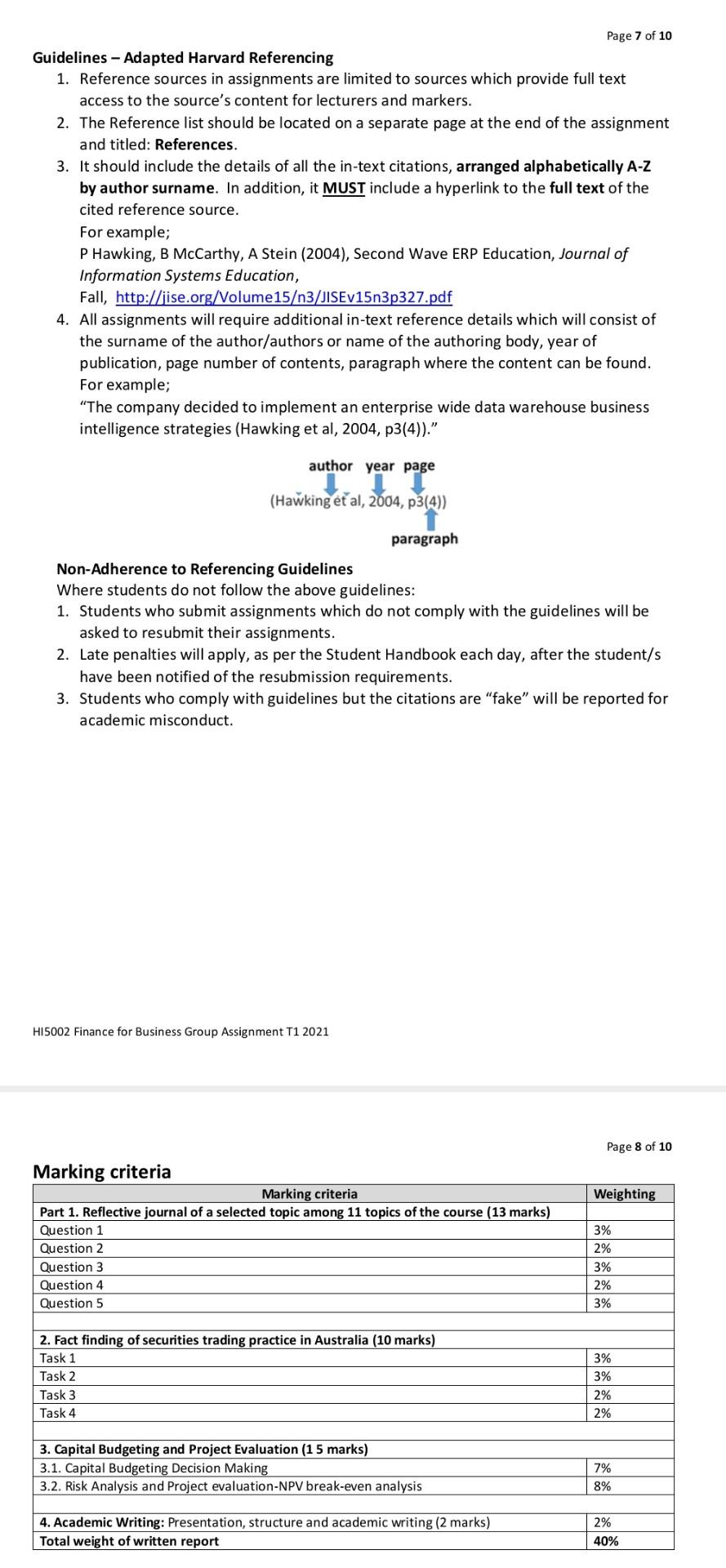

Get step-by-step solutions from verified subject matter experts