Question: Asset Turnover Financial statement data for the years ending December 31, 20Y3 and 20Y2, for Linstrum Company follow: Sales Total assets: Beginning of year End

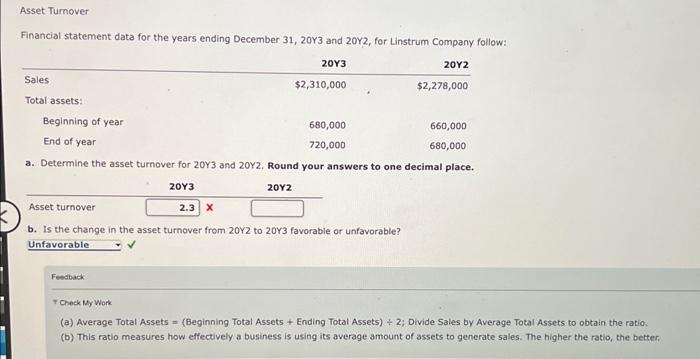

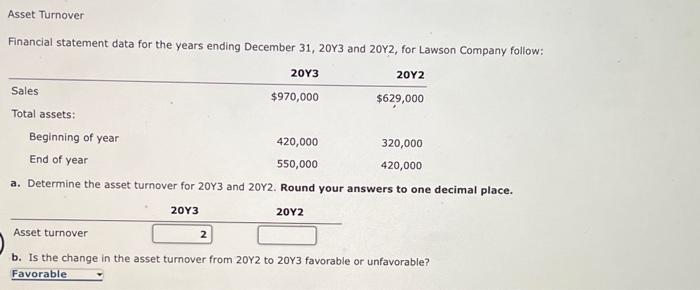

Asset Turnover Financial statement data for the years ending December 31, 20Y3 and 20Y2, for Linstrum Company follow: Sales Total assets: Beginning of year End of year 2013 $2,310,000 680,000 720,000 2012 $2,278,000 660,000 680,000 a. Determine the asset turnover for 20Y3 and 20Y2. Round your answers to one decimal place. Asset turnover 2013 2.3 X 2012 b. Is the change in the asset turnover from 2012 to 2013 favorable or unfavorable? Unfavorable Feedback Check My Work (a) Average Total Assets (Beginning Total Assets + Ending Total Assets) + 2; Divide Sales by Average Total Assets to obtain the ratio. (b) This ratio measures how effectively a business is using its average amount of assets to generate sales. The higher the ratio, the better, Asset Turnover Financial statement data for the years ending December 31, 20Y3 and 20Y2, for Lawson Company follow: Sales Total assets: Beginning of year End of year 20Y3 $970,000 420,000 550,000 2012 $629,000 320,000 420,000 a. Determine the asset turnover for 20Y3 and 2012. Round your answers to one decimal place. Asset turnover 20Y3 2 2012 b. Is the change in the asset turnover from 2012 to 20Y3 favorable or unfavorable? Favorable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts