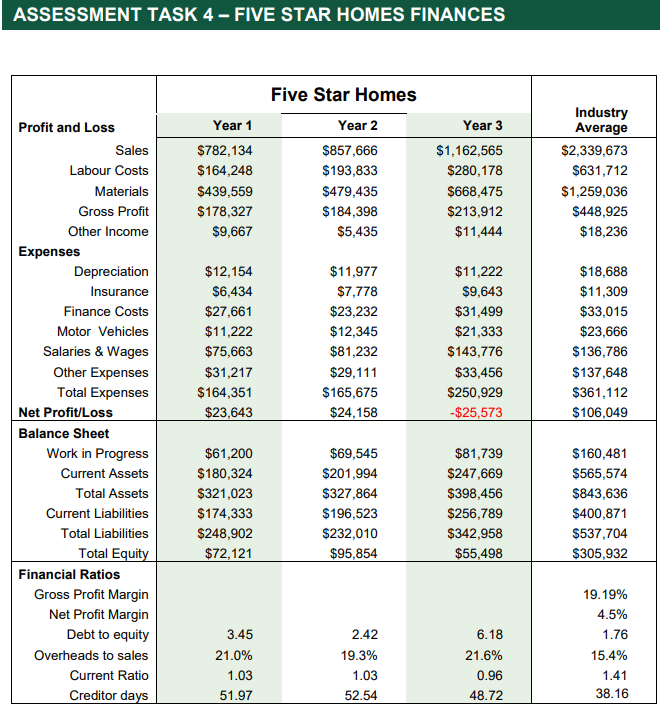

Question: ASSESSMENT TASK 4 - FIVE STAR HOMES FINANCES Five Star Homes Industry Profit and Loss Year 1 Year 2 Year 3 Average Sales $782,134 $857,666

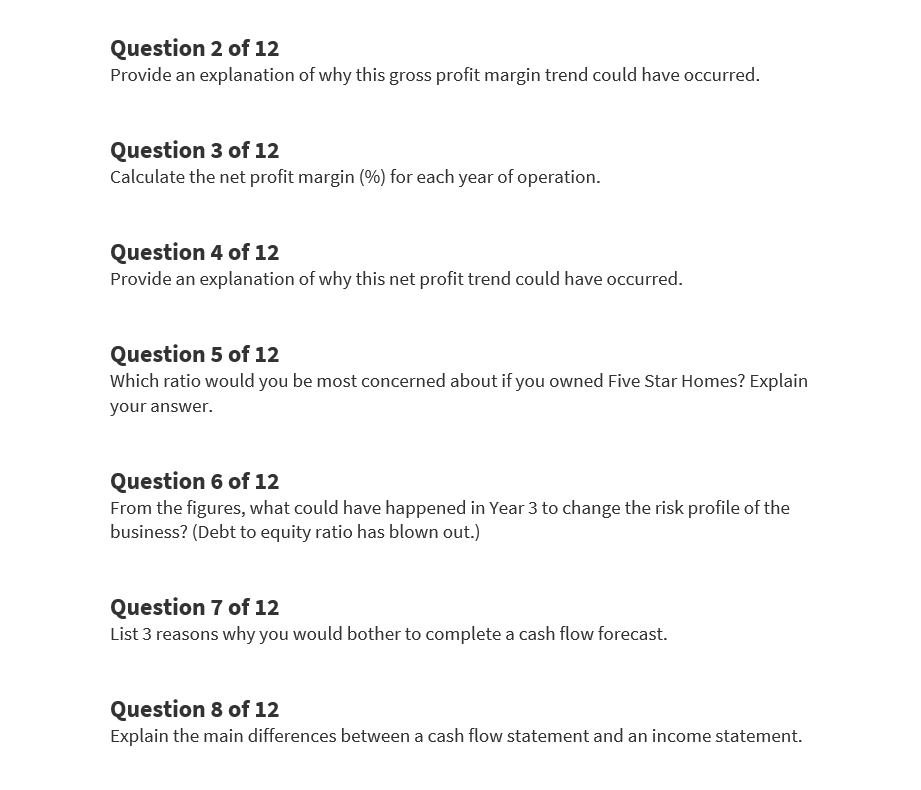

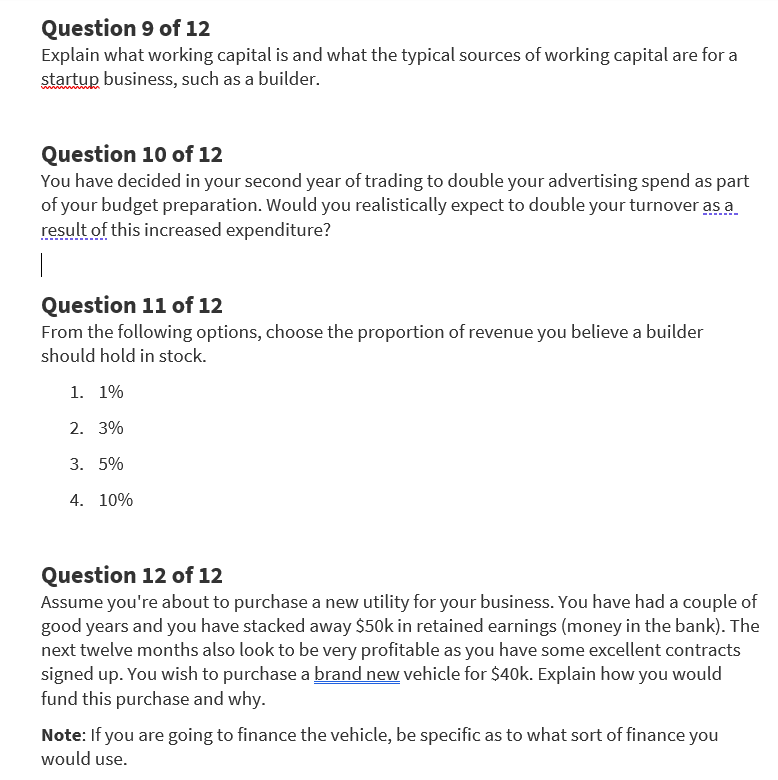

ASSESSMENT TASK 4 - FIVE STAR HOMES FINANCES Five Star Homes Industry Profit and Loss Year 1 Year 2 Year 3 Average Sales $782,134 $857,666 $1, 162,565 $2,339,673 Labour Costs $164,248 $193,833 $280, 178 $631,712 Materials $439,559 $479,435 $668,475 $1,259,036 Gross Profit $178,327 $184,398 $213,912 $448,925 Other Income $9,667 $5,435 $11,444 $18,236 Expenses Depreciation $12, 154 $11,977 $11,222 $18,688 Insurance $6,434 $7,778 $9,643 $11,309 Finance Costs $27,661 $23,232 $31,499 $33,015 Motor Vehicles $11,222 $12,345 $21,333 $23,666 Salaries & Wages $75,663 $81,232 $143,776 $136,786 Other Expenses $31,217 $29, 111 $33,456 $137,648 Total Expenses $164,351 $165,675 $250,929 $361, 112 Net Profit/Loss $23,643 $24, 158 -$25,573 $106,049 Balance Sheet Work in Progress $61,200 $69,545 $81,739 $160,481 Current Assets $180,324 $201,994 $247,669 $565,574 Total Assets $321,023 $327,864 $398,456 $843,636 Current Liabilities $174,333 $196,523 $256,789 $400,871 Total Liabilities $248,902 $232,010 $342,958 $537,704 Total Equity $72, 121 $95,854 $55,498 $305,932 Financial Ratios Gross Profit Margin 19. 19% Net Profit Margin 4.5% Debt to equity 3.45 2.42 6.18 1.76 Overheads to sales 21.0% 19.3% 21.6% 15.4% Current Ratio 1.03 1.03 0.96 1.41 Creditor days 51.97 52.54 48.72 38.16Question 2 of 12 Provide an explanation of why this gross profit margin trend could have occurred. Question 3 of 12 Calculate the net profit margin (%) for each year of operation. Question 4 of 12 Provide an explanation of why this net profit trend could have occurred. Question 5 of 12 Which ratio would you be most concerned about if you owned Five Star Homes? Explain your answer. Question 6 of 12 From the figures, what could have happened in Year 3 to change the risk profile of the business? (Debt to equity ratio has blown out.) Question 7 of 12 List 3 reasons why you would bother to complete a cash flow forecast. Question 8 of 12 Explain the main differences between a cash flow statement and an income statement.Question 9 of 12 Explain what working capital is and what the typical sources of working capital are for a startup business, such as a builder. Question 10 of 12 You have decided in your second year of trading to double your advertising spend as part of you r budget preparation. 1Would you realistically expect to double you r turnover gs__a_ [esyltpf this increased expenditu re? Question 11 of 12 From the following options, choose the proportion of revenue you believe a builder should hold in stock. 1. 1% 2. 3% s. 5% 4. mix: Question 12 of 12 Assume you're about to purchase a new utility for your business. You have had a couple of good years and you have stacked away $50k in retained earnings {money in the bank}. The next twelve months also look to be very profitable as you have some excellent contracts signed up. 'i'ou wish to purchase a brand new vehicle for $413k. Explain how you would fund this purchase and why. Note: If you are going to finance the vehicle, be specic as to what sort of finance you would use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts