Question: Asset Allocation problem The Bison Research Foundation has $40 million cash gift donated recently. The foundation's spending policy pays out about 5% of the market

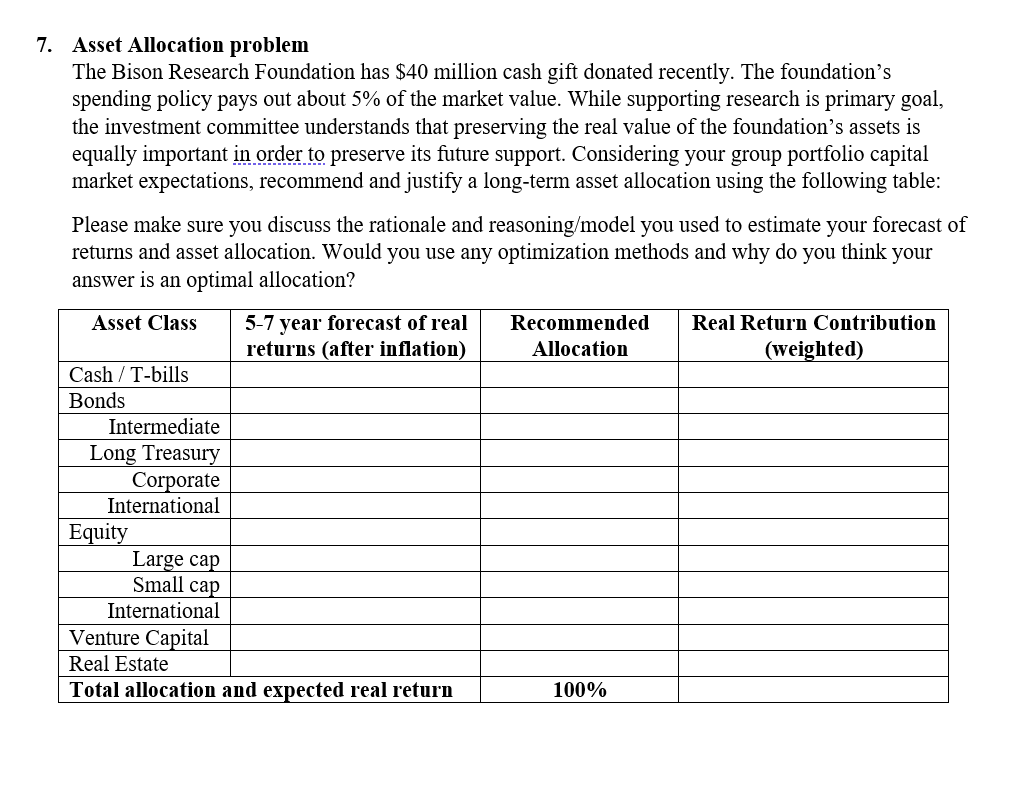

Asset Allocation problem The Bison Research Foundation has $40 million cash gift donated recently. The foundation's spending policy pays out about 5% of the market value. While supporting research is primary goal, the investment committee understands that preserving the real value of the foundation's assets is equally important in order to preserve its future support. Considering your group portfolio capital market expectations, recommend and justify a long-term asset allocation using the following table: Please make sure you discuss the rationale and reasoning/model you used to estimate your forecast of returns and asset allocation. Would you use any optimization methods and why do you think your answer is an optimal allocation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts