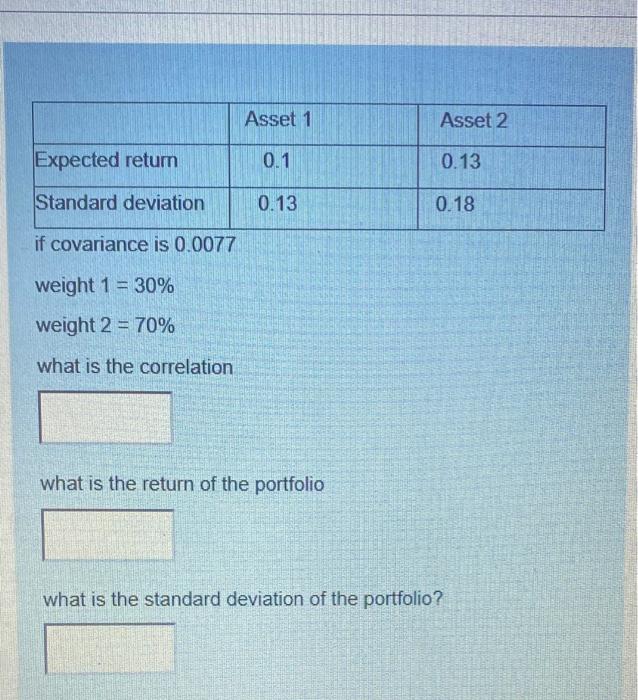

Question: Asset 1 Asset 2 Expected return 0.1 0.13 Standard deviation 0.13 0.18 if covariance is 0.0077 weight 1 = 30% weight 2 = 70% what

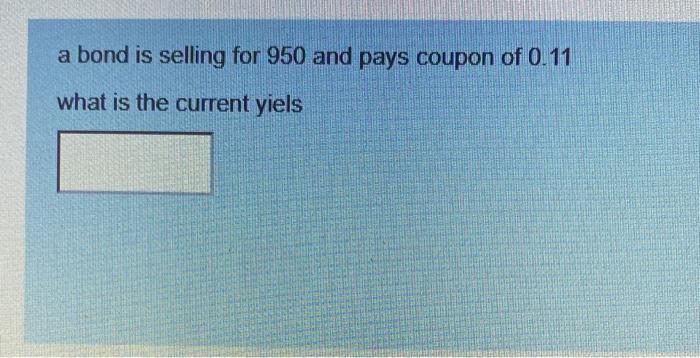

Asset 1 Asset 2 Expected return 0.1 0.13 Standard deviation 0.13 0.18 if covariance is 0.0077 weight 1 = 30% weight 2 = 70% what is the correlation what is the return of the portfolio what is the standard deviation of the portfolio? a bond is selling for 950 and pays coupon of 0.11 what is the current yiels

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts